22nd April 2023 – 28th April 2023 | Another week in the markets

| S&P 500 | Nasdaq | VIX | DJIA | Russell 1000 | NYSE |

| 4,169.48 | 12,226.58 | 15.78 | 34,098.16 | 2,279.16 | 15,545.88 |

| 0.87% | 1.28% | -5.90% | 0.86% | 0.72% | 0.21% |

| Nifty 50 | Gold | Silver | Brent crude | USD-INR | EUR-INR |

| 18,065.00 | $1,999.20 | $25.34 | $80.26 | 81.74 | 90.05 |

| 2.50% | 0.26% | 0.72% | -1.82% | -0.38% | -0.13% |

Source: MarketWatch

Hello Saturday,

This week, airlines project profits for the second quarter, big banks continue to post strong profits despite the industry crisis, and Bed Bath & Beyond files for bankruptcy.

- FDA-approved drugs like Ozempic, Wegovy, and Mounjaro gain traction on TikTok as miracle weight loss drugs, leading to a shortage in supply.

- US airlines post first-quarter losses but project profitability for the current quarter as capacity and demand are expected to increase with the busy summer travel season.

- Several major US and European banks post soaring profits despite the tremors in the global banking industry; regional banks seem to be more at risk, with First Republic Bank on the brink of collapse.

- Bed Bath & Beyond finally files for bankruptcy; this meme stock’s price crashed by 99% from its January 2021 highs to 29 cents last week.

- After years of rapid growth, the commercial real estate industry seems to be in trouble due to remote work, rising interest rates, and the recent banking crisis.

Taking stock | Weight, what? | Fight and flight | Fortune teller | Bed Bath & bye bye | OOO | Invest wisely

Taking stock

All major market indices rose this week and ended the month higher, with the Dow notching up its best month since January. For the week, the Dow rose 0.86%, the S&P 500 added 0.87%, and the Nasdaq climbed 1.28%. Tech earnings came out this week, with Big Tech posting higher-than-expected profits. For the first quarter, Alphabet’s revenue rose 3% to $69.79 billion, Amazon’s revenue grew 9% to $127.4 billion, and Meta’s revenue increased 3% to $28.65 billion from a year ago.

Weight, what?

Weight loss drugs like Ozempic, Wegovy, and Mounjaro are becoming increasingly popular due to TikTok influencers, celebrities, and even Elon Musk singing their praises. People have begun using these injectable medicines to lose excess weight in short periods of time, and can’t stop raving about them. But do they really work?

While Ozempic (made by Danish pharmaceutical company Novo Nordisk) and Mounjaro (made by American pharma firm Eli Lilly and Co.) have been approved by the FDA for diabetes, they have not been approved for weight loss. Wegovy (also a Novo Nordisk product), on the other hand, is FDA-approved for chronic weight management. However, such weight loss drugs can have several side effects, including malnutrition, facial ageing, nausea, and diarrhoea.

Nevertheless, with these drugs getting extremely popular on TikTok and similar platforms, people in the US and the UK are keen to try these drugs out. The resulting spike in demand has resulted in the FDA listing all three drugs as medicines in short supply.

While weight loss pills have been around for decades, no other drugs have gained as much traction or seemed as effective as these three. This represents a massive opportunity for certain pharmaceutical companies, which may see a major jump in their profits soon.

Fight and flight

After losing almost $200 billion over three years due to the pandemic, the airline industry is finally in recovery mode. With countries being accessible again and people wanting to make up for lost time, leisure travel is picking up rapidly. And while most major US airlines reported a first-quarter loss, they are projecting profitability for the current quarter as they get ready for the busy summer travel season.

While Delta Air Lines posted a higher-than-expected first-quarter loss, it forecasts sales to increase by 15% to 17% in the current quarter compared to a year ago, with a capacity increase of 17%. United Airlines expects capacity to increase by 18.5% compared to last year, and projects a revenue increase of 14% to 16% over last year.

Southwest Airlines posted a first-quarter loss of $159 million and expects second-quarter costs like fuel to go up by 5% to 8%. Despite this, the airline expects to be profitable in the second quarter, with a capacity increase of 14%. American Airlines posted a $10 million profit in the first quarter; it also plans to increase its long-haul international capacity by 82% in the current quarter compared to a year ago, with a higher-than-expected profit forecast for the second quarter.

Fortune teller

Several major US banks reported strong quarterly profits earlier this month despite the failure of Silicon Valley Bank and Signature Bank last month. JPMorgan Chase saw a 52% increase in profits compared to last year; the corresponding numbers for Wells Fargo and Citigroup were 32% and 7% respectively. European banks like Barclays and Deutsche Bank also show minimal signs of distress. Barclays posted a first-quarter profit this week, up 27% from last year. Deutsche Bank also posted its earnings this week, and logged its 11th straight quarter of profit.

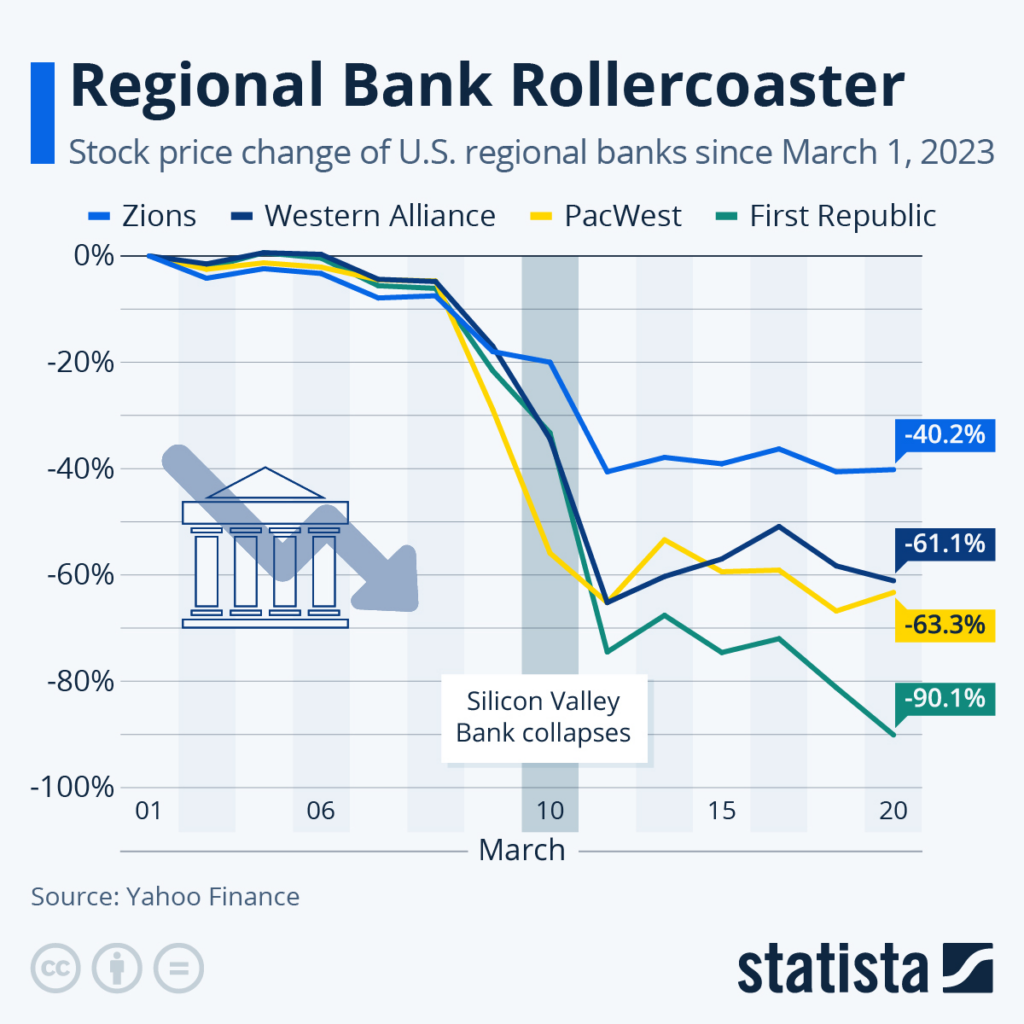

While most banks expected deposits to decline, big banks like JPMorgan and PNC saw a slight increase. Despite soaring profits and fairly stable deposits, bank executives have announced a lending pullback to set aside more reserve cash. In addition, regional banks seem to be particularly affected by the industry crisis: First Republic Bank is currently on the brink of collapse after customers withdrew more than $100 billion in deposits.

Source: Statista

Bed Bath & bye bye

Bed Bath & Beyond finally filed for Chapter 11 bankruptcy on Sunday after warning that it would have to do so for several months. The meme stock was trading around $4 in April 2020, soared to above $50 in January 2021, traded at $20 last April, and closed at 29 cents last Friday, crashing more than 99% from its 2021 highs.

This year, the company made several efforts to raise money to keep the company alive. In February, it secured a stock offering that could have brought in $1 billion, but the plan didn’t pan out, and only $360 million were infused.

Last week, the market value of the company came down to $136.9 million, and it could no longer hold off its inevitable end. During the last few months, the company was struggling to maintain vendor relationships, had low inventory levels and declining sales, and was quickly running out of cash. The home goods retailer’s 360 Bed Bath & Beyond stores and 120 buybuyBaby stores will remain open for the time being while it figures out a plan to liquidate its assets and repay its creditors.

OOO

The $20 trillion commercial real estate industry in the US seems to have hit a wall after decades of rapid growth. Before the pandemic, the industry was supported for a long time by growing demand, easy credit access, and low interest rates. But since March 2020, the valuations of office and retail property have been falling because of lower occupancy rates and declining demand. The pandemic has brought about significant shifts in how and where people work, and remote work seems to be here to stay in many industries.

In addition to this, the Federal Reserve ‘s interest rate hikes have not helped the industry either. The commercial real estate industry is heavily dependent on credit, and the current interest rate environment has made credit costlier. Moreover, the recent banking crisis is likely to worsen the industry’s state. This is because the liquidity pressures on small and mid-sized banks have been the most severe, and it’s exactly such banks that provide the most loans to the commercial real estate industry. As per Goldman Sachs, around 80% of bank loans for commercial properties are given out by regional banks.

Invest wisely

While you might not want to take weight loss drugs, you could benefit in another way from them, and that’s by investing in the companies producing them. To invest in US pharma stocks like Eli Lilly and Co., download the Appreciate App today!

Warm regards,

Another week

in the markets