20th May 2023 – 26th May 2023 | Another week in the markets

| S&P 500 | Nasdaq | VIX | DJIA | Russell 1000 | NYSE |

| 4,205.45 | 12,975.69 | 17.95 | 33,093.34 | 2,298.97 | 15,078.69 |

| 0.32% | 2.51% | 6.78% | -1.00% | 0.30% | -1.60% |

| Nifty 50 | Gold | Silver | Brent crude | USD-INR | EUR-INR |

| 18,499.35 | $1,946.10 | $23.45 | $77.17 | 82.56 | 88.57 |

| 1.63% | -1.71% | -2.39 | 2.09% | -0.33% | -1.05% |

Source: MarketWatch

Hello Saturday,

This week, Nvidia’s market cap reaches close to $1 trillion, American Airlines and JetBlue have 30 days to end their Northeast alliance, and US negotiators near an agreement on the debt ceiling.

- President Biden and House Republican Speaker Kevin McCarthy are nearing a deal to raise the current debt ceiling to avoid a market-shaking default.

- US chip maker Nvidia’s stock surges 24% as it profits from the AI gold rush, with tech companies using its Graphics Processing Units (GPUs) to enable generative AI technology like ChatGPT.

- A US judge has ruled that American Airlines and JetBlue must end their alliance on northeast US flight routes within 30 days; this is a big win for the Biden administration, which is fighting to protect antitrust laws and competition.

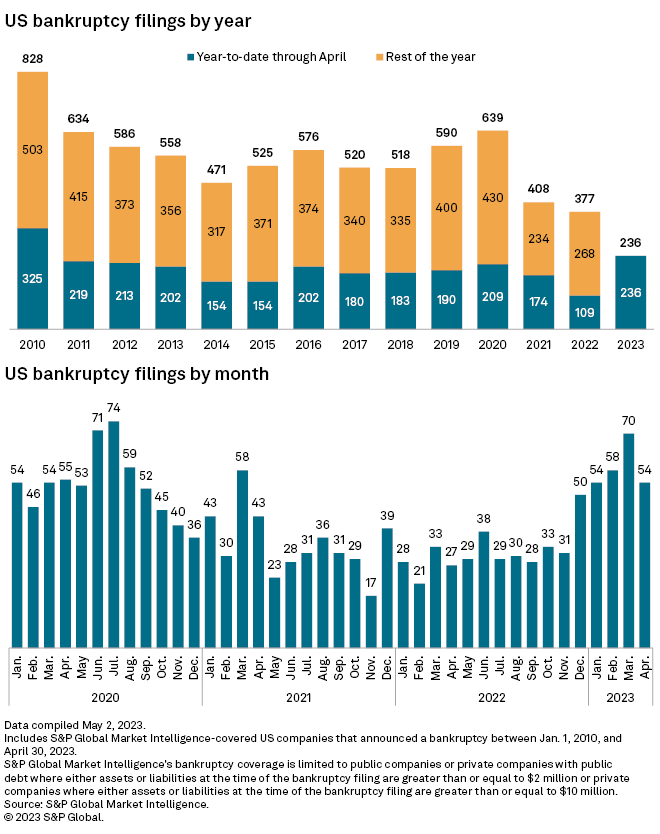

- Corporate bankruptcies in the US are on the rise, with year-to-date filings for 2023 being the highest since 2010; high interest rates resulting from inflation have cut off companies’ access to credit, which is often the last resort for those struggling.

- Apple’s mixed-reality headsets, which might be priced at up to $3,000, will be unveiled by Tim Cook on June 5; the company is working on developing a range of software to complement the new headsets.

- ChatGPT can outperform your money manager, according to findings by the financial comparison platform finder.com; a dummy portfolio it created beat the top-performing funds and market indices over an eight-week period.

Taking stock | Debt hits the fan | Cashing its chips | Air Blues | Shutters down | What’s Cooking? | WarrenGPT | Invest wisely

Taking stock

Wall Street rallied on Friday in the hope that US lawmakers would soon reach a deal to raise the debt ceiling and prevent a default. For the week, the S&P 500 gained 0.32%, while the Dow lost 1%. The Nasdaq notched its fifth straight weekly gain, climbing 2.51%.

Debt hits the fan

With June 5 being the latest debt ceiling deadline, US negotiators are nearing a deal that would raise the current $31.4 trillion ceiling. This would let the US avoid a default, along with the catastrophic economic consequences that could ensue. While the deal has not been finalised yet, here’s what’s expected.

The debt ceiling could be raised for two years through the 2024 elections by $1.5 trillion in exchange for spending cuts. Discretionary non-defence spending in the next financial year is expected to be below the current year’s levels. The IRS could lose a significant portion of the $80-billion fund allotted to it under the Inflation Reduction Act. Moreover, unused COVID-19 relief funds, estimated to amount to $50-70 billion, could be revoked.

Cashing its chips

Nvidia’s stock surged 24% on Thursday after the chip maker’s Q2 earnings beat Wall Street expectations. This stock surge means that the company is now worth $939.3 billion. For the year, Nvidia is up more than 160%, making it one of the best performers of the S&P 500 year-to-date.

The reason behind this stellar performance? The AI boom!

For several years now, Nvidia has been making Graphics Processing Units (GPU) — chips that can process heavy graphics, of the sort typically associated with computer games. However, the processing prowess of these chips has also found many other applications.

Big Tech companies and start-ups alike have been using Nvidia’s GPUs to develop AI technology. These chips are perfect for chewing on the massive amounts of data required to train generative AIs. For instance, OpenAI’s ChatGPT has been trained using thousands of Nvidia GPUs, and it’s been estimated that it might soon require up to 30,000 Nvidia GPUs.

While Nvidia has focused on growing its AI-oriented business for the past several years, the last six months have been especially notable in terms of interest as well as investments, thanks to the AI gold rush. This has helped the company boost its sales significantly, to the extent that Nvidia’s outlook for the current quarter is 50% higher than analysts’ estimates.

Air Blues

A federal judge has ruled in favour of the US Justice Department, and has ordered the American Airlines Group and the JetBlue Airways Corp to end their alliance on northeast US flight routes within 30 days. The lawsuit in question was filed in 2021 by the Justice Department, based on its contention that this alliance had led to higher ticket prices and reduced choices for consumers travelling to and from major cities like New York City and Boston.

This decision has come as a win for the Biden administration, which has vowed to take action against industry consolidation and protect competition across industries. Back in March, the Justice Department also sued to block JetBlue’s $3.8 billion acquisition of discount carrier Spirit Airlines. That was the first time in over two decades that the US government had sued to stop an airline merger.

Shutters down

What happens when an economy faces high inflation and high interest rates? Well, cheap credit becomes more difficult to access, and companies start going bankrupt. And that’s exactly the kind of situation looming over corporate America right now. The number of US companies that have filed for bankruptcy protection so far this year is higher than in the first four months of any year since 2010. While the number of corporate bankruptcy petitions in April went down to 54 from 70 in March, the year-to-date tally has still doubled to 236.

Source: S&P Global

Some of the largest bankruptcies include Bed Bath & Beyond, Whittaker Clark & Daniels Inc., SVB Financial Group, and Party City Holdco Inc. Companies in the consumer discretionary sector have recorded the highest number of bankruptcies in 2023, followed by industrials, financials, healthcare, and technology. According to economists, with interest rates remaining high and banks cutting back on lending, more companies that are struggling despite cost-cutting measures and layoffs will find themselves filing for bankruptcy. Analysts are also warning that a failure to reach a timely agreement on the debt ceiling could push many more companies to the brink.

What’s Cooking?

Apple CEO Tim Cook is all set to unveil the company’s long-awaited mixed-reality headsets. The headsets’ specs will be revealed at Apple’s Worldwide Developers Conference on June 5. The headsets will go on sale a few months later for as much as $3,000: this price point is twice as high as that of Meta’s Quest Pro.

Apple’s hardware products have always heavily relied on its robust software offerings, and the company is currently racing to build a range of software products and services for these headsets. For instance, the company is working towards adapting iPad apps so that users can access millions of apps through the headsets’ new 3D interface. Apple is also working on a version of Apple Books so that headset users can read in virtual reality.

Another feature that the headsets will offer will be generating 3D versions of FaceTime users. This has long been one of the primary goals of virtual reality goggles, and while Meta’s Quest headsets offer such 3D avatars as well, they haven’t proven to be a huge hit among Quest users.

WarrenGPT

It seems like there’s nothing that OpenAI’s ChatGPT cannot do. From writing poetry and translating languages to coding and providing customised music recommendations, ChatGPT has been donning many hats since its launch in November last year. And now, it seems that ChatGPT might be able to pick stocks better than your fund manager, according to CNN.

Earlier this month, CNN reported that a dummy portfolio created using ChatGPT gained 4.9% between March 6 and April 28. This portfolio contained 38 stocks, and was put together as an experiment by finder.com, a financial comparison site. During the same period, 10 leading investment funds in the UK booked an average loss of 0.8%. These funds included funds managed by HSBC and Fidelity. Europe’s broad-market-based index Stoxx Europe 600 rose only 0.5% during the same eight-week period, while the S&P 500 gained 3%.

Major funds around the world have been using AI technology for years, but with ChatGPT, retail investors might finally be able to tap into this powerful technology as well. However, ChatGPT still needs to be prompted in very particular ways to get the best results, knowledge that many retail investors may not have.

Invest wisely

Want to make use of AI technology to build a profitable portfolio in a risk-adjusted manner? Download the Appreciate App! With Appreciate, you get AI-based investment recommendations and a range of other helpful tools that allow you to maximise returns and minimise risk. What’s more, you gain easy access to high-performing US stocks and exchange-traded funds, allowing you to build a well-diversified portfolio.

Warm regards,

Another week

in the markets