06th May 2023 – 12th May 2023 | Another week in the markets

| S&P 500 | Nasdaq | VIX | DJIA | Russell 1000 | NYSE |

| 4,124.08 | 12,284.74 | 17.03 | 33,300.62 | 2,254.83 | 15,246.36 |

| -0.29% | 0.40% | -0.93% | -1.11% | -0.28% | -0.87% |

| Nifty 50 | Gold | Silver | Brent crude | USD-INR | EUR-INR |

| 18,314.80 | $2,015.60 | $24.13 | $74.17 | 82.26 | 89.25 |

| 1.36% | -0.46% | -6.94% | -1.59% | 0.65% | -0.89% |

Source: MarketWatch

Hello Saturday,

This week, the White House holds a debt ceiling meeting, Google announces several AI updates in its annual developer conference, and Elon Musk finds Twitter’s next CEO.

- The US will hit its debt ceiling by June 1, and even a short breach would result in catastrophic economic consequences, from a credit rating downgrade to an increase in unemployment.

- Google announces several updates on its AI chatbot Bard, including moving it to PaLM2, a much more advanced large language model; makes Bard available in up to 180 countries and territories without a waitlist.

- Japan’s SoftBank has strategically been cashing out on tech holdings like Alibaba and is looking to pivot and heavily invest in AI companies to capitalise on AI’s potential.

- Disney+ loses 4 million paid subscribers this quarter as the company struggles to balance subscriber growth and profit.

- Elon Musk finds Twitter’s next CEO and will step down in six weeks to serve as its chief technical officer. Linda Yaccarino, Comcast NBCUniversal executive, to take over.

Taking stock | Don’t debtonate | Mann ki Bard | AI we go | Downstream consequences | CXO | Invest wisely

Taking stock

Stocks ended lower Friday after disappointing consumer sentiment data increased investor concerns regarding the US economy — University of Michigan’s consumer sentiment index for May fell to a six-month low of 57.7. The S&P 500 fell 0.29% and the Dow slipped 1.11%, while Nasdaq gained 0.4%. Shares of regional banks such as PacWest, PNC, and Zions Bancorporation dropped further this week after PacWest announced a sharp decline in its deposits last week.

Don’t debtonate

On Tuesday, the White House debt ceiling meeting failed to yield a breakthrough. If the US debt ceiling is not soon lifted, the US Treasury could run out of cash and default on its debt as early as June 1, known as the ‘X date’. If this happens, it could unleash economic chaos with catastrophic repercussions.

The US has never defaulted on its debt obligations before, so the exact consequences in the US and across the global economy are unknown. However, according to Moody’s, even a short debt limit breach of a week could result in a 0.5% decline in real GDP, an increase in the unemployment level from the current 3.5% to 5%, and 1 million lost jobs. Hitting the debt ceiling would also shock the global markets, and stocks could lose as much as a third of their value. The government would also no longer be able to pay pensions and salaries of federal and military employees.

Defaulting would also downgrade the US’s credit rating. Back in 2011, when the US was on the brink of default, S&P cut the country’s prized AAA rating by one notch to AA-plus. This downgrade was never reversed, and it has raised the country’s borrowing costs by about $1.3 billion.

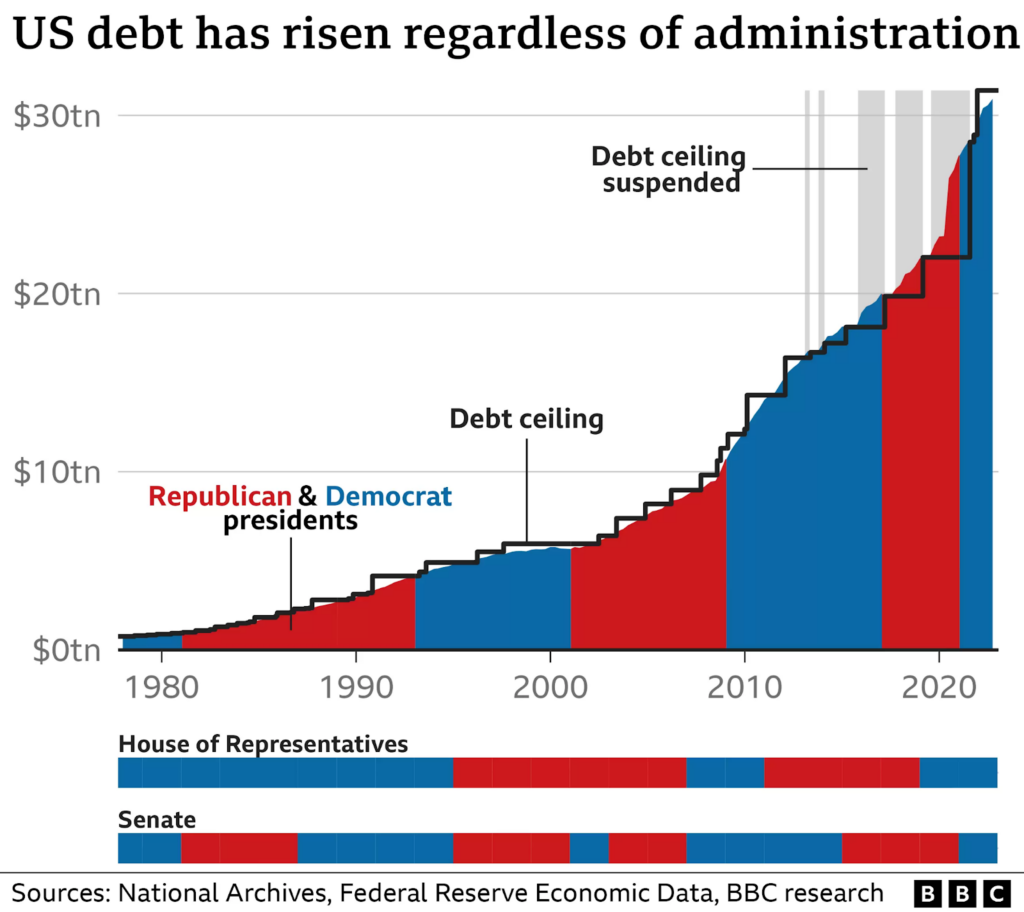

Friday’s debt ceiling meeting between President Biden and congressional leaders has been postponed until next week. Since the Democrats and the Republicans have different priorities when it comes to government spending, there has always been a standoff between them over the debt ceiling. That’s why it has never been easy to raise the debt ceiling because the two parties struggle to find common ground. However, it’s important to note that over the years, the debt ceiling has increased, irrespective of who was in power.

Source: BBC

Mann ki Bard

This Wednesday, Google hosted its biggest event of the year — the annual Google I/O 2023 developer conference, where it announced a range of impressive AI updates in a bid to regain leadership in the space. At the event, Google announced several updates to its chatbot Bard.

Google has moved Bard to PaLM 2, a more advanced large language model. PaLM 2 is behind most of Bard’s recent improvements, such as coding capabilities and advanced reasoning skills. Bard is now available in 180 countries and territories without a waitlist. It is also available in Korean and Japanese, and Google is working on adding 40 more languages soon. Several other features, such as a dark theme, export options, more precise citations, and integrations with third-party services, are being incorporated.

AI we go

AI is a buzzy area not just for tech companies but also for investors, and Japan’s SoftBank Group, one of the world’s most prolific tech investors, is ready to capitalise on it finally. Since the recent tech downturn, SoftBank has been playing defensive, but this week as it reported its quarterly results, it signalled that it is ready to go on the offensive again with AI as its focus.

In recent months, not only had SoftBank stopped buying tech companies, but it had also been selling its holdings. For example, it cashed out almost its entire stake in Alibaba Group — its holding in Alibaba is worth around $5 billion compared to $39 billion a year ago. Now, it can use these funds to pivot to AI companies.

Downstream consequences

Walt Disney stock closed down 8.7% on Thursday, a day after the company posted its results showing the media giant lost 4 million paid Disney+ subscribers over the last quarter. While Disney’s revenue increased 13% year-over-year, it was primarily due to the surge in sales witnessed by its theme parks. However, its media and entertainment business saw a revenue increase of only a little over 3%, missing analysts’ estimates.

Since the last quarter, Disney has been trying to move away from its prior narrative of strong subscriber growth and wants investors to focus on revenue and profit instead. As a result, in recent months, Disney has increased its subscription prices, reduced new content offerings, consolidated various divisions, and laid off thousands of employees to trim its streaming losses.

CXO

With a tweet on Friday evening, Elon Musk ended speculation about Twitter’s new CEO, welcoming Linda Yaccarino, the (soon-to-be former) Comcast NBCUniversal executive, to take his position at the helm. Yaccarino will be starting in six weeks, and Musk has made her mandate expressly clear – to transform Twitter into X, the everything app.

Ever since Elon Musk took over Twitter, he has been criticised heavily for a range of policy changes, mass layoffs, and more. Not only have Twitter users been concerned since Musk became the social media platform’s CEO but also shareholders of Tesla who believe that Musk has been distracted. Musk had been talking about relieving himself of the position, and on Thursday, he finally announced that Twitter’s getting a new CEO –– after which, Tesla shares closed 2% higher and gained an additional 1.6% in after-hours trading.

Musk will transition to the role of CTO during this time. Though stepping down from CEO, he will likely maintain significant control over the company’s direction.

Invest wisely

Want to rebalance your portfolio and redirect your funds towards industries and companies expected to remain fairly stable despite the upcoming recession? Invest in Exchange-Traded Funds (ETFs) that focus on specific sectors and hedge portfolio risk. Download the Appreciate App to access a wide range of high-performing US ETFs and stocks today!

Warm regards,

Another week

in the markets