29th April 2023 – 5th May 2023 | Another week in the markets

| S&P 500 | Nasdaq | VIX | DJIA | Russell 1000 | NYSE |

| 4,136.25 | 12,235.41 | 17.19 | 33,674.38 | 2,261.25 | 15,380.87 |

| -0.80% | 0.07% | 8.94% | -1.24% | -0.79% | -1.06% |

| Nifty 50 | Gold | Silver | Brent crude | USD-INR | EUR-INR |

| 18,069.00 | $2,024.90 | $25.93 | $75.37 | 81.73 | 90.06 |

| 0.02% | 1.40% | 3.87% | -3.75% | 0.01% | 0.01% |

Source: MarketWatch

Hello Saturday,

This week, JPMorgan Chase buys First Republic Bank, the Federal Reserve hikes rates, and the Federal Trade Commission proposes to bar Meta from monetising minors’ data.

- JPMorgan Chase to pay $10.6 billion to buy most of First Republic’s assets and gain access to its coveted client base. This helps calm some panic but does not end the fears of regional banking contagion.

- The Federal Reserve hikes key interest rates by 0.25 percentage points. While inflation is still high, it has begun to wane, and this may be the last rate hike.

- Berkshire Hathaway to host its Warren Buffett-led annual meeting this Saturday in Omaha. 30,000 investors will attend to soak up insights from Buffett on the state of the markets and economy.

- The Federal Trade Commission accuses Meta of violating the terms of its 2020 landmark deal and misrepresenting parental controls in its services; it proposes to bar the company from monetising the data of users under 18.

- Geoffrey Hinton quits Google and decides to blow the whistle on AI technology he helped develop; warns of the dangers of AI becoming smarter than humans.

Taking stock | Golden scraps | “We’ve got this” | The good stock Woodstock | Minor violations | Dr. FrankenstAIn | Invest wisely

Taking stock

US stocks rallied on Friday as Apple posted better-than-expected quarterly results. Shares of regional banks rebounded as JPMorgan upgraded several of them to overweight. For the week, however, the S&P 500 and the Dow ended in red, logging their worst week since March. The S&P 500 lost 0.8%, while the Dow dropped 1.24%. Nasdaq managed to log a small weekly gain of 0.07%.

Golden scraps

On Monday, regulators seized the assets of First Republic Bank as it became the third US bank to collapse since March 2023. JPMorgan Chase & Co. won the bid to buy the failed bank over three smaller rivals. JPMorgan will be paying the US Federal Deposit Insurance Corp (FDIC) $10.6 billion to take control of most of First Republic’s assets and get access to its wealthy client base. JPMorgan’s shares climbed 2% on Monday after this deal was announced.

While this acquisition deal may have helped defuse some panic, it’s not the end of the banking crisis in the US, especially where regional banks are concerned. Depositors and investors have shifted their attention to other regional banks, and it does not look good.

Shares of PacWest midweek were down by over 50%, and the bank is exploring options, including a sale. On Friday, however, in a broader rebound in regional bank shares, PacWest jumped over 80%. While the big US banks remain stable and largely unimpacted, volatility in the banking sector will persist as long as regional banks keep failing.

First Horizon’s stock has also plunged about 40% in recent months, and its $13 billion deal with TD Bank was called off on Thursday. The KBW Bank Index, which tracks 24 of the leading US banks, has plummeted over 30% since March.

“We’ve got this”

On Wednesday, the Federal Reserve raised interest rates by 0.25%, bringing the federal funds rate to the 5% to 5.25% range. While the markets expected this, an interesting thing to note is that this time the Fed’s statement announcing this rate hike did not include language previously used to signal more possible hikes. This could mean a pause on future hikes, but that isn’t yet confirmed as inflation still remains far above the target level of 2%.

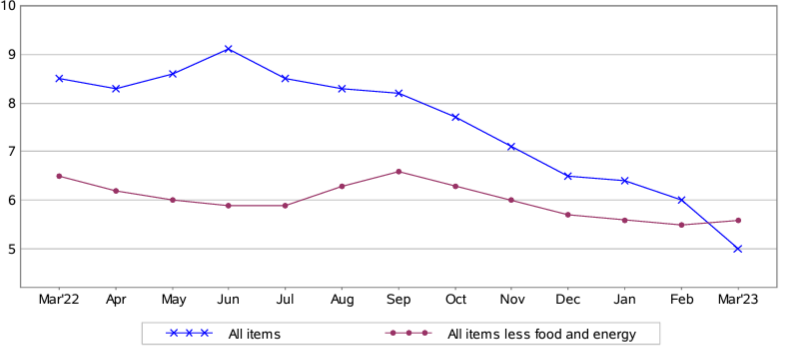

Increasing rates has always been a helpful measure in curbing soaring inflation, and with this being the 10th interest rate hike in a little over a year, inflation is beginning to wane in the US. The Consumer Price Index (CPI), a key measure of inflation, peaked in June 2022 at an annual growth rate of 9.1%. Ever since then, however, it has been falling continuously. In March this year, CPI rose at an annual rate of 5%. This is the lowest level since 2021 and was lower than the 5.3% gain expected by economists. On a monthly basis, CPI was up only 0.1%. Increasing interest rates makes borrowing costlier, and this leads to a decline in spending on both consumer and business ends.

12-month percentage change in CPI:

Source: US Bureau of Labor Statistics

The good stock Woodstock

This Saturday, the Warren Buffett-led annual meeting of Berkshire Hathaway will be held in Omaha, Nebraska. This day-long event is called “Woodstock for Capitalists” by Buffett, as for over five decades, it has served as a chance for investors to soak up financial insights and lessons from the investing legend.

This year, the meeting is being attended by about 30,000 investors, where Buffett and Charlie Munger, Berkshire’s vice chairman, plan on answering shareholder questions for about five hours. Given the current banking turmoil and economic uncertainty, investors are especially eager to hear Buffett’s comments on the financial markets and industry outlook.

Would you like a ticket to this lavish gathering presided by The Oracle of Omaha? All you’ve got to do is hold at least one share in Berkshire Hathaway! Appreciate makes it easy to invest in US stocks like Berkshire Hathaway and more. Download and get started today!

Minor violations

This week, the Federal Trade Commission (FTC) proposed to bar Meta, Facebook’s parent company, from monetising minors’ data, accusing it of violating the terms of its landmark $5 billion deal of 2020. The FTC also said that an independent assessor found several gaps in Facebook’s privacy program. In addition to this, the FTC also accused Meta of violating the Children’s Online Privacy Protection Rule (COPRA) and misrepresenting parental controls on Messenger.

This proposal would prohibit Meta’s companies, including Facebook, WhatsApp, Instagram, and Oculus, from monetising the data of users under 18. The data of all users can only be used for security reasons. In addition, after the users turn 18, data collected previously cannot be monetised. Meta has 30 days to respond.

Dr. FrankenstAIn

Geoffrey Hinton, known as the “godfather of AI”, quit his role at Google this week and blew the whistle on the technology he helped develop. His decision to quit had more to do with retirement, given that he’s 75. However, he also warned about the growing dangers of AI technology.

Hinton said that some of the dangers of AI are far more serious and scary than most realise. He warned that if AI got smarter than humans, it could find ways of manipulating people and find workarounds for restrictions placed on it. Despite this, however, he did not criticise Google and said that the company has been very responsible in its approach to AI.

Invest wisely

Want to make the most of strategic investment recommendations by legendary investors like Warren Buffett? Need easy access to global stocks to do so? Download the Appreciate App and create a well-diversified portfolio across geographies and asset classes today!

Warm regards,

Another week

in the markets