13th May 2023 – 19th May 2023 | Another week in the markets

| S&P 500 | Nasdaq | VIX | DJIA | Russell 1000 | NYSE |

| 4,191.98 | 12,657.90 | 16.81 | 33,426.63 | 2,292.00 | 15,324.32 |

| 1.65% | 3.04% | -1.29% | 0.38% | 1.65% | 0.51% |

| Nifty 50 | Gold | Silver | Brent crude | USD-INR | EUR-INR |

| 18,203.40 | $1,979.90 | $24.02 | $75.59 | 82.84 | 89.51 |

| -0.61% | -1.77% | -0.46% | 1.91% | 0.71% | 0.29% |

Source: MarketWatch

Hello Saturday,

This week, the RBI decides to withdraw ₹2,000 notes from circulation, Japan and the US look to deepen technological cooperation, and Montana bans TikTok.

- The Reserve Bank of India announces the withdrawal of ₹2,000 banknotes from circulation over the next four months, and says there is no need to panic as ₹2,000 notes will continue to be legal tender.

- Japan and the US plan to work more closely with each other in the context of emerging technologies like quantum computing, artificial intelligence, and biotechnology for national and economic security in the face of China’s rapid progress.

- Netflix’s new ad-supported tier begins to pay off as 25% of all new subscribers opt for the ad-supported plan in territories where it is available; however, it still has a long way to go when it comes to increasing its ad-subscriber base compared to rivals.

- Bitcoin mining companies like Bit Digital are looking to expand outside of the US to avoid the regulatory risk of the 30% excise tax on electricity costs as proposed in Biden’s 2024 budget.

- Montana becomes the first US state to approve a state-wide TikTok ban across all devices, including personal ones; penalties will be levied not on individual users but on online app stores offering the app effective from next year.

Taking stock | Why 2k | Samurai Sam | Ad infinitum? | Energy bar | Bannah Montana | Invest wisely

Taking stock

Wall Street closed lower on Friday after debt ceiling negotiations came to a halt. However, during the week, all major indices posted gains. The S&P 500 gained 1.65%, the Dow 0.38%, and the Nasdaq 3.04%.

Why 2k

On Friday, the Reserve Bank of India (RBI) announced its decision to withdraw ₹2,000 banknotes from circulation. Here’s what you need to know:

- The RBI has instructed banks to stop issuing ₹2,000 notes effective immediately.

- You can exchange your ₹2,000 notes at any bank starting May 23, 2023, in batches of up to ₹20,000 at a time. You can also use them to deposit money in your bank account.

- The RBI aims to have all ₹2,000 notes out of circulation and returned to banks by September 30, 2023.

- ₹2,000 notes will continue to be legal tender even after September 30, 2023. The central bank has claimed that this is a routine exercise, and that there is no need to panic.

₹2,000 notes were introduced after the demonetisation of ₹500 and ₹1,000 notes in 2016, supposedly to quickly remonetise the economy. The RBI has stated that that objective has been achieved, since banknotes in other denominations are now available in adequate quantities.

As of March 31, 2023, ₹2,000 notes only made up 10.8% of all currency in circulation. Additionally, about 89% of ₹2,000 notes were issued before March 2017, and are past the end of their estimated life span of 4-5 years.

Samurai Sam

The US and Japan are looking to work more closely with each other in the domains of quantum computing, artificial intelligence, and biotechnology in an attempt to counter China’s rapid strides in these domains. Such cooperation in the matter of emerging technologies is important from an economic security perspective.

IBM and Google are giving $100 million and $50 million, respectively, to the University of Chicago and the University of Tokyo for research into quantum computing. These commitments are to be signed on May 21 in Hiroshima, Japan, during the G7 annual summit.

Micron Technology Inc. will be the first semiconductor company to bring Extreme Ultraviolet Technology (EUV), used in chip manufacturing, to Japan. To this end, it plans to invest about $3.7 billion over the next few years with support from the Japanese government. Japan is trying to increase its domestic semiconductor production, and Micron will receive about $1.5 billion in financial incentives from the Japanese government to install advanced EUV chip-making equipment at its facility in Hiroshima.

Ad infinitum?

This Wednesday, Netflix made its first pitch to advertisers during the Upfronts, an annual event where networks aim to strike deals with advertisers and media buyers for their upcoming shows. During this pitch, updates about Netflix’s new ad-supported plan showed that this business model is starting to pay off.

Netflix launched a cheaper, ad-supported plan at $6.99 in 12 markets last November, and has reported that it has five million monthly active users for this plan. It also revealed that 25% of all new subscribers were signing up for its ad-supported tier in markets where it is available. After its pitch, the streaming service’s stock rose more than 9% Thursday.

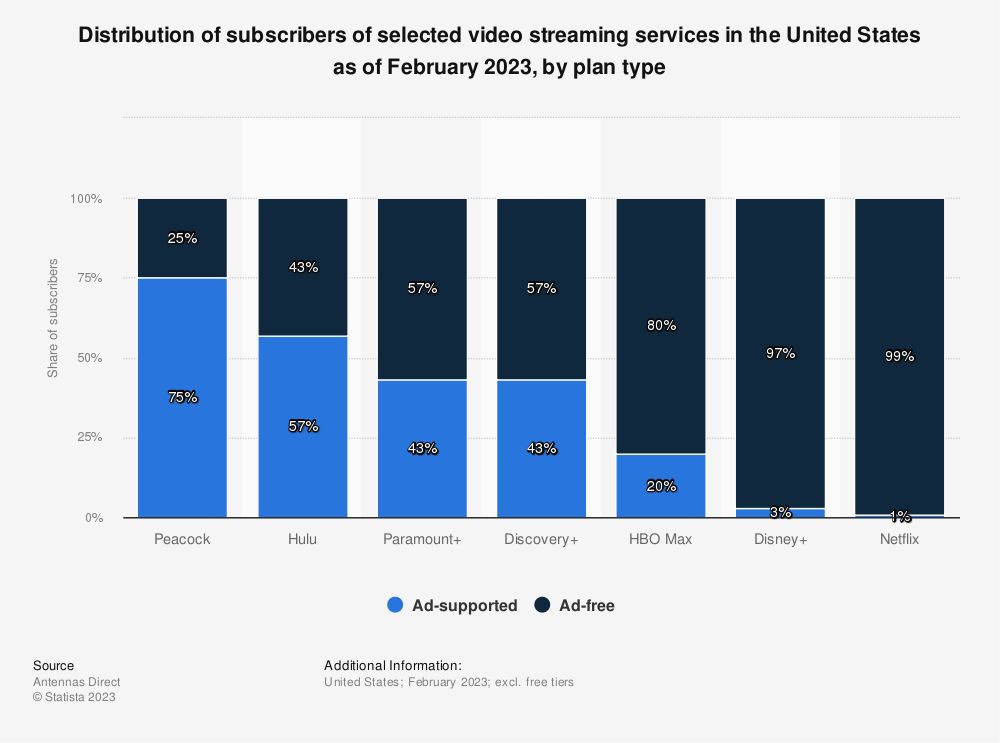

While Netflix’s ad-supported tier may be gaining subscribers, it still has a long way to go when compared to its competitors like NBCUniversal’s Peacock, Paramount, and HBO Max. All these streaming platforms have a far larger subscriber base for their respective ad-supported tiers and are hence more appealing to major advertisers. Peacock, for instance, has 15.5 million ad-tier subscribers in the US.

Source: Statista

Energy bar

President Biden proposed a Digital Asset Mining Energy (DAME) excise tax in his 2024 federal budget, which is a major regulatory risk for crypto mining. DAME would require firms that mine digital assets to pay a crypto mining tax equal to 30% of their electricity costs in instalments of 10% spread out over three years starting January 2024.

This proposed tax would impact Bitcoin the most, as it is the biggest crypto network that uses an underlying mechanism — proof-of-work (PoW) — requiring significant electricity. As opposed to this, networks like Ethereum use proof-of-stake (PoS), which is much more energy-efficient.

To avoid this possible regulatory risk, Bitcoin miners are expanding their infrastructure outside of the US. For instance, Bit Digital is looking to place as many as 2,500 newly purchased mining machines in Iceland.

Bannah Montana

This week, Montana became the first US state to ban the Chinese-owned social media app TikTok. Starting January 1, 2024, Montana will make it unlawful for online app stores like Google Play and Apple’s App Store to offer TikTok to users in Montana. However, no penalties will be imposed on any individuals using the app. A group of TikTok users have already filed a suit to overturn Montana’s statewide ban on the basis that it violates their First Amendment rights.

Invest wisely

Just as companies are vulnerable to regulatory risks, like the proposed DAME tax and Montana’s ban on TikTok, your investment portfolio, too, is vulnerable to a range of risks. Hence, diversification across asset classes, sectors, and geographies is crucial when investing. Download the Appreciate App to add international exposure to your portfolio, and invest in US stocks and ETFs across sectors to build a well-diversified portfolio today!

Warm regards,

Another week

in the markets