14th May – 20th May 2022 | Another week in the markets

| S&P 500 | Nasdaq | VIX | DJIA | Russell 1000 | NYSE |

| 3901.36 | 11,354.62 | 29.43 | 31,261.90 | 2,144.71 | 15,080.98 |

| -3.05% | -3.82% | 1.94% | -2.90% | -2.98% | -1.16% |

| Nifty 50 | Gold | Silver | Brent crude | USD-INR | EUR-INR |

| 16,266.15 | $1,845.10 | $21.965 | $112.91 | 77.82 | 82.20 |

| 3.07% | 1.92% | 3.03% | 1.52% | 0.43% | 1.89% |

Source:MarketWatch

Hello Saturday,

This week the S&P 500 entered the bear market territory, the rupee fell to an all-time low, and major US retailers posted disappointing Q1 earnings.

- The S&P 500 closes just above the bear market threshold

- New digital ad transaction bill was introduced which may force Google to break up its ad business

- Twitter’s stock turns positive as the company confirms the deal with Musk is still on

- Walmart and Target’s stocks fall as their first-quarter earnings fail to meet Wall Street’s expectations

- High-growth startups are accepting discounted valuations to close deals

Taking stock | Bear with us | Ad break | #WaitForIt some more | Retail downturn | Valuation shrinkage | Invest wisely

Taking stock

The markets ended another week in red with the S&P 500 and Nasdaq suffering their seventh consecutive week of losses. This makes it their longest losing streak since the 2001 dot-com bubble crash. The Dow posted its eighth straight weekly decline, its longest since the Great Depression in 1932. Most tech stocks fell on Friday while Apple rallied. On account of sexual misconduct allegations against Elon Musk, the CEO of Tesla, the company’s stock fell by 6.4%. Despite the grim performance of the overall market, certain American Depositary Receipts (ADRs), such as Akari Therapeutics Plc, have been performing well.

Bear with us

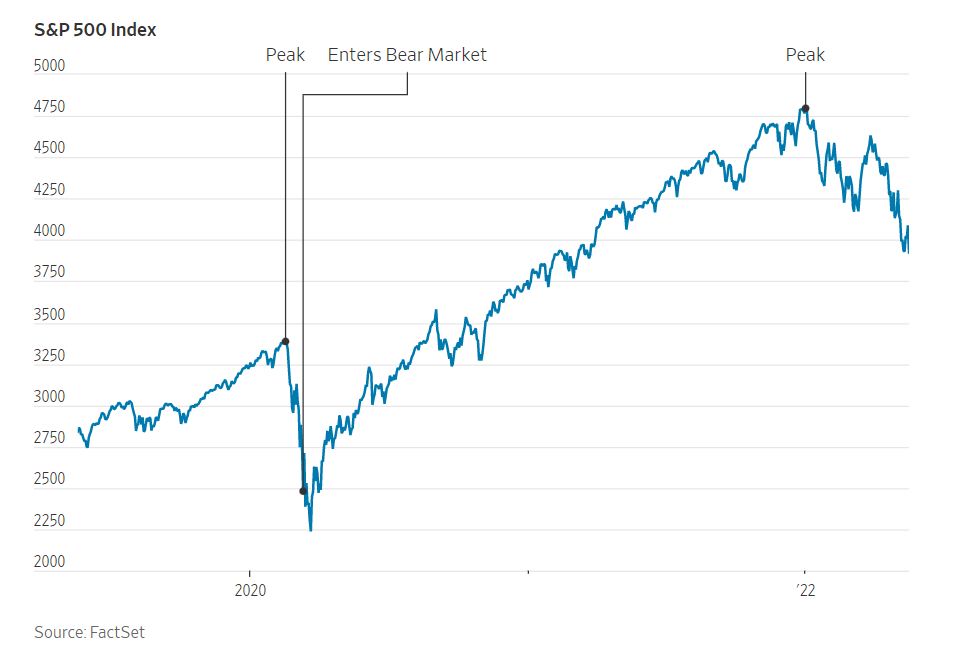

On Friday morning, the S&P 500 entered the bear market territory but rallied out of it as the markets closed. A stock index enters the bear market when it drops by 20% or more from its most recent high, and this reflects extreme negative investor sentiment. With surging inflation, Russia’s invasion of Ukraine, and rising interest rates, the S&P has been flirting with the bear market for a while now by dropping significantly from its high in January earlier this year. Since March, Nasdaq, the tech-heavy index, has been in the bear market and is down by 30.7% from its November 2021 high. While recessions are often preceded by bear markets, bear markets don’t always end in recessions. Therein lies the hope.

Ad break

On Thursday, a bill was introduced by a bipartisan group of senators, which, if passed, would force Google to break up its ad business. The Competition and Transparency in Digital Advertising Act essentially aims to ban companies that have revenue from digital ad transactions of over $20 billion a year from partaking in multiple parts of the digital ad process. This would have a direct impact on Google’s parent company Alphabet. Alphabet reported revenue of $68.01 billion in the first quarter of the year – of which the majority, at $54.66 billion, was ad revenue. Google has an unfair advantage in the digital ad ecosystem because it both runs an auction or exchange to buy and sell ads while also offering companies tools to buy and sell ads. Hence, if this bill is passed, it will have to choose which part of its business it wants to keep.

#WaitForIt some more

After a week of uncertainty since Musk tweeted that the $44 billion deal is on hold on account of confirmation on bot data, Twitter shares rose 3% this Thursday. This spike came after the company disclosed to its employees that the acquisition deal was moving forward as planned and that there would be no price renegotiation. Amidst the Twitter deal chaos, Musk had to soothe Tesla investors by reassuring them that less than 5% of his time is dedicated to the Twitter deal.

This seemed necessary because since Musk’s 9% stake in the social media platform was disclosed in April, Tesla shares have lost about one-third of their value. He has also sold about $8.5 billion worth of Tesla shares, which is assumed to be on account of helping finance the Twitter acquisition.

Retail downturn

On Tuesday, Walmart released its first-quarter results that fell short of Wall Street’s expectations. After reporting a 25% decline in quarterly earnings, Walmart saw its stock drop by 11.38%, touching a 52-week low. The company attributed this to increased labour costs, rising fuel prices, and unwanted inventory pile-ups in the face of consumers’ cutting on discretionary spending. But Walmart is not the only big-box retailer that is being hit by surging inflation. Target released its first-quarter results on Wednesday, which also missed the estimates. Target’s shares fell by almost 25%, hitting a 52-week low and the company’s market cap took a sharp hit falling from $99.82 billion on Tuesday to about $75 billion on Wednesday.

Valuation shrinkage

Investors fear that high startup valuations are simply a bubble that is going to burst any time now. This fear comes from the fact that the private market has also begun to see valuation cuts like the public market. High-growth tech startups, especially, are increasingly raising down rounds. For instance, the fintech giant Klarna, backed by SoftBank, is looking to raise funds at one-third of the $46 billion valuation that it achieved in 2021. But in a rough environment for tech companies, Klarna isn’t the only tech startup seeing massive valuation cuts. The stock price of Affirm Holdings, a competitor of Klarna, has fallen 75% since the year started, giving it a $7.2 billion valuation.

Invest wisely

While the world markets are down and the rupee continues to further depreciate against the US dollar, there is one way you can take advantage of this. By investing in high-performing US stocks, you will benefit from the growth of the stocks as well as from the rupee-dollar exchange rate. A recent study by the IMF has estimated that by 2028, one US dollar will equal roughly 94.40 rupees. Now is the time to start investing in US stocks, and you can gain access to them right away by downloading the Appreciate App.

Warm regards,

Another week

in the markets