31st December 2022 – 06th January 2023 | Another week in the markets

| S&P 500 | Nasdaq | VIX | DJIA | Russell 1000 | NYSE |

| 3839.50 | 10,466.48 | 21.67 | 33,147.25 | 2,105.90 | 15,184.31 |

| -0.14% | -0.30% | 3.83% | -0.17% | -0.11% | -0.03% |

| Nifty 50 | Gold | Silver | Brent crude | USD-INR | EUR-INR |

| 18,105.30 | $1,830.10 | $24.18 | $85.99 | 82.75 | 88.56 |

| 1.68% | 1.33% | 1.09% | 1.70% | -0.05% | 0.76% |

Source: MarketWatch

Hello Saturday,

This week the US tech industry sees more massive layoffs, unemployment rate dips, and Bed Bath & Beyond states it’s on the brink of bankruptcy.

- December Jobs report reveals unemployment rate falls to 3.5% from 3.6% in November; a low unemployment rate is not a good sign for inflation and will only trigger the Fed to keep the monetary policy tight

- Major tech layoffs continue as Amazon, Salesforce, and Vimeo announce laying off their workforce by 1.2%, 10%, and 11% respectively

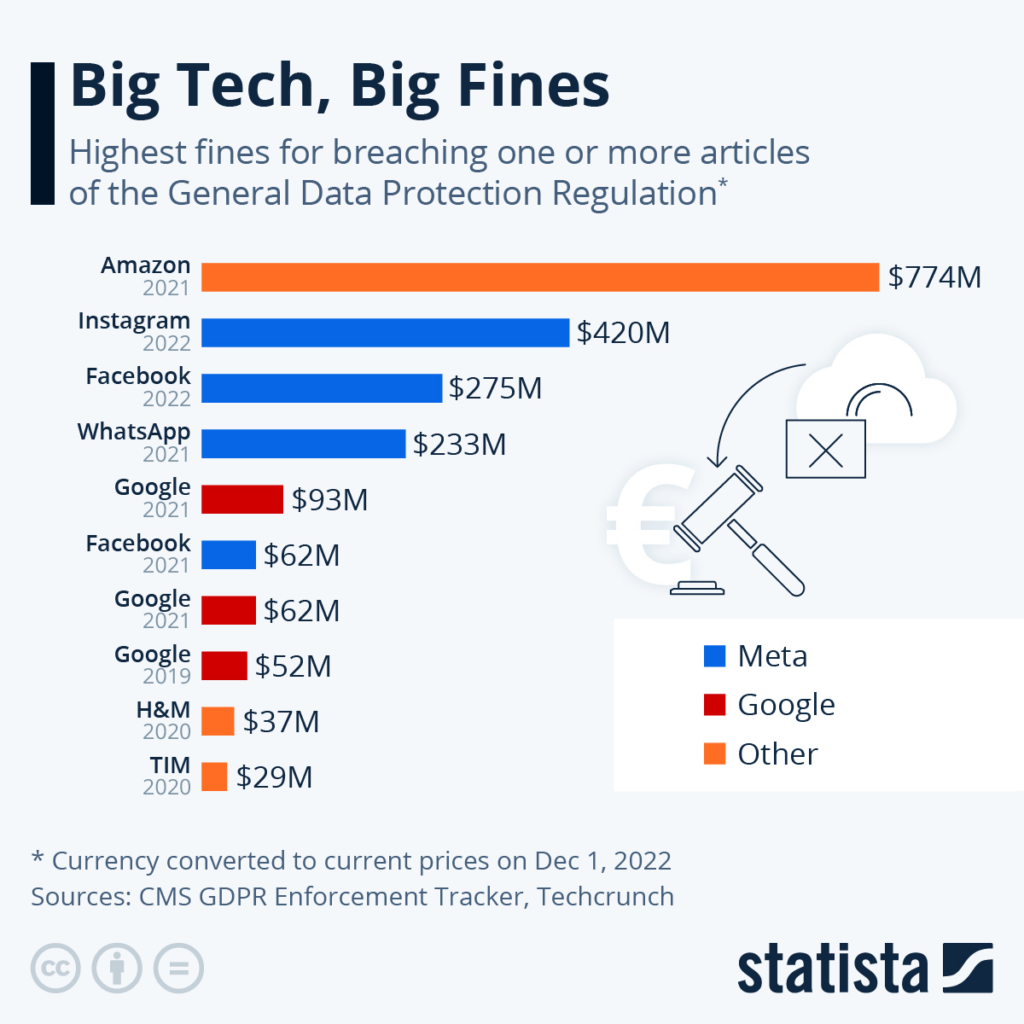

- Meta fined over $400 million by EU’s regulator over Facebook and Instagram’s breach of General Data Protection Regulations; Meta to appeal the ruling over targeted ads

- Special Purpose Acquisition Companies (SPACs) bubble bursts with rapid liquidation at a rate of four per day; SPAC founders lose over $1.1 billion in 2022

- Bed Bath & Beyond stock plunges over 30% as the company announces worse-than-expected sales and potential bankruptcy

Taking stock | Unempflation | New year housekeeping | Fine-toothed comb | SPACing out | Bed Bath & Bankruptcy | Invest wisely

Taking stock

Wall Street rallied on Friday after the December Jobs report showed cooling wage growth, signalling that inflation pressure may be easing. For the week, S&P climbed 1.45%, the Dow gained 1.46%, and Nasdaq advanced 0.98%. Both S&P and Nasdaq snapped out of a four-week losing streak.

Unempflation

On Thursday, major US indices lost more than 1% as the ADP National Employment report revealed a higher-than-expected rise in private employment in December. On Friday, however, stocks rallied as the December jobs report showed that job additions in December were smaller than in November, while average hourly earnings also cooled. However, the unemployment rate fell to 3.5% from 3.6% a month ago. Lower unemployment, while good news for the economy, is not the best news for stocks.

There is a historical inverse relationship between unemployment and inflation – low unemployment tends to drive up inflation. And hence a strong labour market will only further prompt the Federal Reserve to keep the monetary policy tight and aggressively increase the interest rates to bring down inflation. Even the anticipation of a rise in interest rates leads to a decline in stock prices, as rising interest rates make stocks less attractive to investors. And for the Fed to reach its desired 2% inflation target, the unemployment rate will have to rise to about 4.5% in 2023 as per projections.

New year housekeeping

Not even a week into 2023, and the tech industry is seeing layoffs accelerate at a sharp pace. This week tech giants including Amazon, Salesforce, and Vimeo announced major layoffs. Amazon said it would lay off 18,000 employees starting January 18, citing the uncertain economy and rapid hiring as reasons for such job cuts. Salesforce announced it would lay off about 8,000 employees, which equates to 10% of its workforce, while Vimeo said it would be laying off 11% of its workforce.

The economic conditions of 2022 have been forcing tech companies to focus on their core strengths and stop the years-long trend of diversifying revenue. Additionally, tech companies are also being forced to correct their overzealous staffing during the pandemic boom.

Fine-toothed comb

On Wednesday, Irish Data Protection Commission, Meta’s primary regulator in the EU, fined Meta over $400 million for sending ads to users based on their online activity, i.e. targeting too fine. This is divided into two fines. First, a fine of around $222.5 million for violations of the EU’s General Data Protection Regulation (GDPR) by Facebook and second, a fine of around $188 million for violations of the law, same by Instagram.

This ruling stems from complaints filed against the company in 2018 and brings an end to two lengthy investigations. Meta has three months to bring its data collection practices into compliance with EU regulations. However, the company announced that it plans to appeal the ruling. This isn’t the first time Meta has been fined for violations of GDPR. Over the last few years, most of Big Tech has paid millions in fines.

Source: Statista

SPACing out

Imagine investing in the Initial Public Offer (IPO) of a company without any commercial operations and little information on what will happen with your money. For as crazy as it may sound at first, such companies, known as Special Purpose Acquisition Companies (SPACs) are legit. Also known as blank check companies, SPACs are formed to raise money through an IPO to acquire an existing company. And while they have been around for a long time, they gained immense popularity in 2020 and 2021. The SPAC boom saw prominent investment banks like Goldman Sachs and Credit Suisse as underwriters and celebrities like Jay-Z and Serena Williams as investors, with a record 613 SPAC IPOs in 2021. But this SPAC boom busted at the end of 2022 and is continuing to fizzle out.

Currently, SPACs are liquidating at a rate of four a day, and SPAC creators have lost over $1.1 billion in 2022. Why is this happening? One of the primary reasons is the fact that SPACs have two years to complete an acquisition, or else they need to return the money they have raised to the investors. With the way the global markets have been, given surging inflation, rising interest rates, and falling stock prices, SPAC executives have been finding it difficult to find a good deal. Another reason is the recent legislative changes such as the Inflation Reduction Act of 2022 that includes a 1% tax on corporate stock buybacks effective from 2023. While it’s still unclear if this tax will apply to the liquidation distributions from SPACs, it has been one of the triggers for the rapid liquidation in the second half of 2022.

Bed Bath & Bankruptcy

Once upon a time, Bed Bath & Beyond used to be one of the leading American big box retailers, but 2023 may soon see the company file for bankruptcy. Over the last decade, Bed Bath & Beyond became one of the worst-hit brick-and-mortar retailers as it struggled to transition online. Despite that, in early 2021, its stock price surged as it gained the designation of a meme stock. Now, stocks have plunged about 95% from a high of $35 in January 2021. This week on Thursday, shares of the retailer ended 30% down at $1.69 after it announced going concern warnings and worse-than-expected sales. While the company said it would explore restructuring, selling assets, and seeking additional capital, a Chapter 11 bankruptcy may be unavoidable as the company is running out of cash and crumbling under a massive debt burden.

Invest wisely

The direction of the markets in the coming months will primarily be determined by the Fed’s policy, China’s COVID-19 scenario, and the energy crisis in Europe. All of this may translate to short-term volatility, which is best to disregard if you are investing with a long-term horizon in mind. To meet your long-term financial goals, you should focus on investing in equity and equity-linked instruments like exchange-traded funds through Systematic Investment Plans (SIPs). You can set up multiple SIPs, each linked to a specific goal, and invest in high-performing US stocks to meet these goals through the Appreciate App. Download today!

Warm regards,

Another week

in the markets