15th April 2023 – 21st April 2023 | Another week in the markets

| S&P 500 | Nasdaq | VIX | DJIA | Russell 1000 | NYSE |

| 4,133.52 | 12,072.46 | 16.77 | 33,808.96 | 2,262.83 | 15,578.93 |

| -0.10% | -0.42% | -1.76% | -0.23% | -0.09% | -0.15% |

| Nifty 50 | Gold | Silver | Brent crude | USD-INR | EUR-INR |

| 17,624.05 | $1,994.10 | $25.16 | $81.75 | 82.05 | 90.17 |

| -1.14% | -1.16% | -1.22% | -5.63% | 0.25% | 0.21% |

Source: MarketWatch

Hello Saturday,

This week, major US companies continue to announce layoffs, Netflix announces the closure of its DVD rental service, and Apple launches a high-yield savings account.

- Earnings season continues as Goldman Sachs, Morgan Stanley, IBM, Tesla, and AT&T report first-quarter earnings this week.

- Fox Corp. settles a defamation suit with Dominion Voting Systems by agreeing to pay $787.5 million over false claims that Dominion’s machines swayed the outcome of the 2020 US presidential elections.

- Netflix announces that its DVD rental service will be shut down on September 29, 2023, as DVD rental demand continues to shrink — DVD.com accounts for only 0.5% of the company’s total revenue.

- Major companies continue with layoffs in an attempt to cut costs; BuzzFeed Inc. announces the closure of its news arm BuzzFeed News, Meta begins its latest round of layoffs, and companies including Ernst & Young and Opendoor announce large-scale layoffs.

- Apple and Goldman Sachs launch a new high-yield savings account offering an interest rate of 4.15%: 10 times higher than the US national average.

Taking stock | What does the Fox say? | Teslag | DVDone | No axe evasion | Green Apple Twist | Invest wisely

Taking stock

All major indices booked a small weekly loss. The S&P 500 slipped 0.10%, the Nasdaq fell 0.42%, and the Dow dropped 0.23%. Most corporate earnings reports this week beat expectations, but that failed to boost stocks as investors are worried about a potential recession and a drop in earnings.

What does the Fox say?

On Tuesday, Fox Corp. agreed to pay Dominion Voting Systems $787.5 million to settle a defamation lawsuit, thus avoiding a week-long trial. Dominion Voting Systems, a company that sells voting machines and election software, filed a lawsuit against Fox News over claims that Dominion’s machines swayed the outcome of the 2020 US presidential elections.

Even though Fox Corp. got away with a settlement amount that was roughly half of the $1.6 billion that Dominion had originally demanded, this is the largest known defamation settlement involving a media house in US history. The settlement also averted the risk of network boss Rupert Murdoch and various Fox hosts facing hostile questioning and having to testify publicly.

However, Fox Corp. is not fully off the hook yet — Smartmatic, another voting technology company, has filed a similar defamation suit worth $2.7 billion over Fox’s coverage of the 2020 election.

Teslag

One of the bigger disappointments during the ongoing earnings reporting season was Tesla, which posted a major decrease in net income. Here are some key earnings reports from this week:

- Tesla: Tesla’s net income fell 24% to $2.51 billion from a year ago, while earnings per share, at 85 cents, were in line with estimates. The electric vehicle maker clarified that the underutilisation of its new factories had stressed margins; in addition, higher costs for raw materials, commodities, logistics, and warranties had contributed to the drop in its earnings.

- Goldman Sachs: On Tuesday, Goldman Sachs reported revenue and net income that missed expectations at $12.22 billion and $1.78 billion, respectively. The earnings per share, however, at $8.79, was better than estimates. Goldman Sachs is not as diversified as rivals like Morgan Stanley, and gets most of its revenue from trading and investment banking; as a result, Wall Street’s activities have a greater impact on it.

- IBM: IBM’s Q1 earnings came in stronger than expected. Net income rose 26% to $927 million, while the revenue increased 0.4% from a year earlier. The firm’s shares rose around 4% in extended trading.

- Morgan Stanley: Morgan Stanley’s revenue beat estimates as its wealth management revenue increased by 11% in the first quarter, even though trading and investment banking revenue dropped. The bank’s revenue of $14.5 billion and earnings per share of $1.70 beat estimates.

- AT&T: AT&T’s stock closed more than 10% down on Thursday after the company reported Q1 earnings that failed to meet estimates. It reported a net income of $4.18 billion, a decline from the $4.76 billion from a year earlier.

Big Tech firms are expected to start putting out their earnings reports next week.

DVDone

After running it for 25 years, Netflix is finally shutting down the DVD rental service that initially helped it become a household name. The streaming giant began as a DVD rental and sales site in 1998 and only began its streaming service in 2007. As of November 2022, Netflix had shipped more than 5.2 billion DVDs to its estimated 1.5 million DVD service subscribers.

On Tuesday, CEO Ted Sarandos said DVD.com would send its last red envelope on September 29, 2023, following which the rental service would be shut down. The company will continue to focus on digital streaming, which is where the majority of its revenue comes from: the DVD rental service represented only 0.5% of Netflix’s total revenue in 2022.

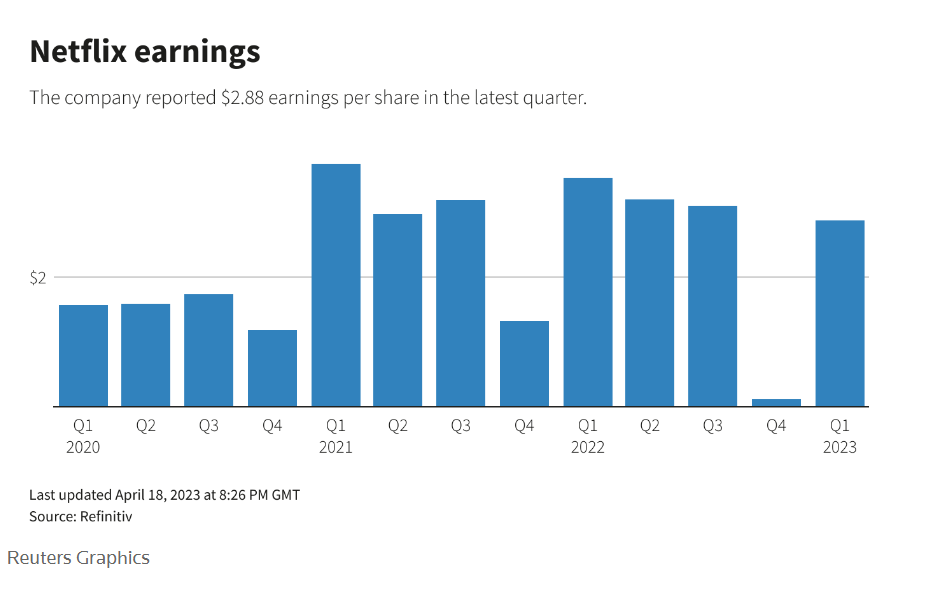

As per its Q1 earnings report, Netflix’s revenue and earnings per share were more or less in line with Wall Street estimates at $8.16 billion and $2.88, respectively. After the company posted its earnings, its stock fell by as much as 11% in after-trading hours but recovered to gain 1.4%. Netflix added 1.75 million paid subscribers in Q1 2023, and has delayed the rollout of its password-sharing crackdown to the second quarter.

Source: Reuters

No axe evasion

Additional rounds of layoffs were announced this week by major companies as they continued with cost-cutting measures in an economy marked by high inflation and instability. On Thursday, BuzzFeed Inc. announced that it has started the process of shutting down its news arm, BuzzFeed News, as it can no longer fund it. The company is laying off 15% of its total workforce across business, content, tech, and admin in its second round of layoffs — the first round of layoffs was announced in December and resulted in 12% of jobs being axed.

This week, Meta began its latest round of layoffs, which will focus on technical workers. In March, Mark Zuckerberg had announced that the company would cut loose an additional 10,000 employees in the coming months. Other companies to announce large-scale layoffs this week include Ernst & Young, Opendoor, and David’s Bridal.

Green Apple Twist

On Monday, Apple and Goldman Sachs collaboratively launched a high-yield savings account that will offer an interest rate of 4.15%. This interest rate is 10 times higher than the US national average, and is significantly higher than that offered by even some of the biggest banks. To open such an account, Apple users must have Apple’s credit card, known as Apple Card.

This move is being seen by experts as an attempt to increase customer loyalty rather than an attempt to compete with the big banks: if users are managing their money and banking through Apple, then there is a lower chance of them moving to Android.

Invest wisely

With a new financial year having been ushered in, it’s important to review your portfolio and overall investment strategy. And whether you want to diversify your equity holdings with overseas investments or get started with systematic investment plans for disciplined investing, Appreciate has got you covered. Download the app today to access a wide range of high-performing US stocks and ETFs, as well as a range of helpful investing tools.

Warm regards,

Another week

in the markets