Semiconductors and semiconductor products are vital to the modern world as we know it, with laptops, smartphones, and most telephony infrastructure being dependent on the products this sector produces. Semiconductor products also find applications in artificial intelligence (AI) research, supercomputing, and various kinds of “smart” devices.

The semiconductor sector was able to shrug off the effects of the COVID-19 pandemic to post revenue growth of 6.5% in 2020. Moreover, the sector is slated to grow at a CAGR of 9.2% over the period 2022-2029.

Given the rising importance of AI-based research (including medical research), smart medical devices, robots, cloud computing, and autonomous vehicles, and the growing popularity of games, augmented reality (AR), virtual reality (VR), and cryptocurrency mining, the demand for semiconductor products is almost certain to remain elevated for the next few years.

QUICK TAKEAWAYS

- Semiconductor products are essential to most modern technology.

- Overall, the semiconductor sector was unfazed by the COVID-19 pandemic and posted strong numbers during the 2020-2021 period. Moreover, it is poised to grow robustly over the coming decade.

- There is an ongoing chip shortage caused by a confluence of several factors, including a “trade war” between the US and China. This shortage is likely to continue for a few more years until companies can ramp up production.

- The demand for semiconductor products is growing due to several relatively new applications of processors, such as AI, cloud computing, AR/VR, cryptocurrency mining, and autonomous vehicles.

- The United States is making efforts to improve its existing chip manufacturing infrastructure and reduce its reliance on imports.

STATS CORNER

PROJECTED MARKET VALUE BY 2030

$1 trillion

(Source)

WORLDWIDE SEMICONDUCTOR REVENUE IN 2022

$601.7 billion

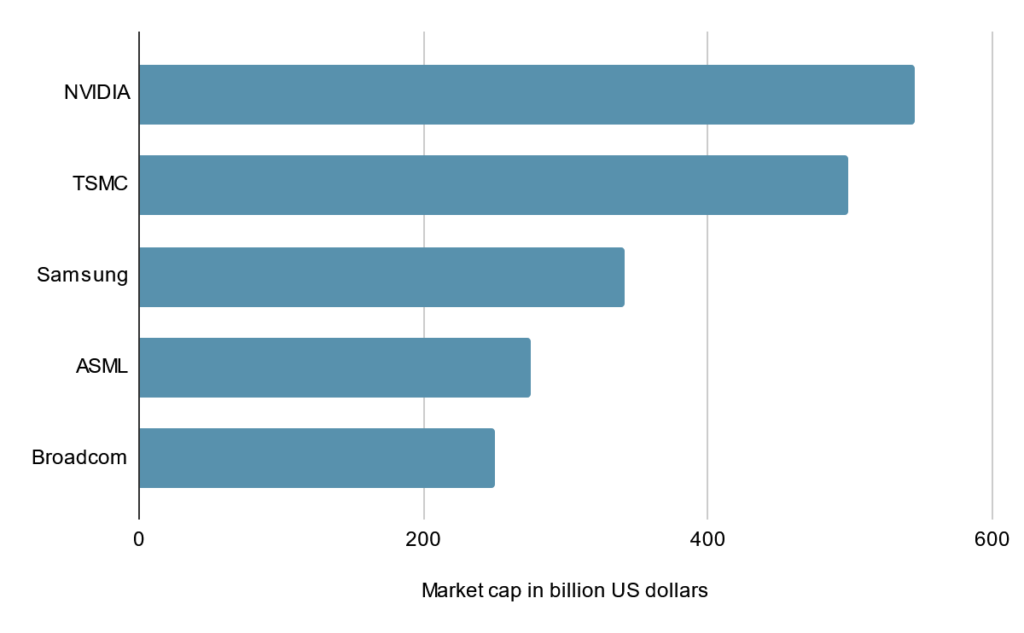

KEY PLAYERS

[WORLDWIDE, BY MARKET CAP]

(Source)

[THE UNITED STATES, BY REVENUE]

| Company Name | Revenue Generated | Revenue Generated | Revenue Generated | Revenue Generated | Revenue Generated |

| 2022 | 2021 | 2020 | 2019 | 2018 | |

| Intel Corporation (Jan – Dec) | $63.05 B | $79.02 B | $77.87 B | $71.97 B | $70.85 B |

| Qualcomm (Oct – Sep) | $44.20 B | $33.57 B | $23.53 B | $24.27 B | $22.61 B |

| Broadcom (Nov – Oct) | $33.20 B | $27.45 B | $23.89 B | $22.60 B | $20.85 B |

| Micron Technology (Sep – Aug) | $30.76 B | $27.71 B | $21.44 B | $23.41 B | $30.40 B |

| Applied Materials (Nov – Oct) | $25.79 B | $23.06 B | $17.20 B | $14.61 B | $16.71 B |

(Source)

- Intel Corporation (NASDAQ: INTC): Intel is one of the most well-known companies in this sector. It is the world’s largest semiconductor chip manufacturer by revenue and also manufactures related equipment such as integrated circuits, graphics chips, and flash memory.

- Qualcomm (NASDAQ: QCOM): In addition to manufacturing semiconductors, Qualcomm also makes software and provides services related to wireless technology. It sells its semiconductor products using a business model that is mainly based on fabless manufacturing, i.e. the actual fabrication of those products is outsourced to a specialised manufacturer.

- Broadcom (NASDAQ: AVGO): Broadcom started out in 1961 as a semiconductor products division of Hewlett-Packard, from which it split in 1999. It designs, manufactures, and supplies semiconductor and software products that cater to the networking, storage, and broadband markets, among others.

- Micron Technology (NASDAQ: MU): Micron Technology produces computer memory and data storage solutions, including flash memory and USB flash drives.

- Applied Materials (NASDAQ: AMAT): Applied Materials is a supplier for the semiconductor, computer, and electronics industries. Its offerings include equipment, services, as well as software. It also supplies flat panel displays for electronic devices and solar products.

KEY DRIVERS

- Growing demand: Chips and processors are now being used in smartphones, refrigerators, washing machines, cars, and a whole host of household devices. They’re also being used for automation and cryptocurrency mining. The advent of 5G and the ‘Internet of Things’ (IoT) is also likely to contribute to the growing demand for semiconductor products. Given such high demand and the fact that semiconductor manufacturing is extremely expensive and high-precision, it will take at least a few years for the supply to catch up.

- Trade relations: The ongoing US-China ‘trade war’ has made it difficult for China, a fast-growing semiconductor manufacturing hub, to procure the components and equipment it needs to manufacture chips. This was one of the main reasons for the chip shortage of the past few years. How global trade relations play itself out will have a major impact on the sector as a whole.

- Growth in US production: The United States recognises the importance of having strong domestic chip manufacturing capabilities and has begun working in that direction. For instance, the US government has reached an agreement with Taiwan Semiconductor Manufacturing Company (TSMC) to set up a new production facility in Arizona. Intel has also announced its plans to set up fabrication plants in the US, and to invest up to 80 billion euros in the entire semiconductor value chain in the EU.

WHAT DOES THE FUTURE HOLD?

With their application steadily growing across industries, AI and machine learning represent a major opportunity for the semiconductor sector in the near to long term. AI is now being used in cars and household devices (e.g. Alexa, Siri), as well as to automate processes across several industries. It is also being used in medical research (e.g. determining the shapes of proteins). This list is bound to grow longer over time, resulting in greater demand for chips and processors.

In addition, better AI systems could also help design faster and more efficient processors, creating a positive feedback loop.

The rise in popularity of the so-called ‘Metaverse’, along with other manifestations of AR/VR, is also likely to play a key role in accelerating the demand for semiconductor products, mainly for headsets and other sensors.

Lastly, if quantum computing, which is currently a highly tentative technology, were to become practically usable using semiconductor-based substrates, then it could result in an explosion of demand for semiconductor products.

Download the Appreciate trading app to invest in a high-demand sector that is central to our modern world. Get AI-based insights and recommendations to build a diversified investment portfolio that is suited for your financial goals and risk appetite.