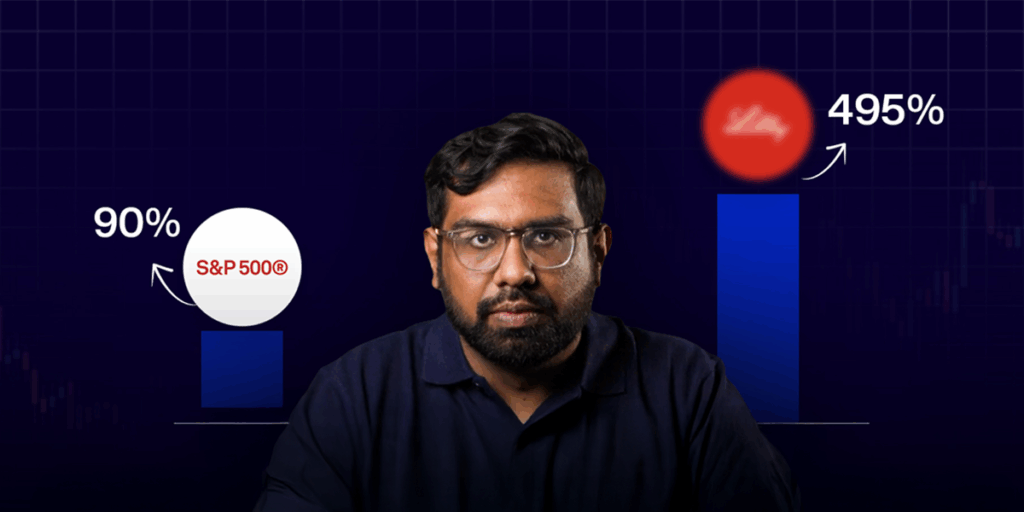

From 2020 through 2023, some US-listed companies posted annual returns that exceeded the S&P 500 in each of those years. This performance occurred across a period that included sharp market swings, interest rate changes, and differing economic conditions. Watch the video below for the complete breakdown and details on the companies involved.

Examining these companies’ results shows several recurring characteristics. Their business models appeared flexible enough to perform in both growth-driven and more defensive market phases. They maintained solid fundamentals, disciplined capital allocation, and consistent execution of strategic priorities.

In many cases, resilience stemmed from diverse revenue sources, steady demand for core offerings, and a willingness to invest in innovation or efficiency improvements. Their ability to sustain these traits over multiple years suggests that long-term market leadership is not purely dependent on short-term catalysts.

For investors, the takeaway is that repeated outperformance against a major benchmark like the S&P 500 can provide useful case studies. Identifying similar operational and strategic qualities in other companies may help in finding investments with the potential for durable returns, even in changing market conditions.

Disclaimer: Investments in securities markets are subject to market risks. Read all the related documents carefully before investing.