Introduction

Poland’s stock market emerged as one of the top performers globally in 2025. Year-to-date, the main Warsaw Stock Exchange index (WIG) has surged over 25%, hitting a record high of 101,485 in April. In contrast, both the US and Indian markets have delivered more modest gains, underscoring how global opportunities can sometimes outperform the usual giants.

For Indian investors seeking diversification, Poland’s rally is a timely reminder that strong returns can come from beyond the traditional powerhouses like the US or China. With platforms like Appreciate, investors can effortlessly access global opportunities through US-listed ETFs, including the iShares MSCI Poland ETF (EPOL). Appreciate makes it simple for Indian investors to invest in international markets, with options starting from just ₹1, providing a seamless way to diversify their portfolios globally.

Major Growth Drivers

As of May 6, 2025, the Warsaw Stock Exchange’s main index (WIG) has surged over 25% year to date, reaching a record high of 101,485 in April. This rally is backed by strong economic growth, rising investments, and pro-business government policies.

Poland’s Economic Growth Outlook

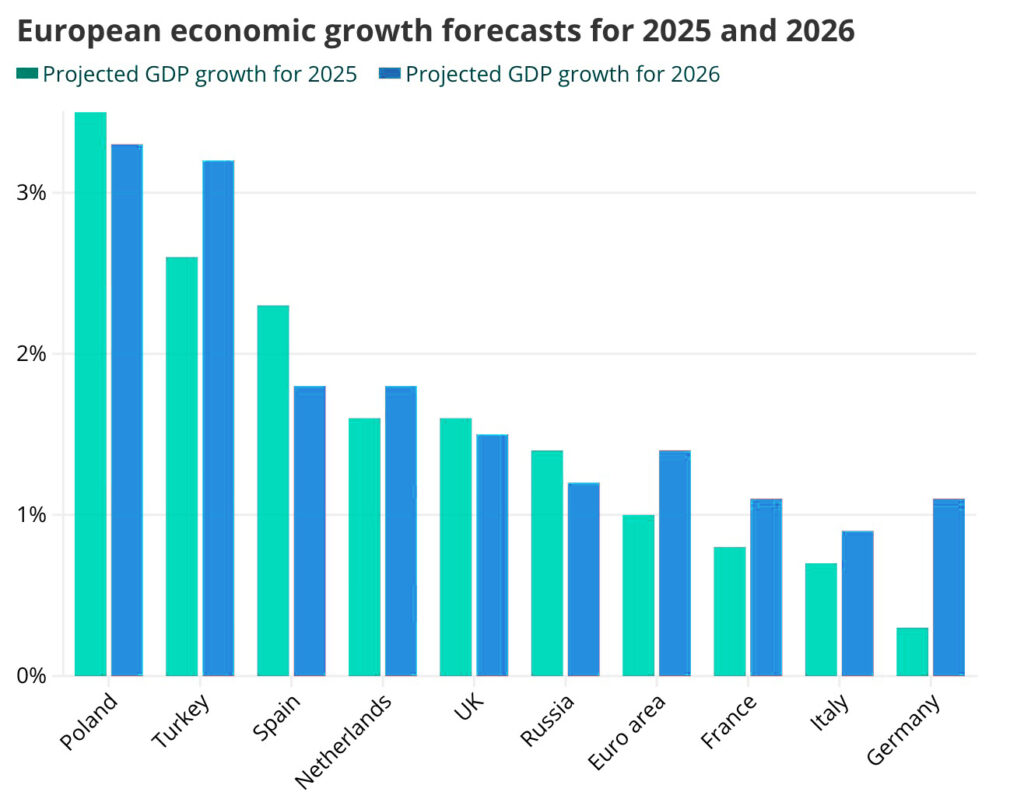

According to the World Economic Outlook, Poland’s economy is expected to grow by 3.2% to 4% in 2025, significantly outperforming the EU average of 1.2%. In comparison, major European economies such as Germany, France, and Italy are projected to grow by less than 1%, positioning Poland as one of the fastest-growing economies in the region.

Investment Inflows

As stated on the official Polish government website, the country is projected to attract between PLN 650 and 700 billion in investments in 2025 (around $160 billion). A significant portion of this capital is expected to flow into key sectors such as green energy, infrastructure, and technology, which are essential to Poland’s long-term growth strategy.

Government Initiatives

The Polish government is advancing a six-pillar economic strategy aimed at innovation, digital development, clean energy, and infrastructure improvement. This proactive approach, as outlined by government sources, is boosting investor confidence and positioning Poland as one of the most promising emerging markets globally.

How Indian Investors Can Benefit

Direct Investment in Polish Stocks

Indian investors can purchase shares of companies listed on the Warsaw Stock Exchange (WSE), Poland’s primary stock market, offering direct exposure to top Polish firms across sectors like finance, technology, energy, and manufacturing.

This allows investors to participate in Poland’s growth story. The advantages of this approach include direct access to leading companies, the potential for higher returns in a fast-growing market, and the opportunity to benefit from Poland’s strong economy and robust investment inflows.

However, there are challenges, such as currency risk from investments being denominated in Polish Zloty (PLN), the need to open foreign trading accounts and navigate Polish market regulations, as well as additional tax and compliance requirements that can add complexity to the investment process.

Exchange-Traded Funds (ETFs)

Indian investors can also invest in Poland through US-listed ETFs available on Appreciate, which offer a simpler, more diversified approach. No need for country-specific brokerage accounts or manually managing currency exchanges.

Currently, the iShares MSCI Poland ETF (EPOL) is the only US-listed ETF with pure exposure to Poland:

iShares MSCI Poland ETF (EPOL)

- Tracks: MSCI Poland IMI 25/50 Index

- YTD Returns (As of May 6, 2025): 42%

- Expense Ratio: 0.60%

- Poland Weight: 87.85%

Other US-listed ETFs also include Polish companies as part of their portfolio:

Cambria Global Value ETF (GVAL)

- Tracks: Cambria Global Value Index

- YTD Returns (As of May 6, 2025): 25%

- Expense Ratio: 0.64%

- Poland Weightage: 1.67%

Global X Video Games & Esports ETF (HERO)

- Tracks: Solactive Video Games & Esports Index

- YTD Returns (As of May 6, 2025): 23.85%

- Expense Ratio: 0.50%

- Poland Weightage: 4.45%

WisdomTree Emerging Europe SmallCap Dividend Fund (EPSO)

- Tracks: WisdomTree Emerging Europe SmallCap Dividend Index

- YTD Returns (As of May 6, 2025): 16.77%

- Expense Ratio: 0.58%

- Poland Weightage: 3.3%

Key Takeaways

Importance of Global Diversification

Poland’s strong market performance highlights the importance of diversifying investments globally. Poland’s WIG index has surged over 25% year-to-date (YTD), while India’s Nifty 50 is up around 2.6%, and the S&P 500 is down by 3.4% YTD. This shows that significant returns can come from less conventional markets.

By expanding beyond traditional markets like the US and China, investors can reduce risk and tap into growth opportunities in emerging regions. Poland’s success is a prime example of how global diversification can enhance a portfolio, and platforms like Appreciate make it easy for investors to access these opportunities.

Impact of Currency Fluctuations

Currency movements play a crucial role in global investments. In 2025, as the US dollar appreciated, Indian investors who diversified into markets like Poland would have not only benefited from the strong performance of the WIG Index but also seen additional gains due to favorable exchange rates.

Conclusion

Poland’s strong performance in 2025 shows the value of global diversification for Indian investors. Beyond Poland, markets like Spain and Greece have also shown strong growth this year. Through platforms like Appreciate, investors can easily access a wide range of global investments, including these high-performing markets.

Global investing offers opportunities but requires careful risk management. By diversifying internationally, Indian investors can tap into growth across multiple regions while staying alert to economic trends and geopolitical shifts.

Disclaimer: Investments in securities markets are subject to market risks. Read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory.