When you start adulting, living paycheck to paycheck usually becomes the norm. Life and all its obligations just have a way of sweeping your hard-earned money away! However, this doesn’t have to go on forever. You may have not learned useful things like taxes and managing your money in college, but that’s okay. We’ve got you covered.

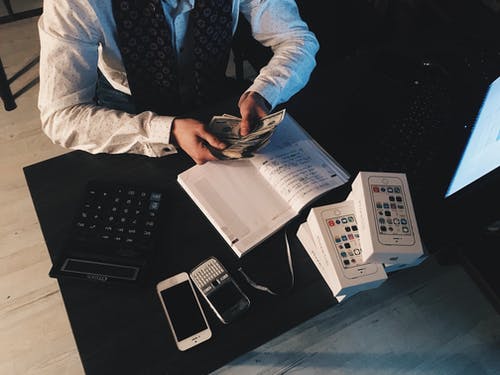

If you are ready to become that person who manages their money with an air of confidence and prudence, basically manage your money like a pro, here are some steps to get you started.

Step 1: Identify your relationship with money

The first step is to identify the nature of your relationship with money. How you spend, how you save, what your priorities are, etc. This one may be a bit tricky because it requires you to be completely honest with yourself. Only once you assess your current money relationship can you make decisions to improve it and manage your finances more efficiently. Remember, everyone has a different relationship with money and that’s okay.

You can ask yourself some of these important questions:

- How important a role does money play in your life?

- How many people are dependent on your income or wealth?

- How often do you make big purchases and how do they make you feel?

- Are your purchase decisions carefully planned or are you more of an impulse buyer?

- What are your spending patterns?

- Are you satisfied with the necessities and a little more?

- Do you like to make a lot of luxury purchases?

Once you’re mindful of your money behaviour, you can move on to step 2 —setting financial goals for yourself

Step 2: Set financial goals

One way to improve your relationship with money is to set certain goals or milestones. Everyone has different goals and there certainly isn’t a “one-size-fits-all” template. But some goals can be considered more or less universal. Here’s a list with some of the most common financial goals:

- Buying a house

- Setting up passive income streams

- A dream vacation or honeymoon

- Buying a car

- Preparing for medical expenses

- Saving to kick start a business

- An emergency fund

- Education fund for your children

- Funds set aside to further your own education

- Retirement and or early retirement

You can create your own list and divide it into short-term and long-term goals for clarity on the timeline. Once you have a rough list in place, you can move on to step 3 — budgeting!

Step 3: Budget

Budgeting simply means using your income efficiently to allocate it to your expenses, savings, investments, etc. However, it is one of the most difficult things to do! Everyone, from individuals to small, medium, and large businesses finds it difficult to stick to a strict budget.

No matter how Herculean a task it is, a budget can and should be put in place. It’s important to budget for the short and long-term goals you have set in the previous step. To do this, you have to estimate the money required to fulfil a particular goal.

Once this is done, see if the expenses are practical and fit into your income cycle. Cut out any expenses you can do without but not to an extent where you’re taking away the basic comforts and pleasures of life. Understanding your current spending pattern is essential when making and adhering to a realistic budget.

Budgeting done? On to step 4 — dividing up your salary.

Step 4: Divide Salary

Dividing up your salary as soon as you receive it is a foolproof way of meeting your expenses, thus helping you to stick to your budget. While it might seem simple enough to do in theory but it’s difficult to put into practice without a salary division plan in place. Here’s how to get started.

Break up your regular earnings into different baskets:

- Fixed expenses such as rent, food, transport

- Mortgage instalments and EMIs

- Insurance instalments

- Medical

- Separate funds for different goals

Whatever remains is for you to spend on whatever you like — your expendable income.

There’s one more important thing

Following steps 1 through 4 will certainly help you manage your money. But there is one more very important factor you need to keep in mind — paying off your debts. Experts suggest that any sort of annual bonus or large windfall/earnings you receive should be reserved solely towards paying off any debts you may have. If there is more than one loan to repay, we suggest prioritising the one with a higher interest rate while continuing the minimum payments on the other loans.

One way to minimise interest payment is debt re-consolidation. It is the process of taking out a new loan to repay an old one — allowing the borrower to change the type of loan, the financial institution and the interest rate paid on the loan.

For those of you who are looking for a convenient, easy and safe way to invest and manage your money like a pro, visit www.appreciatewealth.com and sign up!