Introduction

The US stock market has had a rocky start to 20266.

After reaching all-time highs in early January, investor optimism quickly faded. The S&P 500 is now down almost 8.5% YTD. For many, this drop has come as a surprise, especially after a strong finish to 2024.

There’s no single reason behind the downturn, but rising trade tensions, inflation worries, and policy uncertainty have shaken investor confidence.

What’s interesting, though, is that some global markets, particularly Europe and China, are performing much better. This can be seen through the performance of country-specific ETFs, which track the stock markets of individual countries. These ETFs—such as those from Germany, Spain, or China—are available for investment on platforms like Appreciate. They are US-listed ETFs that provide exposure to markets outside the US, offering a simple way to diversify and take advantage of global opportunities.

In this blog, we’ll break down what’s happening with the US market, why international markets are performing better, and how you can access these opportunities through global ETFs.

Weak Start of US Markets

The S&P 500 posted strong back-to-back returns of over 20% in 2023 and 2024, marking a period of robust economic growth. Following Donald Trump’s re-election in November 2024, the market saw an initial rally, with the Dow Jones gaining 1,500 points in a day, fueled by optimism around tax cuts and deregulation.

However, the market’s positive momentum faded in early 2025. After hitting all-time highs in January and February, the S&P 500 dropped sharply in April, with a 5% decline on April 2, followed by another 6% drop, wiping out over $2 trillion in market value. This was largely due to fears around tariffs, as Trump imposed new duties, including 10% on imports and 34% on Chinese goods, leading to retaliation from China.

A 90-day tariff pause on April 8 provided temporary relief, with a 10% rebound, but the market remains volatile, heavily influenced by trade and economic uncertainty.

How Europe and China Are Leading the Charge

While the US stock market has struggled in 2025, Europe and China have shown strong growth, especially since late 2024.

Europe’s Strong Performance

Starting in late 2024, European markets began to recover, helped by economic stimulus, political stability, and a bounce-back in sectors like manufacturing, technology, and energy. As trade tensions remained more stable in Europe compared to the US, investor confidence grew, and the positive trend continued into 2025.

This growth can be seen in the performance of the iShares MSCI Eurozone (EZU) ETF, which tracks the Eurozone. As of April 23, 2025, EZU is up more than 16.4% YTD, reflecting the strong recovery in European markets, driven by solid economic support and fewer trade disruptions.

China’s Resilience

China also showed impressive growth starting in late 2024, driven by government policies like monetary easing and fiscal measures, along with a shift towards stronger regional trade in Asia. With less reliance on the US, China’s economy remained resilient, especially in sectors like tech, green energy, and consumer goods.

This growth is reflected in the iShares China Large-Cap (FXI) ETF, which tracks large-cap Chinese stocks. As of April 23, 2025, FXI is up more than 13% YTD, highlighting the strength of China’s market despite ongoing trade challenges.

Other International Markets Outperforming the US

Apart from Europe and China, many emerging markets are also performing well in 2025, showcasing the growing interest in global diversification. Beyond traditional markets, investors are also evaluating digital assets, asking is cryptocurrency a good investment in 2025, especially with Bitcoin ETFs gaining regulatory approval and institutional adoption.

Emerging Markets Gaining Momentum

Since late 2024, emerging markets like Mexico, Chile, and South Africa have seen impressive growth, driven by favorable domestic policies and economic recovery. These markets, along with others across the globe, are benefiting from more stable conditions and less exposure to the volatility of US-China trade tensions.

Here are the returns of some key markets as of April 23, 2025:

iShares MSCI Poland ETF (EPOL)

- 3M Return: 25.26%

- Expense Ratio: 0.60%

- Index Tracked: MSCI Poland IMI 25/50 Index

iShares MSCI Spain ETF (EWP)

- 3M Return: 21.11%

- Expense Ratio: 0.50%

- Index Tracked: MSCI Spain 25/50 Index

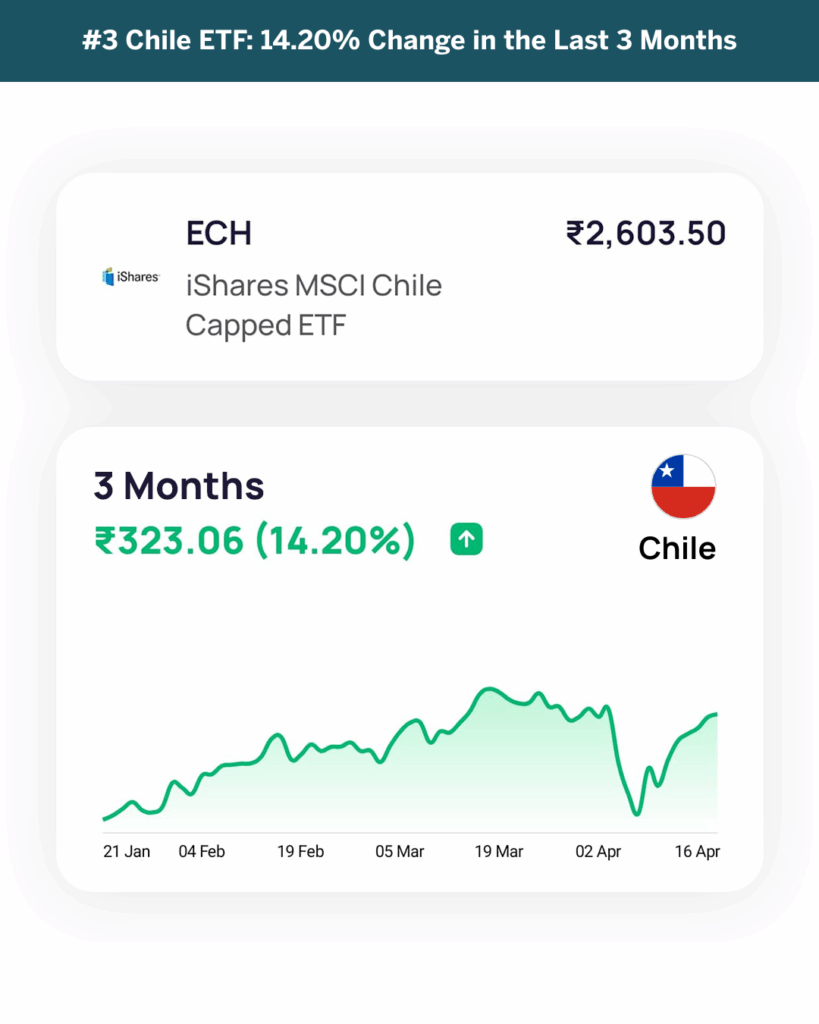

iShares MSCI Chile ETF (ECH)

- 3M Return: 14.20%

- Expense Ratio: 0.60%

- Index Tracked: MSCI Chile IMI 25/50 Index

Global X MSCI Greece ETF (GREK)

- 3M Return: 13.09%

- Expense Ratio: 0.57%

- Index Tracked: MSCI All Greece Select 25/50 Index

iShares MSCI Mexico ETF (EWW)

- 3M Return: 12.43%

- Expense Ratio: 0.50%

- Index Tracked: MSCI Mexico IMI 25/50 Index

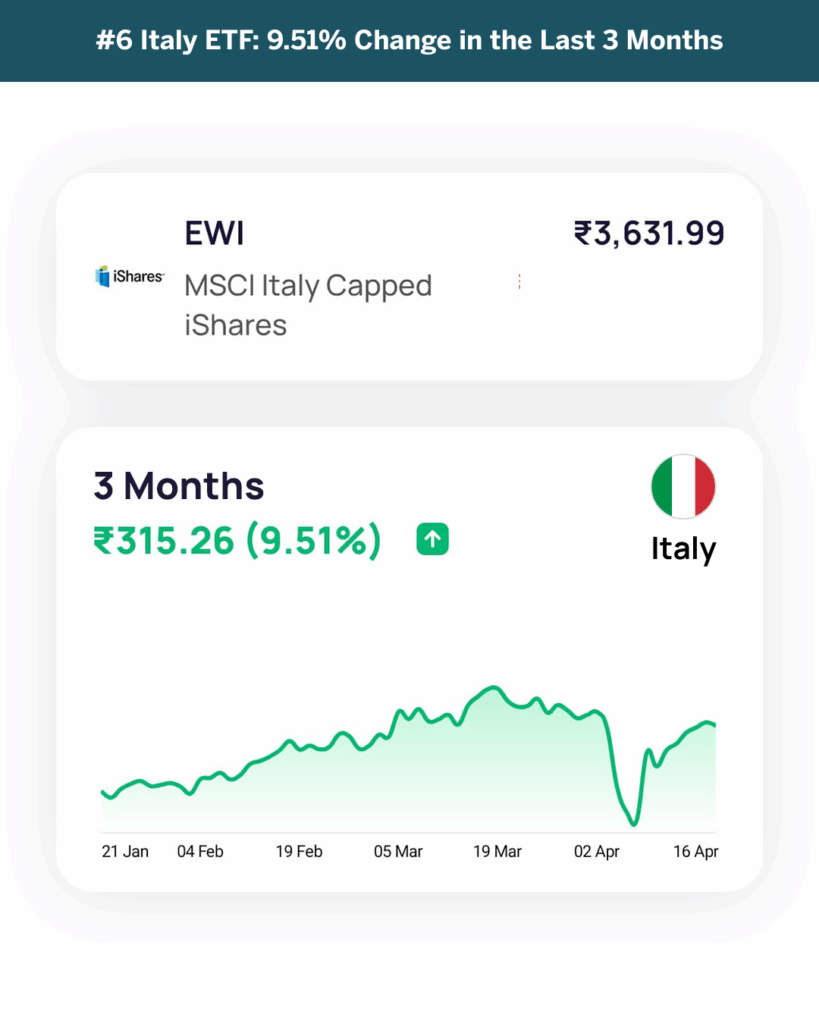

iShares MSCI Italy ETF (EWI)

- 3M Return: 9.51%

- Expense Ratio: 0.50%

- Index Tracked: MSCI Italy 25/50 Index

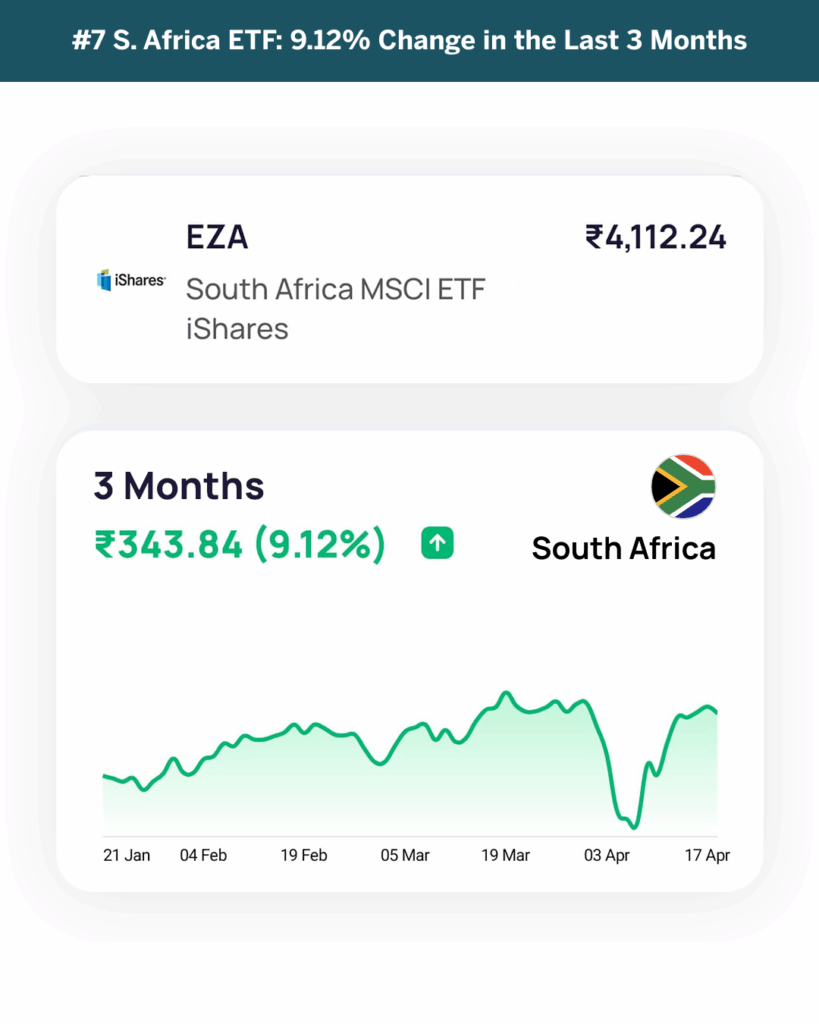

iShares MSCI South Africa ETF (EZA)

- 3M Return: 9.12%

- Expense Ratio: 0.59%

- Index Tracked: MSCI South Africa 25/50 Index

iShares MSCI Germany ETF (EWG)

- 3M Return: 8.92%

- Expense Ratio: 0.50%

- Index Tracked: MSCI Germany Index

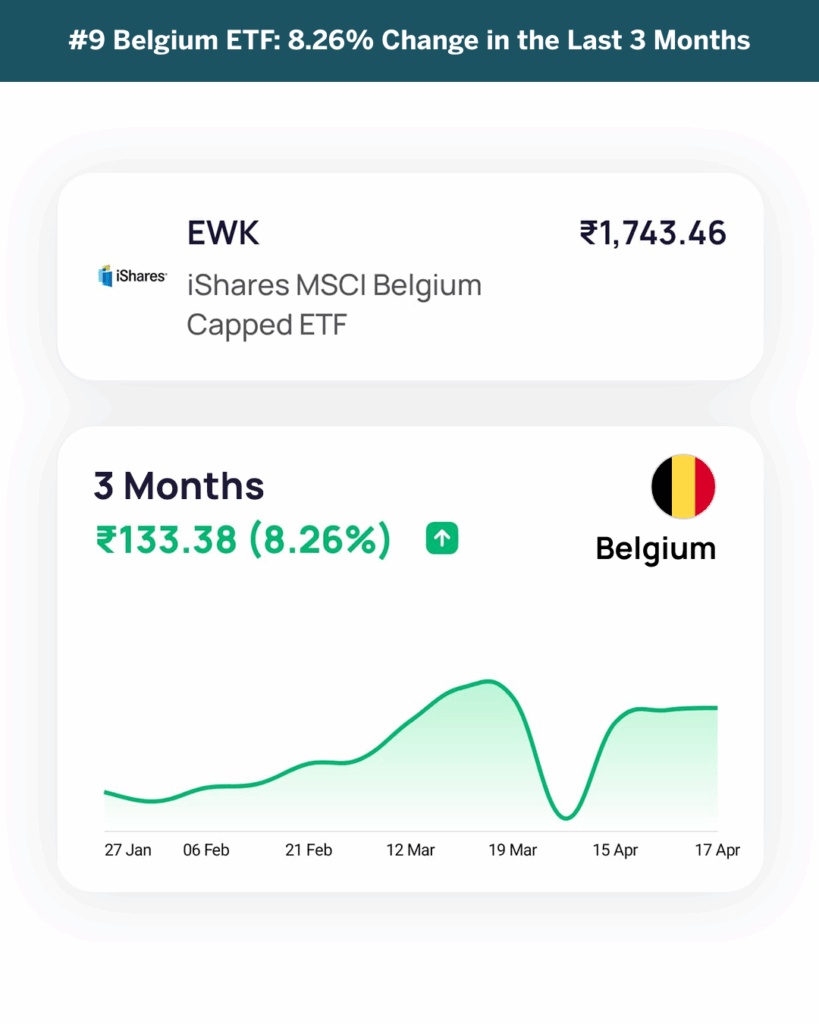

iShares MSCI Belgium ETF (EWK)

- 3M Return: 8.26%

- Expense Ratio: 0.50%

- Index Tracked: MSCI Belgium IMI 25/50 Index

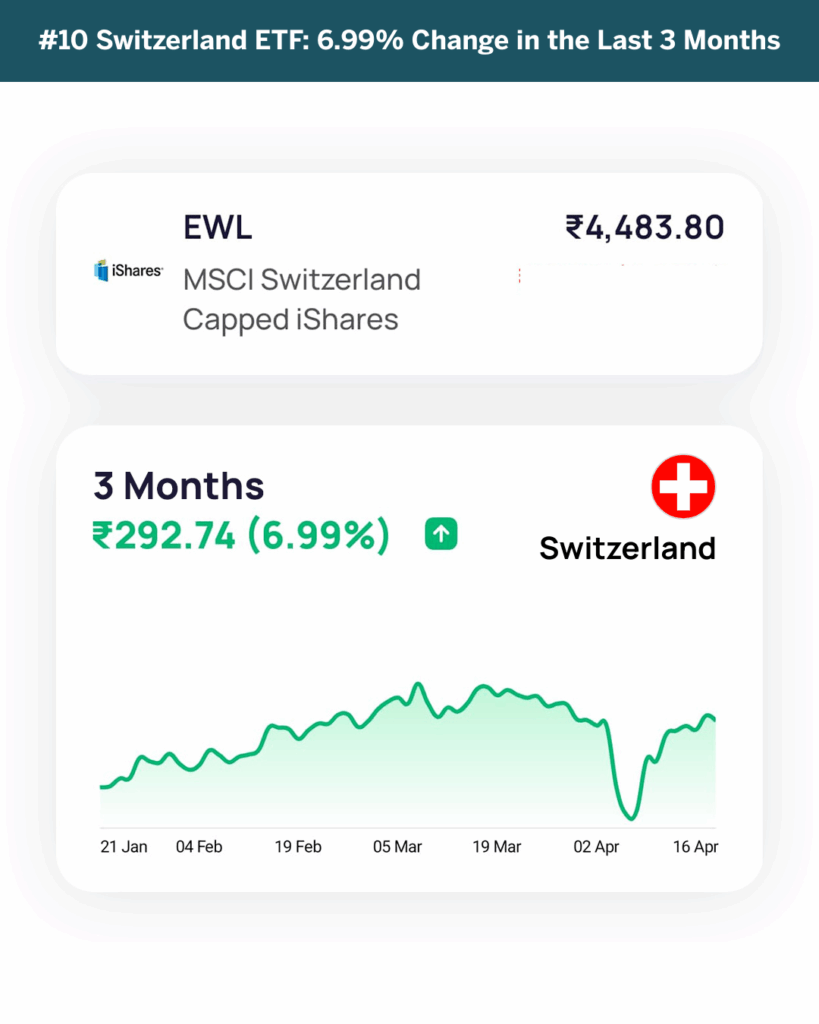

iShares MSCI Switzerland ETF (EWL)

- 3M Return: 6.99%

- Expense Ratio: 0.50%

- Index Tracked: MSCI Switzerland 25/50 Index

These markets show strong growth, offering attractive opportunities for investors seeking to diversify beyond the US.

These returns can be tracked and invested in through US-listed ETFs with exposure to these countries. You can invest in these and other international ETFs and stocks easily through Appreciate, which makes it simple to build a globally diversified portfolio.

Conclusion

The US stock market has struggled in 2025, with the S&P 500 down 8% YTD, due to inflation concerns and trade uncertainty. Meanwhile, global markets, particularly in Europe and China, have performed better, with EZU up 16% YTD and FXI up 13% YTD.

Looking ahead, global diversification is key. With US volatility, regions like Europe, China, and emerging markets are offering strong growth, benefiting from more stable conditions and less exposure to trade disruptions.

Emerging markets such as Mexico, Chile, and Poland have outperformed, showing solid economic growth. For investors, diversifying into these regions can reduce risk and open up growth opportunities outside the US.

With Appreciate, you can easily invest in US-listed ETFs with exposure to these global markets, helping you diversify and position your portfolio for long-term success.

Disclaimer: Investments in securities markets are subject to market risks. Read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory.