Nvidia’s $4 trillion market cap has made it the leading face of the AI revolution. But here’s what most investors are overlooking: behind every breakthrough chip lies a critical supply chain that’s creating its own investment opportunity.

Two companies—Applied Materials (AMAT) and Lam Research (LRCX)—are the unsung heroes enabling this growth. These firms supply the sophisticated equipment essential for manufacturing Nvidia’s AI chips, yet they trade at roughly half Nvidia’s price-to-earnings multiple. That valuation gap? It’s telling a story worth paying attention to.

The Valuation Gap Nobody’s Talking About

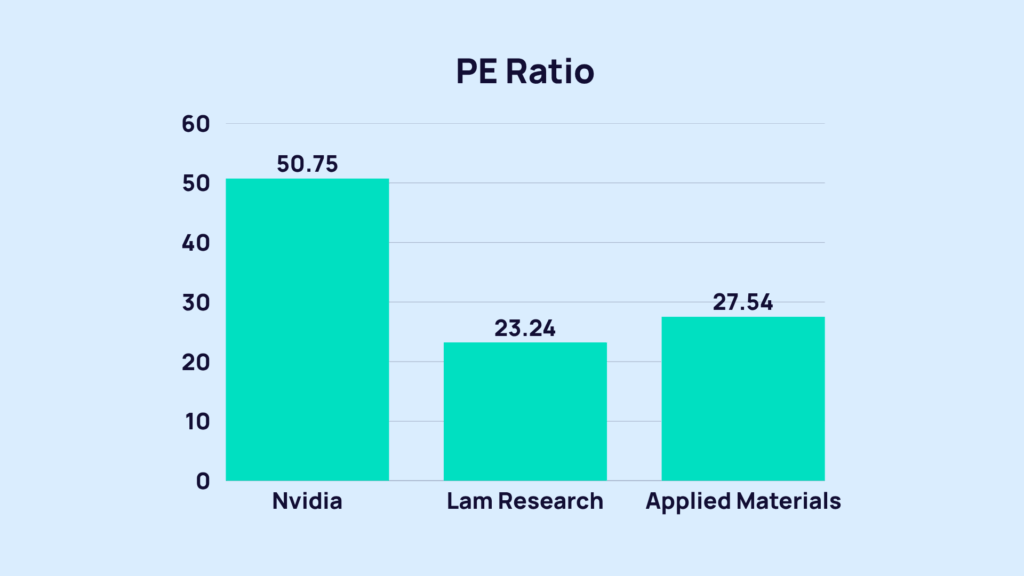

Here’s where things get interesting. Nvidia commands a premium PE ratio of 50.75, reflecting Wall Street’s sky-high expectations for continued AI dominance. Meanwhile, Lam Research and Applied Materials trade at much more modest 23.24 and 27.54, respectively—roughly half of Nvidia’s valuation despite being essential to its success.

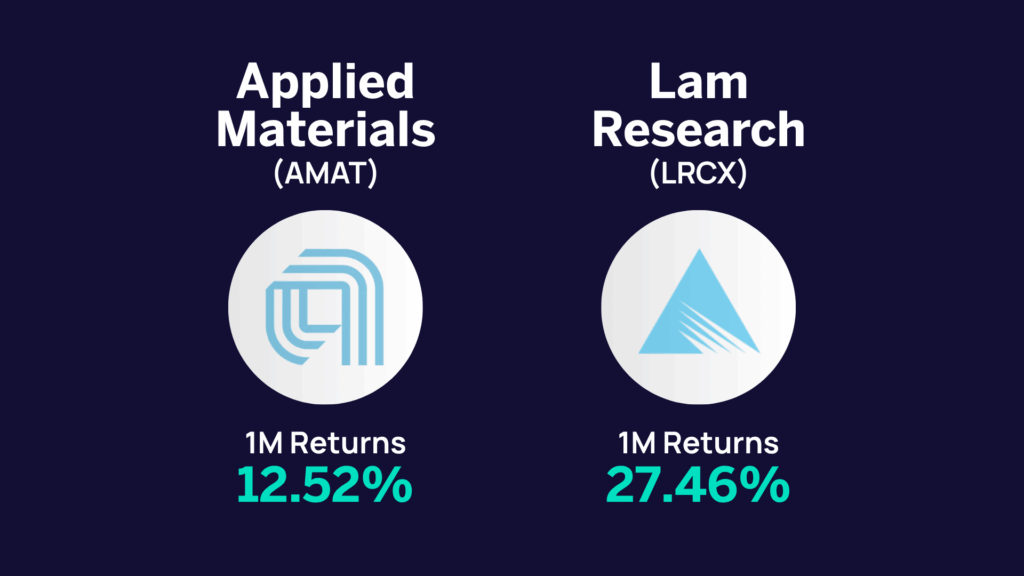

Recent performance has been impressive across the board. Applied Materials jumped 12.52% in one month, while Lam Research delivered an even stronger 27.46% surge. Both moves signal growing investor recognition of these companies’ strategic importance in the AI supply chain.

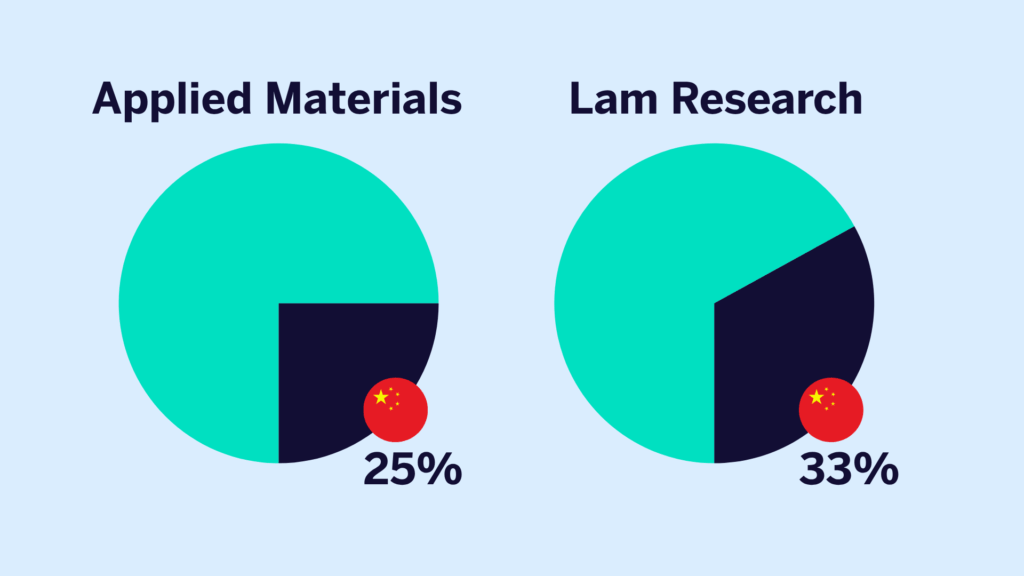

So why the discount? The answer lies in risk perception, particularly around China exposure.

The China Factor

Here’s where things get complicated. Applied Materials derives about 25% of its revenue from China, while Lam Research is even more exposed at 33%. With U.S. export controls tightening, industry analysts estimate these firms could lose up to 7% of their Chinese revenue annually through 2030.

That’s a real headwind. But it’s also creating what may be a compelling entry point for patient investors who can see past the near-term noise.

The $100 Billion Opportunity Taking Shape

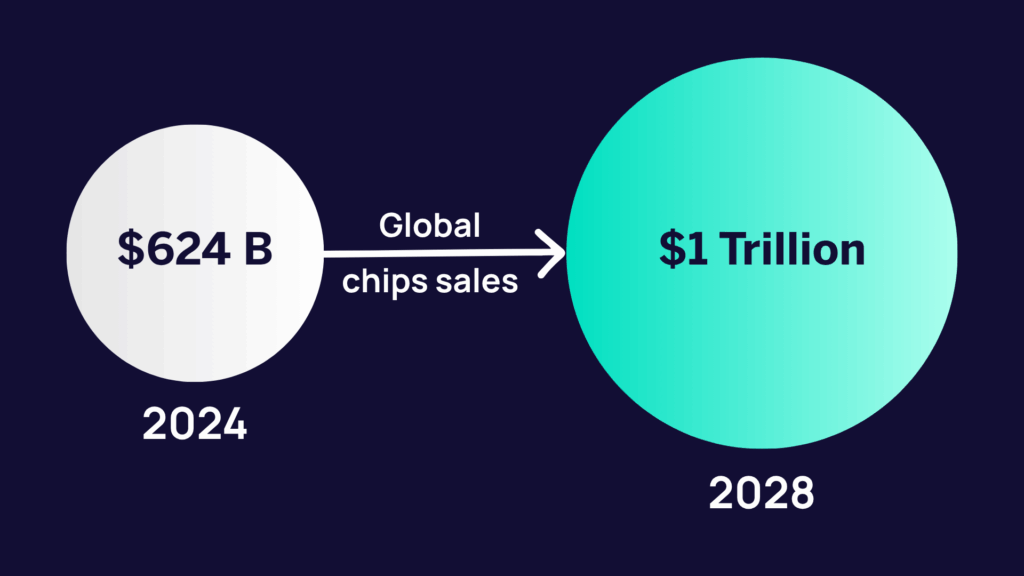

Despite short-term challenges, the long-term outlook remains robust. Capital spending on chip-making equipment is projected to double between 2024 and 2028, with global outlays expected to exceed $100 billion in 2025 alone. The global chip market is forecasted to grow from $624 billion to $1 trillion by 2028.

These aren’t just impressive numbers—they represent a fundamental shift in how the world thinks about computing infrastructure.

Why Equipment Makers Might Be the Smarter Play

Unlike Nvidia, whose fortunes are tied primarily to AI chips, Applied Materials and Lam Research benefit from growth across all chip categories. Their equipment is indispensable to every chip manufacturer worldwide, making them less vulnerable to fluctuations in any single segment.

Think of it this way: while Nvidia is betting on AI’s continued dominance, these companies are selling the tools that make any semiconductor advancement possible. It’s a diversified play on the entire chip ecosystem.

The Contrarian Case for Infrastructure

For investors seeking value in the AI-driven semiconductor boom, these companies represent a contrarian yet strategic bet. They’re not chasing the latest AI headline—they’re building the foundation that makes those headlines possible.

The market’s focus on end-market winners like Nvidia has created an opportunity in the companies that enable those wins. Applied Materials and Lam Research aren’t just equipment suppliers anymore—they’re critical infrastructure providers in the digital economy.

That’s the kind of positioning that tends to reward patient investors who can see beyond the current market narrative to identify where real, sustainable value is being created.

Disclaimer: Investments in securities markets are subject to market risks. Read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory.