Gold has always held a steady place in Indian portfolios. Over time, investors have moved away from physical gold and started looking at paper gold options that are easier to buy, sell, and track.

Two options stand out today: Gold ETFs and Sovereign Gold Bonds. Both give exposure to gold prices, but they work very differently when it comes to liquidity, holding period, taxation, and returns.

This blog compares Gold ETFs and Sovereign Gold Bonds in clear terms, so you can decide which one fits your investment plan without confusion.

Key Takeaway

- Gold ETFs offer higher liquidity and are easier to trade at any time.

- Sovereign Gold Bonds are best suited for long-term investors who can stay invested till maturity.

- Both track gold prices, but Sovereign Gold Bonds also pay fixed interest.

- The right option depends on your time horizon, tax planning, and liquidity needs.

What Are Gold ETFs?

Gold ETFs are exchange-traded funds that track the price of physical gold.

Each unit of a Gold ETF represents a specific quantity of gold, usually backed by physical gold held with a custodian. The value of the ETF moves in line with domestic gold prices, after accounting for expenses.

Gold ETFs are traded on stock exchanges, similar to shares. You can purchase or sell them during market hours using a trading and demat account. Prices change all through the day based on demand, supply, and gold prices in the market.

There is no fixed lock-in. You can exit whenever the market is open.

What Are Sovereign Gold Bonds?

Sovereign Gold Bonds are government-issued securities linked to the price of gold.

They are issued by the Government of India and represent gold in paper form. Instead of holding physical gold, you hold a bond whose value rises or falls with gold prices.

Sovereign Gold Bonds do not invest in physical gold directly. Their value is derived from the prevailing price of gold, and the government guarantees the redemption value. In addition to price movement, they also pay a fixed annual interest on the invested amount.

These bonds have a fixed maturity period, and while early exit is possible through the secondary market, they are primarily designed for long-term holding.

Key Differences Between Gold ETFs and Gold Sovereign Gold Bond

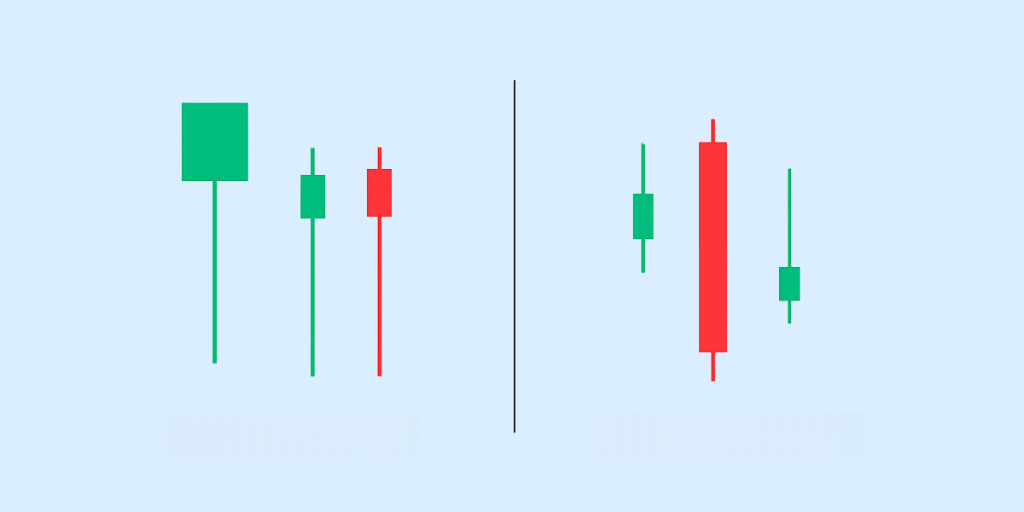

Before choosing between Gold ETFs and Sovereign Gold Bonds, it helps to understand how they differ in structure, trading access, costs, tax treatment, and risk. While both track gold prices, the way you buy, hold, and exit these investments can lead to very different outcomes.

The comparison below breaks down the key differences so you can see which option aligns better with your investment approach.

Trading Flexibility

Gold ETFs offer high trading flexibility. They can be purchased or sold on stock exchanges during market hours, just like shares. Liquidity is generally good, especially for popular ETFs.

Sovereign Gold Bonds can be traded on exchanges too, but volumes are usually low. Exiting before maturity may require selling at a discount, depending on market demand.

Costs and Fees

Gold ETFs involve:

- The expense ratio charged by the fund

- Brokerage and exchange charges during buying and selling

Sovereign Gold Bonds do not have ongoing management fees. However, if sold on the exchange before maturity, brokerage and price differences may apply.

Tax Implications

Gold ETFs are taxed based on the holding period. Long-term gains qualify for indexation benefits, while short-term profits are taxed according to your income slab. Sovereign Gold Bonds offer tax-free capital gains if held till maturity. Interest earned is taxed as per the income slab.

Risk and Returns Comparison

Gold ETFs carry market-related risks such as price fluctuations and minor tracking differences. Returns depend completely on gold price movement.

Sovereign Gold Bonds reduce issuer risk since they are government-backed. Returns include gold price appreciation and fixed interest, but liquidity risk exists if you exit early.

Both track gold prices, but the experience differs based on holding period and exit needs.

| Basis | Gold ETFs | Sovereign Gold Bonds |

| Structure | Exchange-traded fund backed by physical gold | Government-issued bond linked to gold prices |

| Issuer | Asset management companies | Government of India |

| Form | Units held in demat form | Bond held in demat or certificate form |

| How returns are earned | Movement in gold prices | Gold price movement + fixed annual interest |

| Trading | Bought and sold on stock exchanges | Can be sold on exchanges, but liquidity is limited |

| Lock-in | No lock-in | Fixed maturity period |

| Interest income | Not applicable | Fixed annual interest |

| Management | Managed by fund house | Managed and backed by the government |

| Best suited for | Short- to medium-term investors | Long-term investors |

Why Choose Gold ETFs?

Gold ETFs work well for investors who want simple access to gold without long-term holding commitments.

They are suitable if you:

- Want exposure to gold prices without buying physical gold

- Prefer flexibility to buy or sell anytime

- Plan to use gold as a short- or medium-term allocation

- Want to rebalance your portfolio easily

Pros of Gold ETFs

A few key pros of investing in gold ETFs are:

- Convenience and ease of trading: Gold ETFs trade on stock exchanges and can be bought or sold during market hours using a demat account.

- Lower expense ratios: Compared to physical gold, Gold ETFs avoid storage and insurance costs, keeping overall expenses lower.

- Transparency in holdings: Gold ETFs disclose their gold holdings regularly, so pricing closely reflects actual gold value.

Why Choose a Sovereign Gold Bond?

Sovereign Gold Bonds suit investors who are comfortable with long-term holding and want a more tax-efficient way to invest in gold.

They are a good fit if you:

- Do not need frequent liquidity

- Want to earn returns beyond gold price movement

- Prefer a government-backed instrument

- Are investing with a long-term goal in mind

Pros of Sovereign Gold Bond

Some reasons why you should invest in sovereign gold bonds are:

- Government backing: Sovereign Gold Bonds are issued by the Government of India, which removes issuer risk.

- Potential for capital appreciation: The bond value moves in line with gold prices which allows investors to benefit if gold prices rise over time.

- Additional interest income: Unlike Gold ETFs, Sovereign Gold Bonds pay a fixed annual interest on the invested amount.

- No SIP or fund management layer: These bonds are not actively managed funds and do not offer SIPs. You invest directly in gold-linked bonds without ongoing management decisions.

- Tax advantage at maturity: Capital gains are tax-free if the bonds are held till maturity, which improves post-tax returns for long-term investors.

Start Investing in US ETF

“US ETFs (Exchange Traded Funds) offer a great opportunity for investors looking to diversify their portfolio with international exposure. With Appreciate, you can now access these ETFs easily, benefiting from the growth of US-based companies. Investing in US ETFs can be a strategic way to tap into global markets, adding stability and potential growth to your investment strategy.

Conclusion

Gold ETFs and Sovereign Gold Bonds both offer ways to invest in gold without having to hold it physically, but they serve different purposes.

Gold ETFs work better if you want flexibility, easy entry and exit, and short- to medium-term exposure to gold prices. Sovereign Gold Bonds suit investors who can stay invested for the long term and want interest income along with tax benefits at maturity.

The right choice depends on your goals. If liquidity and ease of trading are important, Gold ETFs are more practical. If tax efficiency and long-term holding are priorities, Sovereign Gold Bonds make more sense.

Before investing, be clear about how long you plan to stay invested and how often you may need access to your money. That clarity matters more than the product itself.

FAQs on Gold ETF vs. Sovereign Gold Bond

The best option for beginner investors depends on how simple they want the investment to be.

Gold ETFs suit beginners who want flexibility, easy buying and selling, and no lock-in.

Sovereign Gold Bonds suit beginners who are comfortable staying invested for the long term and do not need frequent access to funds.

For most first-time investors in gold, Gold ETFs are usually easier to manage.

Yes, you can invest in Gold ETFs through Appreciate. Indian investors can buy and sell Gold ETFs on the exchange using a trading account, similar to investing in stocks or other ETFs.

Gold ETFs and Sovereign Gold Bonds are both safe ways to invest in gold, but they carry different risks.

Gold ETFs involve market price movement and tracking differences.

Sovereign Gold Bonds are backed by the Government of India but have limited liquidity before maturity.

Neither is strictly safer; the right choice depends on how long you plan to stay invested.

The performance of Gold ETFs and Sovereign Gold Bonds differs mainly in how quickly prices react.

Gold ETFs reflect gold price movements on a daily basis.

Sovereign Gold Bonds follow gold prices over time and reward long-term holding rather than short-term movements.

Both tend to benefit when investors move toward gold during uncertain periods.

The tax benefits vary between the two options:

Gold ETFs are taxed based on holding period, with long-term gains eligible for indexation.

Sovereign Gold Bonds offer tax-free capital gains if held till maturity while the interest you earn is taxable.

Investors focused on long-term tax efficiency often prefer Sovereign Gold Bonds.

Disclaimer

The information provided in this article is for educational and informational purposes only. It should not be considered as financial or investment advice. Investing in stocks involves risk, and it is important to conduct your own research and consult with a qualified financial advisor before making any investment decisions. The author and publisher are not responsible for any financial losses or gains that may result from the use of this information.