Introduction

Various anomalies influence the functioning of markets, one such anomaly is the Calendar Effect.

The Calendar Effect refers to a market anomaly where markets behave differently during a particular month or time of the year.

The Santa Rally is a well-known example of a Calendar Effect that occurs in December.

Historically, the Santa Rally has favored the markets about 80% of the time since its discovery. Let’s delve deeper into this phenomenon, explore its validity, and understand how investors can make the most of it.

What is it?

First introduced by Yale Hirsch in 1972 in his Stock Traders’ Almanac, the Santa Rally, also called the December Effect, describes a market trend where stock prices tend to rise during the last five trading days of December and the first two trading days of January. Hirsch’s analysis of the stock market from 1950 to 1969 showed an average gain of 1.3% during this period.

This phenomenon is more commonly observed in the US than in India, However, with Appreciate, investors in India can now directly benefit from this trend and take advantage of the booming US markets.

To make the holiday season even more rewarding, Appreciate is giving users a chance to win US stocks worth up to ₹20,000. Join the Santa Rally on the Appreciate app between 24th December and 2nd January and trade all you want to increase your chances of winning.

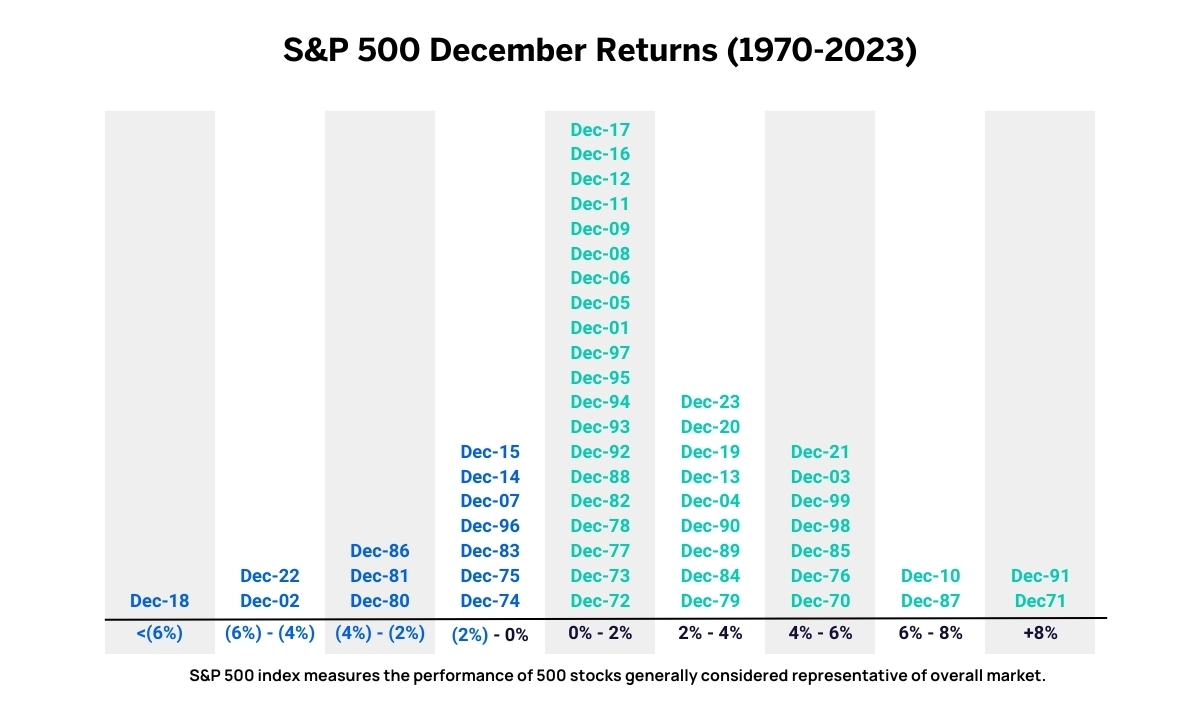

Between 1970 and 2023, the S&P 500 delivered positive returns during these seven days of the Santa Rally in over 41 out of 54 instances. Notably, there have been at least four occasions when the market returned gains exceeding 6%.

Factors Contributing to the Santa Rally

Several factors make the last trading days of December one of the most rewarding periods for the market:

- Tax-Loss Harvesting: At the end of the year, many investors sell underperforming assets to offset gains for tax purposes. This often results in a price rebound in early January.

- Exit of Institutional Investors: With many institutional investors on vacation, the market is largely influenced by retail investors during this time. Retail traders often exhibit more optimism and bullish sentiment, which can drive prices higher.

- Holiday Spending: Increased consumer spending during the holiday season is expected to drive up company revenues and profits, which preemptively impacts stock prices.

Conclusion

While historical trends support the Santa Rally, past performance doesn’t guarantee future outcomes. There also have been instances where markets dropped by more than 4% during this period.

Investors and traders should exercise caution and avoid making decisions solely based on historical data. No matter how well-supported, market predictions are never completely immune to error.

Disclaimer: Investments in securities markets are subject to market risks. Read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory.