Investing in shares and mutual funds is are popular way to grow wealth, but they work differently.

Shares represent direct ownership in a company, giving investors control over buying and selling individual stocks. In contrast, mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets managed by professionals.

Choosing between the two depends on your risk appetite, investment knowledge, and time commitment. Let’s discuss this in a little more detail.

Understanding the Basics

Investing helps you grow your money over time, and two common options are shares and mutual funds. Knowing how they work can help you decide which suits your goals.

What Are Shares?

Shares represent ownership in a company. When you buy shares, you become a shareholder, meaning you own a small part of the company. Companies issue shares to raise money for operations, expansion, or debt repayment.

How Shares Work

- Share prices change based on company performance, market trends, and investor demand.

- You can sell shares at a higher price than you bought them for, earning a profit.

- Some companies pay dividends (profits shared with shareholders) as regular income.

- You have voting rights, allowing you to influence company decisions based on your shareholding.

What Are Mutual Funds?

Mutual funds pool money from multiple investors to buy a mix of stocks, bonds, or other assets. A fund manager (a professional who manages investments) makes decisions based on the fund’s strategy.

How Mutual Funds Work

- Your money is spread across different assets, reducing risk.

- Mutual funds are categorised into equity funds (which invest in stocks), debt funds (which invest in fixed-income securities like bonds), and hybrid funds (which invest in a mix of both).

- You buy units in a mutual fund instead of owning individual stocks.

- Fund managers adjust the portfolio based on market conditions to try and increase returns.

Mutual Funds vs. Stocks: Key Differences

When investing, you can choose between stocks (also called shares) and mutual funds. Both offer opportunities for growth but work differently in control, risk, returns, and taxation. Here are the key differences between them:

| Parameter | Stocks | Mutual Funds |

| Ownership & Control | Direct ownership, full control | Indirect ownership, managed by professionals |

| Risk & Volatility | High, depends on market conditions | Lower due to diversification |

| Investment Strategy | Self-managed, requires market knowledge | Professionally managed |

| Returns & Growth | Potential for high returns but unpredictable | Moderate to high returns, depending on fund type |

| Liquidity & Accessibility | Can be bought/sold anytime during market hours | Redeemable at NAV, some funds have lock-in periods |

| Taxation | STCG: 15%, LTCG: 10% (beyond ₹1 lakh) | Varies by fund type; ELSS offers tax benefits |

| Best for | Experienced investors willing to take risks | New and seasoned investors seeking diversification |

Ownership and Control in Shares vs. Mutual Funds

- Stocks: You own a part of a company and control your investment. You decide when to buy, hold, or sell.

- Mutual Funds: You do not own individual stocks but hold units in a professional fund. The fund manager makes investment decisions on your behalf.

Stocks may be a better choice if you prefer direct control. Mutual funds, on the other hand, can work for you if you prefer a hands-off approach.

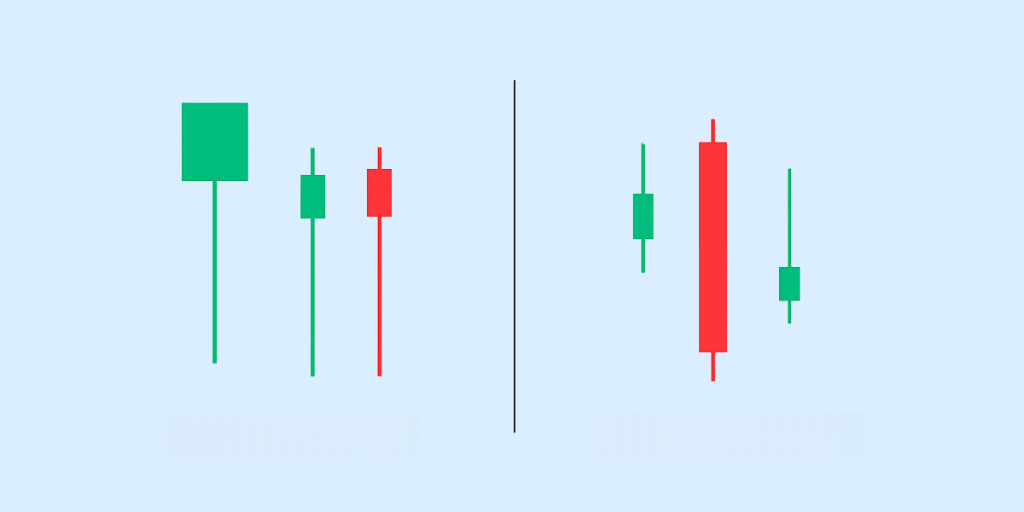

Risk and Volatility Comparison

- Stocks: Prices change daily based on company performance, economic factors, and investor sentiment. Market downturns can lead to significant losses.

- Mutual Funds: Risk is lower because the fund invests in multiple assets, spreading the impact of market fluctuations. However, mutual funds that invest in stocks can still be volatile.

Stocks may suit you if you have a higher risk tolerance and market knowledge. IMutual funds are a safer choice if you prefer lower risk through diversification,

Investment Strategy: Direct vs. Managed Investments

- Stocks: You must research companies, analyse market trends, and actively manage your portfolio.

- Mutual Funds: A fund manager makes investment decisions based on the fund’s objectives.

If you enjoy researching and tracking investments, stocks give you control. If you want a professionally managed investment, mutual funds are more convenient.

Returns and Growth Potential

- Stocks: High return potential, but profits depend on choosing the right stocks and timing the market.

- Mutual Funds: Returns vary based on the fund type. Equity funds (stock-based) have higher return potential, while debt funds (bond-based) provide steady but moderate growth.

Stocks may give better returns over time but require active decision-making. Mutual funds, on the other hand, provide more stable growth with expert management.

Liquidity and Accessibility

- Stocks: You can buy or sell shares anytime when the market is open. The selling process is quick, but stock prices fluctuate, affecting your returns.

- Mutual Funds: Open-ended mutual funds allow buying and selling at Net Asset Value (NAV) (the unit price) but are processed at the end of the trading day. Some funds, like ELSS (Equity Linked Savings Scheme), have a lock-in period of three years.

Taxation on Shares and Mutual Funds

- Stocks:

- If you sell shares within one year, you pay 15% Short-Term Capital Gains (STCG) tax.

- If you sell after one year, Long-Term Capital Gains (LTCG) Tax applies at 10% (if gains exceed ₹1 lakh in a year).

- Mutual Funds:

- Equity mutual funds follow the same tax rules as stocks.

- Debt mutual funds have STCG tax based on your income tax slab (if sold within three years) and LTCG tax at 20% with indexation benefits (if held for over three years).

- Tax-saving mutual funds (ELSS) offer deductions up to ₹1.5 lakh under Section 80C but have a three-year lock-in period.

Stock Market vs. Mutual Funds: Where to Invest?

Investing in stocks or mutual funds depends on your financial goals, risk tolerance, and investment horizon. Here’s how they compare:

Suitability Based on Investment Goals and Risk Appetite

- Stocks are suitable if you want direct ownership, higher control, and comfort with market fluctuations. They are best for aggressive investors seeking high returns.

- Mutual Funds are ideal for those looking for diversification and professional management. They are suitable for beginners and investors with a moderate to low-risk appetite.

Short-Term vs. Long-Term Investments

- Stocks: Can be used for short-term (trading) and long-term investments, but short-term trading is riskier.

- Mutual Funds: More effective for long-term investing. Equity funds perform better when held for 5+ years, while debt funds suit short-term goals.

Diversification and Risk Management

- Stocks: You must build your diversified portfolio to manage risk, which requires market knowledge.

- Mutual Funds: Offer built-in diversification as funds invest in multiple stocks or bonds, reducing risk.

Cost and Expense Comparison

- Stocks: Transaction costs include brokerage fees, Securities Transaction Tax (STT), and capital gains tax.

- Mutual Funds: The expense ratio (management fees) applies, but there are no direct trading costs. Some funds may have exit loads (fees for early withdrawal).

Mutual Fund Share Market: How Are They Related?

Mutual funds and the stock market are closely linked because many mutual funds invest in stocks. When you invest in a mutual fund, your money is pooled with other investors’ funds and managed by fund managers who buy and sell stocks on your behalf.

Additionally, these fund managers are also responsible for:

- Stock selection: Analysing market trends and choosing stocks with growth potential.

- Portfolio balancing: Adjusting investments to maximise returns while managing risks.

- Performance monitoring: Tracking market movements and making decisions accordingly.

How Mutual Funds Invest in the Stock Market

- Equity mutual funds generate returns by investing primarily in stocks. These funds can focus on sectors such as large-cap, mid-cap, or small-cap stocks.

- Hybrid funds invest in both stocks and bonds, balancing risk and returns.

- Index funds track stock market indices like the Nifty 50 or Sensex, ensuring returns mirror the market performance.

Pros and Cons of Shares and Mutual Funds

Investing in shares and mutual funds has advantages and risks; understanding these can help you decide which suits your financial goals. So, let’s get right into it.

Advantages and Disadvantages of Investing in Shares

Some pros and cons of investing in shares include:

Advantages of Investing in Shares

- High Return Potential: Stocks can generate significant returns if the company performs well.

- Direct Ownership: You are part of the company and have voting rights in shareholder meetings.

- Liquidity: You can buy and sell shares quickly, making them a flexible investment.

- Dividend Income: Some companies pay dividends (profits shared with shareholders), offering regular income.

- Control Over Investments: You choose which stocks to buy and when to sell based on market conditions.

Disadvantages of Investing in Shares

- Market Volatility: Stock prices can fluctuate daily, leading to potential losses.

- Requires Knowledge and Research: You must analyse financial reports, market trends, and company performance.

- Emotional Decision-Making: Market ups and downs can lead to impulsive buying or selling.

- No Guaranteed Returns: Unlike fixed-income investments, stocks have no assured profits.

- High Risk: Poor company performance or economic downturns can lead to significant losses.

Advantages and Disadvantages of Investing in Mutual Funds

Some pros and cons of investing in mutual funds include:

Advantages of Investing in Mutual Funds

- Diversification: Your money is spread across multiple stocks, reducing risk.

- Professional Management: Fund managers handle investments, so you don’t need market expertise.

- Lower Investment Requirement: You can start with a small amount, making investing accessible.

- Systematic Investment Plan (SIP): You can invest a fixed amount regularly, reducing market timing risks.

- Less Effort Needed: The fund manager makes decisions, so you don’t have to track markets daily.

Disadvantages of Investing in Mutual Funds

- Expense Ratio (Annual Fee for Managing the Fund): You pay a fee that can impact returns.

- Less Control: You cannot pick individual stocks as the fund manager makes investment choices.

- Lock-in Period in Some Funds: Some funds, like ELSS (Equity-Linked Savings Scheme), have a mandatory holding period.

- Market-Linked Risks: Mutual funds can lose value in a downturn, even with diversification.

- Delayed Liquidity: Unlike stocks, fund redemptions take a few days to process.

The Bottom Line

Both shares and mutual funds have advantages—stocks offer higher return potential but require active monitoring, while mutual funds provide diversification and professional management with lower effort. Understanding your investment goals and risk tolerance is key to making the right choice.

If you’re looking for a simplified, hassle-free investment experience, Appreciate offers access to a wide range of US stocks. It helps you diversify without the complexity of managing individual stocks. With zero commissions, smart portfolio tracking, and AI-driven recommendations, Appreciate ensures that you invest strategically and efficiently.

Download the app now and start invest in US stocks from India today with Appreciate and take control of your financial growth.

Frequently Asked Questions (FAQs)

What are the key differences between shares and mutual funds?

Shares represent direct ownership in a company, while mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets.

Which is a better investment option: mutual funds or stocks?

Mutual funds offer diversification and professional management, making them ideal for passive investors. Stocks, on the other hand, provide direct control and higher return potential but come with greater risk.

How does risk differ between the stock market and mutual funds?

Stock market investments are more volatile as individual stocks can fluctuate significantly, while mutual funds reduce risk through diversification across multiple securities.

Can I invest in both shares and mutual funds simultaneously?

You can invest in shares and mutual funds to balance risk and returns based on your financial goals and risk appetite.

How do mutual funds invest in the share market?

Mutual funds invest in the share market by allocating pooled funds into a diversified selection of stocks based on the fund’s objective, strategy, and risk profile.

Disclaimer: Investments in securities markets are subject to market risks. Read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory.