Invest in the stock market. You must have heard people say this countless times before — at dinner parties, in how-to-get-rich guides, during tea breaks at work, and in every other YouTube video. Invest in the stock market. Everyone tells you that. But not too many people elaborate on the whys, whats, or hows.

What is the stock market? How does the stock market work? What stock market basics should beginners be aware of? How to invest in the stock market? Who ever really answers these questions? Well, this guide finally will!

Table of contents

1. What is the stock market?

2. Understanding the basics of the stock market

3. How to invest in the stock market?

4. What does it cost to invest in the stock market in 2023?

5. Different types of stocks in 2023

6. Begin your stock investing journey today

7. Frequently asked questions

1. What is the stock market?

The stock market is a market where people and organisations buy and sell shares of companies. A share is the smallest unit of stake or ownership that a company offers to investors in exchange for money. You can learn more about shares and their different types here.

Note that while ‘stock’ and ‘share’ technically have distinct meanings, we will use these two terms interchangeably in this guide.

The stock market is also called the secondary market. When a company issues its shares for the first time (an event known as an ‘Initial Public Offering’, or IPO), and an investor buys some of these shares from the company at face value, this transaction is said to take place in the primary market. However, if an investor wants to buy some shares of that company at a later date, then they have to buy them in the secondary market, namely the stock market.

In the latter case, the investor will buy the company’s shares at their current market price not from the company itself but from other investors who hold some shares of that company.

2. Understanding the basics of the stock market

Participants in the stock market buy and sell the stocks of “public” companies, i.e. companies that are listed on a stock exchange in the country. Retail (i.e. individual) investors who want to buy some shares of a company that is not listed on any stock exchange typically have to follow a complicated process, which we won’t discuss here.

In India, the two most popular stock exchanges are the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), while in the US, the New York Stock Exchange (NYSE) and the Nasdaq are two popular exchanges.

The Securities and Exchange Board of India (SEBI) is the stock market regulator in India. It regulates everything from companies launching IPOs and going public to the functioning of stock exchanges.

The stock market is active for trading during certain predetermined hours, which in India are 9:15 am to 3:30 pm on weekdays. Share prices fluctuate during market hours due to various factors that influence their demand and supply; there is also a large random component to such price fluctuation over shorter time scales. Such volatility is inherent to the stock market, and various kinds of traders try to make profits by taking advantage of short-term price fluctuations.

How do you start investing in the stock market as a beginner, though? It’s not as simple as simply walking over to a fruit market and buying the fruits you like, or going to a bookstore and buying a book you want to read. Because when you buy stocks, you are not buying them for consumption, but to build wealth and meet other financial goals. So, how do you go about it? Let’s find out.

3. How to invest in the stock market?

The actual mechanics of investing in the stock market will be handled by a reputable bank or investment broker of your choice. You’ll typically need to open a so-called ‘demat’ (for ‘dematerialised’) account that will hold your shares in electronic form, as well as a trading account where your investment funds will be held temporarily. In addition, most banks and brokers will also provide you with access to a platform that enables online trading.

Once your demat account is set up, you can start buying and selling the stocks of your choice. But this is where the million-dollar question rears its head: what factors should you keep in mind while researching stocks in order to determine which ones you should buy?

Here are the most important such factors to keep in mind when investing in the stock market:

3.1 Define your investment goals

The kinds of investments you make, how long you hold on to them for, the kind of risks you take, and the investing style you adopt all depend on the goals you want to meet. Your goal could be long-term wealth generation in order to finance major life milestones such as buying a house, ensuring an overseas education for your children, or retiring early. Conversely, your goal could be to simply protect your current wealth and earn a fixed income through your investment portfolio.

3.2 Assess your risk tolerance

All investments carry an element of risk, and this is especially pronounced in the stock market due to its volatile nature. Hence, before you invest in the stock market, it’s crucial to assess your risk tolerance and ensure that you are making investments that are aligned with your ability and willingness to take risks. Your income, age, number of dependents, ongoing debt, and personality are some of the key factors you should consider when determining your risk appetite.

3.3 Figure out your investing style

When you first start out investing in the stock market, you need to decide how active you want to be in making investing decisions and managing your portfolio. If you feel like you have sufficient knowledge and time to make informed investment decisions, you can invest in stocks and other related instruments by yourself.

Alternatively, you can also consult a financial advisor or agent who can help you build your investment portfolio. You can even get the best of both worlds through smart investment platforms like the Appreciate trading app. When you invest through Appreciate, you get the control and flexibility needed to manage your own portfolio, but you also get the right tools and guidance to invest confidently and effectively.

3.4 Decide how much equity exposure you want

Two popular asset classes for investments are equity (stocks) and debt (fixed-income securities). Equity is a high-risk/high-return asset class, while debt is a more secure investment avenue that has a lower rate of return but is more stable. Every investment portfolio should have a mix of equity and debt investments, as such diversification reduces risk.

The ideal allocation of your funds between the two asset classes (and others) depends on your risk tolerance and goals, and will likely change over time. When you are first starting to invest in the stock market, you need to decide how much exposure you want to equities and invest accordingly.

Once you have figured these things out, you will have more clarity on how you want to invest in stocks (i.e. which stocks you want to buy and what proportion of your investment funds you want to allocate to equity), as well as the investing strategy you should follow.

4. What does it cost to invest in the stock market in 2023?

When investing in stocks, there are a few different kinds of costs you will have to bear. These include:

4.1 Brokerage

Typically, your broker will levy a commission called a brokerage every time you buy or sell a share. The brokerage amount can either be a predetermined flat rate or can vary based on the value of the trade. Online brokers and investment apps have considerably lower brokerage fees than traditional full-service brokers.

4.2 Transaction charges

Apart from the broker, the stock exchange through which you are buying and selling shares levies a fee called a transaction charge. This fee is charged at a predetermined rate that depends on the stock exchange and is typically nominal.

4.3 Demat charges

As indicated above, a demat account is necessary to invest in the stock market, as it is where your shares are stored in an electronic format. You can open a demat account with a Depository Participant (DP), which can be a bank or a broker. There is a demat account opening charge and an annual maintenance charge, which varies depending on your DP, and is typically between ₹200 to ₹1,000.

When you invest through the Appreciate app, however, there are no such annual maintenance or subscription charges. This helps you minimise your investing and trading costs, thus maximising your returns.

4.4 Capital gains tax

Capital gains are the profits you earn by selling shares you own. Depending on the holding period of the stocks, your capital gains can be categorised as being either Short-Term Capital Gains (STCGs) (if the shares were held for less than 12 months), or Long-Term Capital Gains (LTCGs) (if the shares were held for more than 12 months). STCGs are taxed at 15%, while LTCGs above ₹1 lakh are taxed at 10%.

Once you have selected your investment platform and opened your demat and trading accounts, it’s time to pick your stocks. For this, you need to know the different types of stocks you can invest in.

5. Different types of stocks in 2023

Stocks can be categorised on the basis of several criteria — features, returns, share capital, and market capitalisation. We’ll focus on a categorisation based on market capitalisation, as such a categorisation is used quite frequently in the context of the stock market.

The market capitalisation of a company is the market value of that company based on its outstanding shares. Simply put, it is the value of a company as determined by investors and the stock market. It is also used as a determinant for the size of a company, along with other such metrics such as sales or revenue. On the basis of market capitalisation, the types of stocks you can invest in in 2023 are as follows:

5.1 Large-cap stocks

Large-cap stocks are stocks of well-established companies that have been around for a long time. These companies are often leaders in their respective industries, and their stocks are also referred to as blue-chip stocks. Roughly speaking, the top 100 stocks listed on the major Indian exchanges are considered to be large-cap stocks, and their market capitalisation will typically be ₹20,000 crore or more. While large-cap stocks are subject to market volatility just like all other stocks, they are usually more stable than small-cap and mid-cap stocks during market downturns.

5.2 Mid-cap stocks

Stocks of companies that have a market cap of roughly between ₹5,000 crore and ₹20,000 crore are typically considered to be mid-cap stocks. Mid-cap companies, while established, still have room for rapid growth and expansion. Mid-cap stocks carry a higher level of risk compared to large-cap stocks since they are not as deeply entrenched as the latter.

5.3 Small-cap stocks

Small-cap stocks are typically associated with companies that have a market capitalisation of less than ₹5,000 crore, and that are relatively newer or serve a niche market. Small-cap stocks are the most vulnerable to market volatility and can experience sharp price changes. Hence, they carry the highest amount of risk, but also the highest potential for returns.

Your investment portfolio should have a mix of large-cap, mid-cap, and small-cap stocks based on your risk tolerance and financial goals.

6. Begin your stock investing journey today

There will never be a time when you feel like you know everything you need to know about the stock market and investing. Nevertheless, it’s important to get started once you have a grounding in some share market basics for beginners, as the real learning will come only once you begin investing.

As a beginner, you should aim to use an investment platform that simplifies every aspect of investing for you — and that’s exactly what Appreciate does! Through Appreciate’s AI-based investment recommendations, you can build a strategic and well-diversified portfolio to maximise your returns. You can access both the Indian and the US stock markets in a reliable, secure, and low-cost way with just a few clicks. So download the Appreciate app and get started today!

Frequently asked questions

What is the difference between investing and trading?

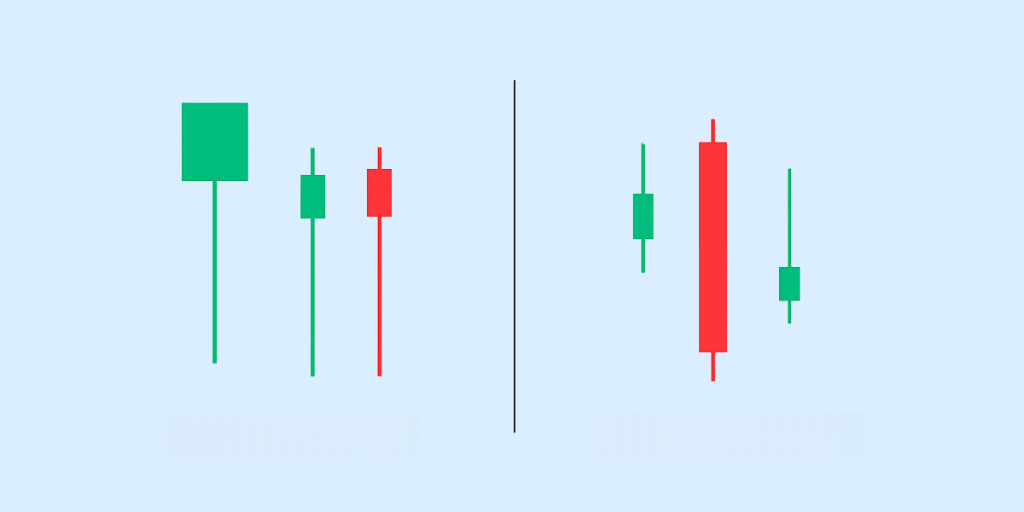

Investing and trading are two methods of benefitting from the stock market. Investing is a long-term approach where you buy and hold stocks to build wealth over time. Trading, on the other hand, is a short-term approach to benefit from the daily, weekly, or monthly price movements of stocks.

Should I invest or trade?

While both investing and trading can enable you to make money in the stock market, as a beginner, it’s better to invest. Investing can result in long-term capital appreciation, and is much less risky than trading.

How can I teach myself to trade?

You can start by reading about share market basics for beginners, learning how to read charts, understanding what causes price movements, and exploring different trading and investing strategies. You can then open a trading and demat account and experiment with small trades to gain some experience with trading and get better at it.

Can I learn trading for free?

Yes, you can learn trading for free through free financial content in the form of blogs, podcasts, books, and videos from reliable sources. You can also follow Appreciate’s weekly newsletter for regular updates on the markets.

Which trading is best for beginners?

Intraday trading and swing trading are the two most common trading approaches. Intraday trading involves buying shares and selling them on the same day, while swing trading involves holding shares for anything between a few days and a few weeks. Swing trading may be the best kind of trading for beginners as it demands less time and is not as stressful as intraday trading.

Note that if you’re a beginner at trading, you should only trade stocks that you have researched thoroughly and whose growth prospects you believe in, so that if you end up having to hold them longer than you had expected, your portfolio is not negatively impacted.

What are the ways to invest in the stock market?

You can invest in the stock market directly by buying shares of individual companies, or you can invest through other products such as mutual funds and Exchange-Traded Funds (ETFs). The latter two products provide inherent diversification as each such fund holds a range of different stocks in its portfolio.