Quick Summary:

– A stop loss order automatically sells a security when its price reaches a specified amount in order to limit the investor’s loss in a volatile market when their portfolio value may be decreasing significantly.

– There are two basic forms of stop-loss orders: market stop-loss orders, where the security is sold at the next available price, and limit stop-loss orders, where the security sells for the stop price or higher.

– Stop-loss orders will reduce the possibility of emotion-based trading decisions by automatically selling a security.

– You can also use a trailing stop-loss Order to adjust the stop price as the price of the underlying asset continues to rise, which will help lock in profits.

– Common mistakes made when placing stop prices are either setting them too close to the price of the security or not adjusting the stop price or stop-losses as the market conditions change.

What is a Stop-Loss Order?

A stop-loss order is a trading tool designed to protect investors from significant losses by automatically selling a security when its price falls to a specified level. This order is set up with a broker and acts as a safety net to prevent excessive losses if the market moves against the investor’s position.

How a Stop-Loss Order Works

When you place a stop-loss order, you specify a stop price. If the market price of the security drops to this level, the stop-loss order is triggered and becomes a market order. This means the security will be sold at the next available price.

For example, if you buy a stock at Rs. 50 and set a stop-loss order at Rs. 45. The order will be executed automatically if the stock price falls to Rs. 45. This helps you limit potential losses and exit a position before the price declines further.

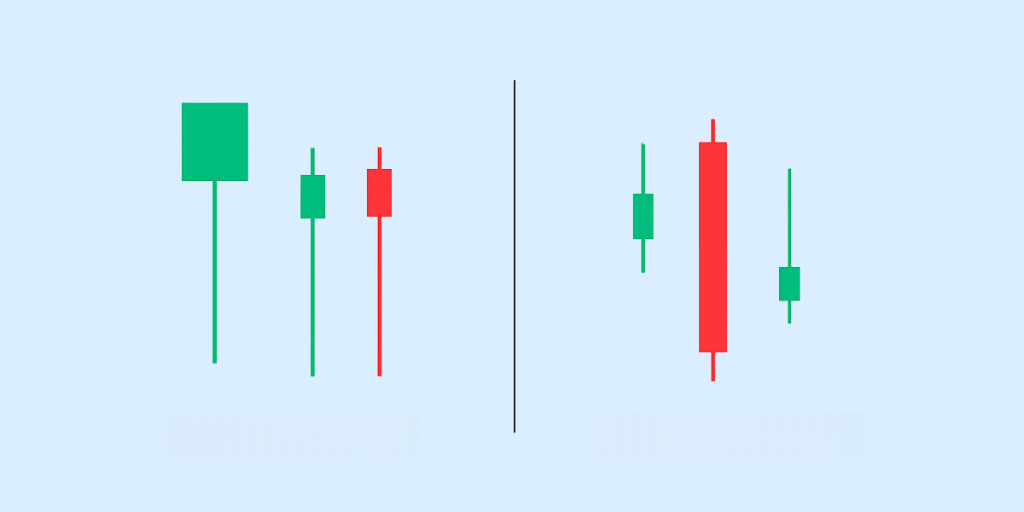

Types of Stop-Loss Orders

Different types of stop-loss orders cater to various trading needs and preferences:

- Market Stop-Loss Order: When the stop price is reached, the order converts to a market order, and the security is sold at the next available price.

- Limit Stop-Loss Order: When the stop price is reached, the order becomes a limit order. The security is sold only at the stop price or higher.

Why Use a Stop-Loss Order?

Stop-loss orders offer several benefits that can help traders and investors protect their capital, including:

Limiting Losses

In volatile markets, stock prices can decline rapidly, but a stop-loss order ensures you don’t experience losses beyond a predetermined level. For instance, if you set a stop-loss at 10% below the purchase price, your trade will be automatically sold once the stock hits that price, protecting you from further declines.

Reducing Emotional Decision-Making

Market swings can lead to panic selling or holding onto losing positions for too long. Stop-loss orders help remove emotions from the trading process by automating the selling decision. This way, you can stick to your plan and avoid making rash decisions driven by fear or greed during periods of high volatility.

Protecting Gains

As the stock price increases, the trailing stop price adjusts upward, ensuring you still capture a portion of your gains if the price reverses. This allows you to ride the upward trend while protecting your profits as the stock rises.

How to Set Up a Stop-Loss Order

Here’s a quick guide to help you get started, ensuring you protect your investments effectively.

Choosing the Right Stop Price

When choosing the stop price, consider factors like:

- The stock’s volatility (how much the price fluctuates)

- Recent price trends and your personal risk tolerance.

For highly volatile stocks, you might want to set your stop price further from the current price to avoid being prematurely stopped out. A closer stop price could work for lower-volatility stocks.

Setting Up a Trailing Stop-Loss

A trailing stop-loss automatically adjusts as the stock price rises, protecting your gains. To set it up, specify a percentage or dollar amount below the current price at which your position will be sold if it falls.

For example, if you set a trailing stop-loss 10% below a stock trading at Rs. 100, the stop price would be Rs. 90. If the stock rises to Rs. 120, the stop price would automatically adjust to Rs. 108, locking in more profit while still providing downside protection.

When to Use a Stop-Loss Order

Let’s explore a few situations where stop-loss orders can be especially advantageous.

During Market Volatility

In volatile markets, prices can swing unpredictably, sometimes resulting in sharp declines within a short period. Stop-loss orders are particularly useful here, as they allow you to set a safety net that automatically sells your asset if the price drops too far.

In Long-Term Investments

By placing a stop-loss at a reasonable level, you ensure that if the market takes a turn for the worse, your profits from earlier growth won’t be wiped out. This is especially helpful during broad market downturns, where you might want to secure profits without constantly monitoring your portfolio.

Stop-Loss Orders in Different Asset Classes

Stop-loss orders are versatile tools applied across various asset classes, not just stocks. Here’s how they work:

Stop-Loss in Stocks

Stop-loss orders are most commonly used in stock trading to limit losses when a stock’s price drops to a specific level. When the stock reaches your stop price, the stop-loss order automatically sells the shares at the best available price, helping you avoid further losses.

Stop-Loss in ETFs

Although ETFs (Exchange-Traded Funds) consist of multiple securities, they still fluctuate in price. Stop-loss orders can be used here to protect your portfolio from sudden drops in the ETF’s value. Since ETFs are traded like individual stocks, the stop-loss mechanism works similarly, giving you an easy way to manage risks even in diversified investments.

Stop-Loss in Options Trading

Using stop-loss orders in options trading can be more complex due to market liquidity and price gaps. Options have expiration dates and can fluctuate rapidly, so be mindful of these dynamics when placing a stop-loss order. Liquidity can affect the execution price, and stop-loss orders may not always execute exactly at the set price, especially in fast-moving markets.

Common Mistakes to Avoid When Using Stop-Loss Orders

Stop-loss orders can be a powerful tool in protecting your investments, but if used incorrectly, they can lead to unnecessary losses or missed opportunities. So, let’s break down a couple of key mistakes and how to avoid them.

Setting the Stop Price Too Close

Placing your stop-loss order too close to the current price might lead to frequent triggering, especially during market volatility. Even minor fluctuations can cause the stop to activate, resulting in an early exit from a trade.

To avoid this, leave enough room for the stock to breathe. Setting the stop price further away allows your position to weather short-term price swings while protecting against significant downturns.

Not Revising Stop Prices

Failing to adjust your stop-loss as the stock price rises can cost you potential profits if you’re holding a stock long-term. Therefore, make it a habit to regularly revise your stop price upward as your stock gains value, locking in profits while still giving the stock space to move.

The Bottom Line

Stop-loss orders are vital for managing risk and helping investors protect their portfolios from unexpected market drops. Stop-loss orders limit potential losses and provide peace of mind by automatically selling a stock when it hits a predetermined price.

With the Appreciate stock market app, you can seamlessly set up stop-loss orders while trading U.S. stocks. This ensures that your investments are protected from sudden market downturns and allows you to stay focused on your long-term financial goals.

FAQs

What is a stop-loss order in trading?

A stop-loss order instructs traders to sell a security when it reaches a specific price, helping them limit potential losses. It’s an automatic order set in advance to protect against significant market downturns.

How does a stop-loss order work?

A stop-loss order becomes a market order to sell once the security hits the predetermined stop price. This ensures the asset is sold immediately at the best available price, preventing further loss.

What are the different types of stop-loss orders?

The two main types are the standard stop-loss order, which converts to a market order when triggered, and the trailing stop-loss, which adjusts with the asset’s price. Each type serves different purposes depending on your trading strategy.

How do I choose the right stop-loss price?

To choose the right stop-loss price, consider your risk tolerance and the asset’s volatility. A common strategy is to set the stop price a certain percentage below the current market price.

Can I set up a trailing stop-loss order?

A trailing stop-loss order allows the stop price to move with the market price, locking in gains as the price increases. It helps you stay in a winning trade longer while limiting potential losses.

When should I use a stop-loss order?

Stop-loss orders are best used to limit potential losses in volatile markets. They’re also useful if you can’t constantly monitor your trades and need automatic protection.

How does a stop-loss order protect my gains?

By setting a stop-loss above your purchase price, you lock in profits if the market reverses. This allows you to capture gains without needing to sell your position manually.

What are the risks of using stop-loss orders?

Stop-loss orders can trigger brief price fluctuations, leading to an unintended sale. Additionally, due to slippage, you might not get the exact stop price in highly volatile markets.

Can stop-loss orders be used for ETFs and options?

Yes, you can use stop-loss orders for ETFs and options, just like with individual stocks. However, due to their time-sensitive nature, special attention is needed with options.

What are common mistakes to avoid with stop-loss orders?

One common mistake is setting the stop price too close to the current price, which leads to premature exits. Another is failing to adjust the stop loss as market conditions change.

Disclaimer: Investments in securities markets are subject to market risks. Read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory.