The Dow Jones Industrial Average has long been treated as a shorthand for the health of corporate America. Made up of 30 of the largest and most established U.S. companies, the index spans sectors from technology and healthcare to industrials, financials, and consumer goods. While narrower than benchmarks such as the S&P 500, the Dow’s focus on blue-chip leaders gives it a distinct character that many long-term investors value.

In 2025, the Dow Jones reaffirmed that relevance. The index crossed 48,000 points during the year and traded near record highs, supported by resilient U.S. economic data, easing inflation pressures, and expectations that the Federal Reserve is approaching a more accommodative phase of monetary policy. For global investors, the rally has underlined the Dow’s role as a steady compounder rather than a speculative growth index.

What the Dow Jones Represents

Unlike most modern indices, the Dow is price-weighted, not market-capitalisation-weighted. This means stocks with higher share prices exert a greater influence on index movements, regardless of company size. While this methodology is often debated, it results in a benchmark that behaves differently from tech-heavy indices and tends to reflect performance in established, cash-generating businesses.

The Dow’s composition also changes infrequently, reinforcing its reputation as a measure of long-term corporate leadership rather than short-term market trends. In periods when investors rotate toward quality and balance-sheet strength, the index has historically held up well.

Why You Can’t Buy the Dow Directly

The Dow Jones Industrial Average is an index, not a security. Investors cannot purchase it directly. Exposure must be gained through instruments designed to replicate or approximate its performance.

One option is to buy all 30 constituent stocks individually, but that approach requires significant capital, constant rebalancing, and close monitoring as index components change. For most investors, this is inefficient. Instead, pooled vehicles such as exchange-traded funds provide a far more practical solution.

ETFs That Track the Dow Jones

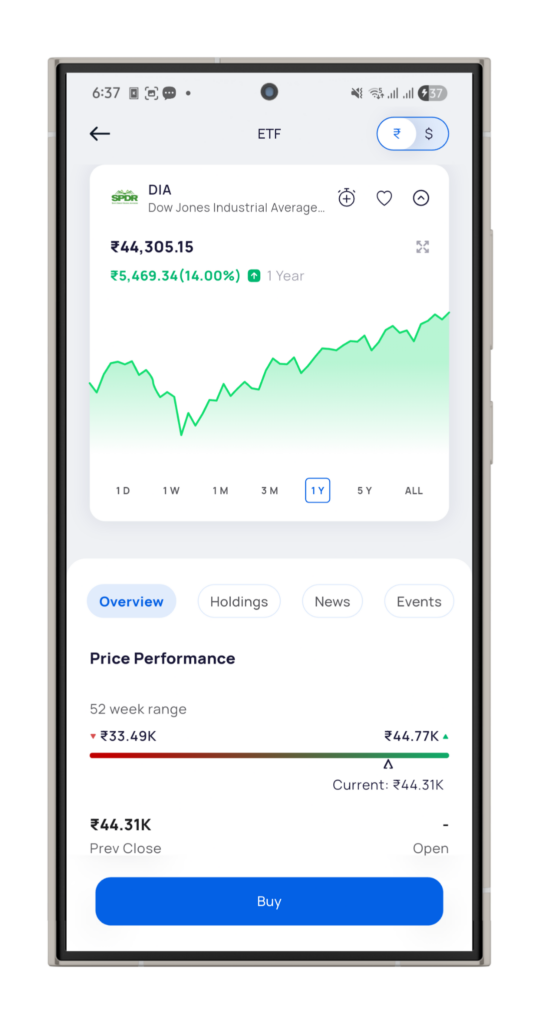

The most widely used instrument for Dow exposure is the SPDR Dow Jones Industrial Average ETF Trust (DIA). It seeks to closely mirror the index by holding the same 30 stocks in proportions aligned with the Dow’s price-weighted structure. DIA is commonly used by investors who want direct, transparent exposure to the index’s movements.

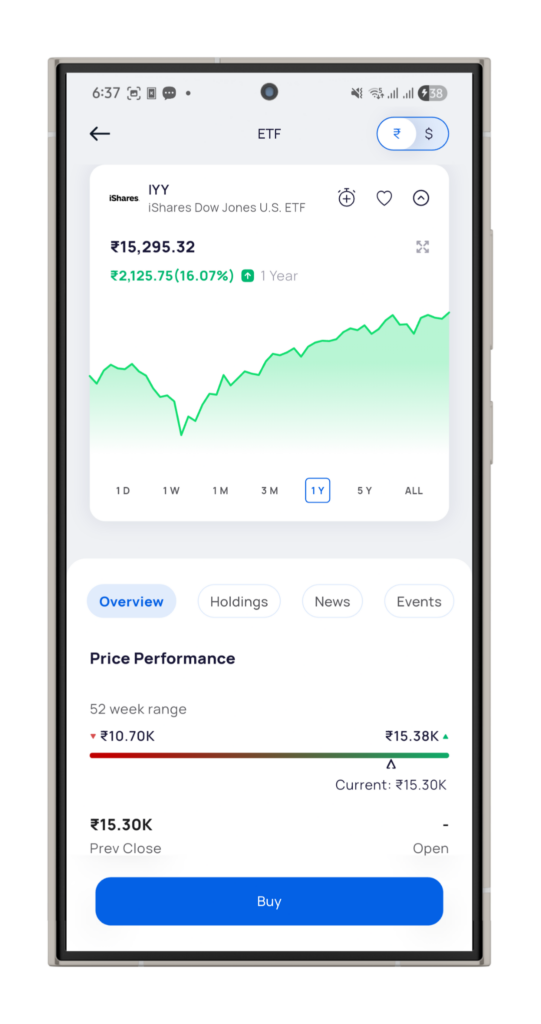

Another option is the iShares Dow Jones U.S. ETF (IYY). While broader in scope, IYY tracks a wide segment of the U.S. equity market that includes many Dow constituents. It can suit investors who want Dow exposure as part of a more diversified U.S. allocation rather than a narrow index-only position.

Both ETFs trade on U.S. exchanges and offer liquidity, transparency, and ease of execution.

How Indian investors can invest in the Dow Jones

Indian investors can access Dow Jones exposure through Appreciate, which enables direct investing in U.S. stocks and ETFs from India under the Liberalised Remittance Scheme (LRS). This allows Dow exposure to sit alongside domestic assets as part of a globally diversified portfolio.

Investing in Dow Jones through Appreciate

Step 1: Open a U.S. Investing Account

The process begins by creating an account on Appreciate and completing standard KYC verification, similar to opening a domestic investment account.

Step 2: Activate U.S. Market Access

Once verification is complete, international investing access is enabled, allowing participation in U.S. stocks and ETFs.

Step 3: Transfer Funds Under LRS

Funds are remitted in U.S. dollars under India’s Liberalised Remittance Scheme, which permits overseas investments of up to $250,000 per financial year.

Step 4: Select ETFs tracking the Dow Jones Index

After funding, investors can easily invest in ETFs that track the DJIA Index, like SPDR Dow Jones Industrial Average ETF Trust (Ticker: DIA) or iShares Dow Jones US ETF (Ticker: IYY), which closely track the index.

Step 5: Place Orders and Monitor Holdings

Investments are executed during U.S. market hours and can be tracked, added to, or rebalanced over time based on portfolio strategy.

What to Consider Before Investing

While the Dow offers stability and global recognition, it is not without trade-offs. Currency movements between the rupee and the U.S. dollar can influence returns for Indian investors. The index’s concentrated structure means it may lag broader benchmarks during periods when a small group of high-growth stocks dominate market performance. Costs such as ETF expense ratios and international transaction fees also matter over long horizons.

As with any global investment, Dow exposure works best when aligned with clear objectives rather than short-term market timing.

Conclusion

Investing in the Dow Jones in 2025 offers access to some of the world’s most established companies at a time when the index is trading near historic highs. While the index itself cannot be bought directly, ETFs such as DIA and IYY provide efficient pathways to participate in its performance.

For Indian investors, platforms like Appreciate have made this exposure more accessible, enabling Dow investments to complement domestic portfolios. As global diversification becomes increasingly relevant, understanding how and why to invest in benchmarks like the Dow is an important step toward building resilient, long-term portfolios.

Disclaimer: Investments in securities markets are subject to market risks. Read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory.