Walmart Inc. has long been viewed as a bellwether of the American consumer. Founded in 1962 and listed publicly since 1970, the company has evolved from a brick-and-mortar discount retailer into a global retail and logistics platform spanning groceries, general merchandise, e-commerce, advertising, and last-mile delivery.

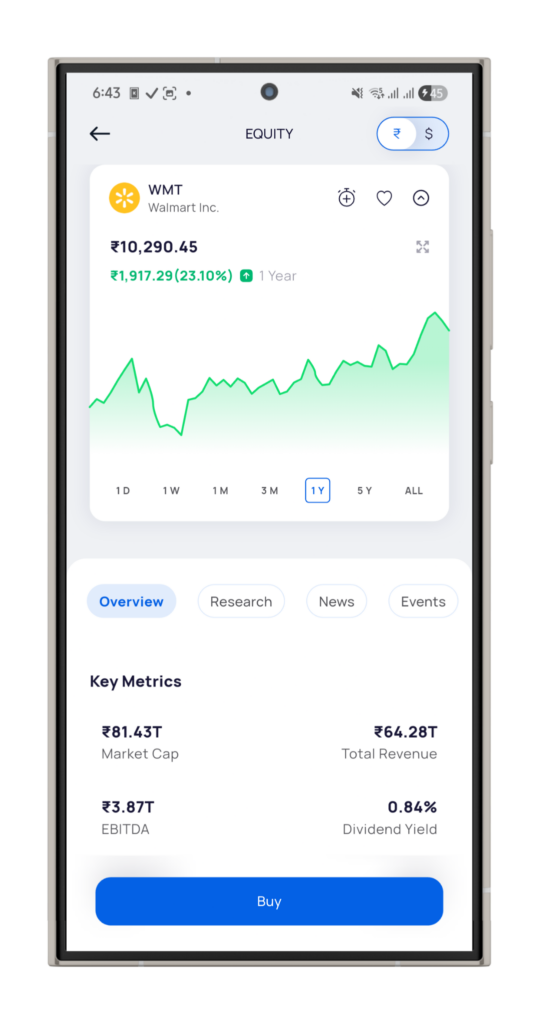

In 2025, Walmart’s relevance has only increased. As inflation moderated in the U.S. and consumers remained value-conscious, Walmart continued to gain market share in essentials while expanding higher-margin businesses such as advertising and membership services. The stock has traded near record levels during the year, reflecting steady earnings growth, resilient cash flows, and investor confidence in its defensive qualities.

What Walmart Represents for Investors

Walmart is not a high-growth technology stock, but it occupies a unique position in global portfolios. It combines scale, pricing power, and predictable demand, making it one of the most stable consumer businesses in the world. With more than 10,000 stores globally and a rapidly growing digital operation, Walmart sits at the intersection of physical retail and e-commerce infrastructure.

For investors, this translates into a different risk profile compared with discretionary or cyclical retailers. Walmart’s revenues tend to hold up during economic slowdowns, while its investments in automation, private labels, and online fulfilment support long-term efficiency gains.

Recent Performance and 2025 Context

Through 2025, Walmart shares have benefited from consistent earnings delivery and improving margins in its U.S. segment. Grocery volumes have remained strong, while e-commerce losses have narrowed as scale improves. The company has also expanded its retail media business, which carries significantly higher margins than traditional retail.

These factors have helped Walmart stock outperform many traditional retailers during the year, reinforcing its role as a defensive compounder rather than a cyclical trade. While short-term price movements fluctuate with broader market sentiment, the longer-term narrative has remained anchored in cash flow stability and incremental growth.

Why You Can’t Buy Walmart Stock Directly in India

Walmart Inc. is listed on U.S. stock exchanges and does not trade on Indian exchanges. As a result, Indian investors cannot buy Walmart shares through domestic trading accounts.

Access requires investing in overseas markets, either through international brokerage accounts or platforms that facilitate U.S. stock investing from India in compliance with Indian regulations.

How Indian Investors Can Invest in Walmart Inc.

Indian investors can invest in Walmart stock through Appreciate, which enables direct access to U.S. equities from India under the Liberalised Remittance Scheme (LRS). This allows Walmart shares to be held alongside other global stocks and ETFs within a single investment account.

Investing in Walmart through Appreciate

Step 1: Open a Global Investing Account

Investors begin by creating an account on Appreciate and completing standard KYC verification, similar to opening a domestic investment account.

Step 2: Activate U.S. Market Access

Once verification is complete, international investing access is enabled, allowing participation in U.S. stock markets.

Step 3: Fund the Account Under LRS

Funds are transferred in U.S. dollars under India’s Liberalised Remittance Scheme, which permits overseas investments of up to $250,000 per financial year.

Step 4: Buy Walmart Inc. Shares

After funding, investors can search for Walmart Inc. and purchase shares, including fractional shares, allowing gradual position building rather than a lump-sum commitment.

Step 5: Track and Manage the Investment

Walmart shares can be monitored alongside other global holdings, with investors choosing to hold long-term, add periodically, or rebalance as part of a broader portfolio strategy.

Key Considerations Before Investing

While Walmart offers stability, investors should still consider currency risk, as returns are denominated in U.S. dollars. Movements in the rupee–dollar exchange rate can amplify or reduce overall returns when converted back to INR.

It is also important to recognise that Walmart’s growth profile differs from that of high-growth technology companies. Returns are more likely to come from steady earnings expansion and dividends rather than sharp valuation re-rating.

Conclusion

Investing in Walmart Inc. from India offers exposure to one of the world’s most resilient consumer businesses. In 2025, the company continues to demonstrate why scale, logistics, and everyday demand matter across economic cycles.

For Indian investors looking to add global consumer exposure, platforms like Appreciate make it possible to own Walmart shares directly, integrating a defensive U.S. stock into a diversified, long-term portfolio. As with any international investment, the key lies in aligning expectations with the company’s role as a steady compounder rather than a short-term momentum trade.

Disclaimer: Investments in securities markets are subject to market risks. Read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory.