One of the biggest misconceptions people have about investing, especially in the stock markets, is that it is a lot like gambling. However, this couldn’t be farther from the truth: good investors make calculated and informed decisions when building their portfolios.

Investing in stocks is not simply speculation based on minimal facts or figures. Instead, experienced investors and wealth managers conduct thorough analyses of market trends to make sound decisions. So, let’s see how you can also analyse stock market trends to make strategic investment decisions and optimise your returns.

Table of contents

1. What are market trends?

2. What is fundamental analysis?

3. What is technical analysis?

4. Difference between technical analysis and fundamental analysis

5. Using fundamental analysis

6. Using technical analysis

7. How to effectively invest

8. Frequently asked questions

1. What are market trends?

A market trend is the general direction in which the price of a specific asset class or market moves over a certain period of time. The most basic kinds of trends are uptrends, downtrends, sideways movements, and reversal trends. Several factors influence stock market trends, including economic indicators like the GDP, the monetary policy of the central bank, corporate earnings, and investor sentiment.

An example of a market trend is the strong uptrend that the technology sector witnessed from 2019 to 2021, which was supported by factors such as the strong earnings of tech companies and the COVID-19 pandemic that accelerated the adoption of digital technologies across industries globally.

There are two main approaches to analysing market trends — fundamental analysis and technical analysis. Each of these market analysis methods has its own set of pros and cons, and investors use both in an attempt to forecast future stock price movements.

2. What is fundamental analysis?

The primary purpose of fundamental analysis is to evaluate the intrinsic value of a stock so that this value can be compared to its market price. This allows investors to see whether the stock is currently undervalued or overvalued, and if it would make for a potentially valuable investment.

3. What is technical analysis?

Technical analysis aims to predict future price movements by focusing on statistical trends like price movements and volume of stocks. Unlike fundamental analysis, the technical analysis of stocks involves examining stock charts using various tools and techniques to identify patterns. Analysts using this method may believe that all relevant fundamentals are already factored into the price and hence do not separately consider them.

Usually, technical analysis is used by traders and short-term investors who are aiming to capitalise on short-term price fluctuations. With the help of technical analysis, they can identify entry and exit points, set stop-loss orders, decide price targets, and more.

Let’s take a look at the key differences between technical analysis and fundamental analysis before delving into how to use each method for your stock investment decisions.

4. Differences between technical analysis and fundamental analysis

Here are the two primary differences between technical analysis and fundamental analysis:

4.1 Information used

Fundamental analysis focuses on a wide range of factors related to both the internal and external business environment of a company to evaluate its intrinsic value. It analyses the company’s financial statements, management, industry trends, and macroeconomic indicators like GDP growth rate, interest rates, etc. Fundamental analysis also uses both quantitative and qualitative data — everything from earnings reports and financial ratios to the regulatory environment in the industry and the level of competition.

Technical analysis, on the other hand, primarily relies on quantitative data. It uses historical price and volume data in order to identify patterns and predict future prices. It does not actively consider the company’s financial health or the current economic scenario as it generally assumes these factors are already reflected in the price.

4.2 Investment strategy

Another factor to consider when looking at technical analysis vs fundamental analysis is the kind of investment strategy each is used for. Usually, fundamental analysis is used for a long-term investment strategy, where assessing a company’s core financial fundamentals and growth potential is key. Hence, this type of analysis is helpful for investors who are looking to hold positions for a couple of months or a couple of years.

Conversely, technical analysis is more popular for short-term investments and trading. This is because in this type of investment strategy, identifying the market entry and exit points is crucial, i.e., timing the market is essential. Analysing price and volume charts is helpful when it comes to understanding short-term price trends, so that positions can be held for anything between a few hours to a few days.

4.3 Technical analysis vs fundamental analysis: a snapshot

| Parameter | Technical analysis | Fundamental analysis |

| Meaning | The analysis of historical price patterns and trends to predict future price movements. | The analysis of the financial health and intrinsic value of a company to assess investment potential. |

| Objective | Timing market entries and exits. | Identifying if a stock is undervalued or overvalued. |

| Type of investor | Traders and short-term investors. | Long-term investors. |

| Type of data | Quantitative data. | Quantitative and qualitative data. |

| Form of data | Historical price and volume charts and technical indicators. | Financial statements, industry reports, and economic data. |

| Time horizon | Short-term — hours, days, weeks. | Long-term — months, years. |

| Use of historical data | Relies heavily on historical data. | Uses historical data but also analyses current data and considers future projections. |

| Time and effort involved | Comparatively less time-consuming as it primarily focuses only on charts and technical indicators for analysis. | Takes more time and effort as it involves extensive research and analysis of a wide variety of data. |

5. Using fundamental analysis

In order to benefit from fundamental analysis to make investment decisions, here’s what you should do:

5.1 Study financial statements

By studying the financial statements of a company — primarily the income statement, balance sheet, and cash flow statement — you can gain insights into its growth trajectory and assess its future potential. You can identify revenue and profit trends over time, compare them to industry standards, and understand the overall financial health of the company.

Make sure to look at the net margin of the company, as it’s an important indicator of its profitability. It lets you know what proportion of the company’s revenue gets translated into net income. A high net margin is a good sign because it indicates cost-effectiveness and operational efficiency. It’s also crucial to understand the company’s cash flows — a positive cash flow often means that the company is able to generate more cash than it uses, pay off debt, and declare and distribute dividends.

5.2 Determine the price-to-earnings ratio

The price-to-earnings (P/E) ratio compares a company’s stock price to its earnings per share, and is a commonly used metric for fundamental analysis. Typically, a high P/E ratio indicates positive investor sentiment, meaning investors are likely to be willing to pay a premium to own the relevant stock.

Along with the P/E ratio, the price-to-earnings growth (PEG) ratio is also used as an indicator of a company’s growth potential. To arrive at the PEG ratio, you need to divide the company’s P/E ratio by its expected earnings growth rate. Usually, a PEG ratio below one indicates an undervalued stock with growth potential, and vice versa.

5.3 Check the return on equity and return on assets

Two other financial ratios to study for fundamental analysis include the return on equity (ROE) and the return on assets (ROA). The ROE indicates how efficiently a company is utilising its shareholders’ equity to generate profits. The higher the ROE, the better.

The ROA is similar to the ROE; however, it aims to assess how efficiently the company is utilising its overall assets, not just its equity, to generate profits. It also takes into consideration the company’s leverage, unlike the ROE.

5.4 Consider the competitive advantage

One of the important qualitative factors to consider for fundamental analysis is a company’s competitive advantage or moat. This can be in the form of economies of scale, intellectual property, strong brand image, innovative products or services, etc. Having a competitive advantage helps a company perform better than its peers, and that is often reflected in stock prices over time as well.

5.5 Analyse the industry and economic factors

It’s also essential to analyse the industry a given company operates in, as well as how it reacts to different economic phases. When analysing the industry, look at the industry trends, barriers to entry for new participants, regulatory framework, and market size. When analysing economic factors, look at how sensitive the company’s revenue and profits are to changes in interest rates, the GDP growth rate, and geopolitical factors.

Once you have gone through the above factors, you will be able to evaluate the company’s intrinsic value and then compare it to its market price to identify whether it makes for a worthy investment opportunity or not.

6. Using technical analysis

Using technical analysis may seem trickier at first because it makes heavy use of charts and initially involves a fair bit of jargon, but it’s quicker to use than fundamental analysis once you get accustomed to it. Here’s an overview of how you can go about using technical analysis:

6.1 Select relevant indicators

One of the most important things when it comes to the technical analysis of stocks is to understand the various available indicators and select the ones that are the most relevant to your trading strategy. Some of the most common technical analysis indicators include moving averages, relative strength index, stochastic oscillator, and MACD.

These indicators are helpful in identifying trends, determining whether a stock is overbought or oversold, and visualising what potential reversals in price movements could look like.

6.2 Understand different types of trends

It’s also essential to understand the importance of different types of trends in technical analysis. Some common types of trends are: secular trends, intermediate trends, and long-term trends. Secular trends are those that last for several years or decades, and hence capture the overall direction of a stock. By identifying secular trends you can align your investments with the broader market direction.

Intermediate trends are those that last several months to a year and occur within the context of secular trends. They help identify trading opportunities to help investors capitalise on shorter-term price movements. Finally, long-term trends are those that are longer in duration than intermediate trends but shorter than secular trends. They are used to help identify entry and exit points for long-term positions.

6.3 Analyse price patterns and volumes

When doing this, you first need to select the timeframe for which you want to undertake your analysis — daily, weekly, monthly, or quarterly. This will be determined by your investment horizon and trading strategy. Once you’ve decided the timeframe you want to analyse, then you can conduct a price pattern and volume analysis.

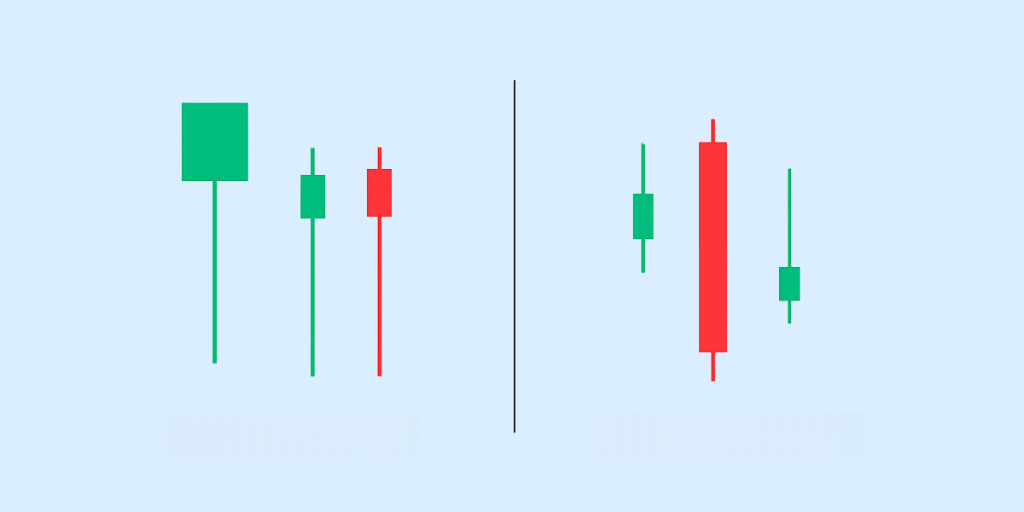

You can look at candlestick patterns, trendlines, support and resistance levels, and chart patterns to get insights into potential trend reversals and market sentiment. In addition to analysing price movements, you can also look at trading volumes, as doing so helps identify the presence of any significant buying or selling pressure for the stock.

Once you have done the above, you can formulate a trading strategy. This includes identifying potential entry and exit points for maximising returns. Another important aspect is learning to manage risk by setting stop-losses.

7. How to invest effectively

Once you have conducted fundamental and or technical analysis and have identified the investments you want to make, when you want to make them, and what your broader investment strategy is, it’s important to invest in a way that is cost-effective, efficient, and convenient. And the Appreciate app lets you do exactly that.

Appreciate allows you to build a well-diversified portfolio that aligns with your financial goals and risk tolerance with the help of tools like AI-based investment recommendations, systematic investment plans for goal-based investing, change investing to inculcate the habit of investing, and more. You also get to add international exposure to your portfolio, setting it up for potentially higher returns. Download the app today!

8. Frequently asked questions

8.1 What are the four main categories of trends?

The four main categories of market trends are uptrends, downtrends, sideways or horizontal trends, and reversal trends. Uptrends are characterised by higher highs and higher lows, and tend to indicate a bullish market sentiment. On the other hand, downtrends are characterised by lower highs and lower lows, and indicate a bearish sentiment. Sideways or horizontal trends indicate that prices are moving within a relatively narrow range, while reversal trends indicate a potential trend reversal and change in market sentiment.

8.2 What are the three layers of fundamental analysis?

The fundamental analysis of stocks consists of three important layers. The first layer is company analysis, which focuses on a company’s financial fundamentals, management quality, corporate governance, and competitive advantage. The second layer is industry analysis, which focuses on studying the industry that the company operates in by looking at the barriers to entry, regulatory framework, level of competition, and market size and demand. The third and final layer of fundamental analysis consists of macroeconomic analysis, which focuses on assessing the overall economic and market conditions like inflation, interest rates, GDP growth rate, and government policies.

8.3 Which one is better, fundamental or technical analysis?

Both fundamental and technical analysis have their strengths and weaknesses. Which one you choose to use depends on your investment strategy, preferences, financial goals, and investment horizon. It’s also important to note that no method of analysis in isolation can help make well-informed decisions, and you may have to sometimes combine multiple methods.

8.4 Does technical analysis beat the market?

While many investors and traders swear by technical analysis to make investment decisions that might outperform the market, it’s essential to note that no type of analysis or strategy can guarantee continued outperformance.

8.5 Is fundamental analysis easier than technical analysis?

Fundamental analysis aims to evaluate the intrinsic value of a company through an in-depth quantitative and qualitative analysis of the various factors involved. Technical analysis, on the other hand, focuses primarily on analysing price patterns and charts for short-term trading and investment decisions and in order to time the market. Both technical and fundamental analysis require a certain level of knowledge and expertise. Neither is easier than the other, and the outcome ultimately depends on the skills of the investor.