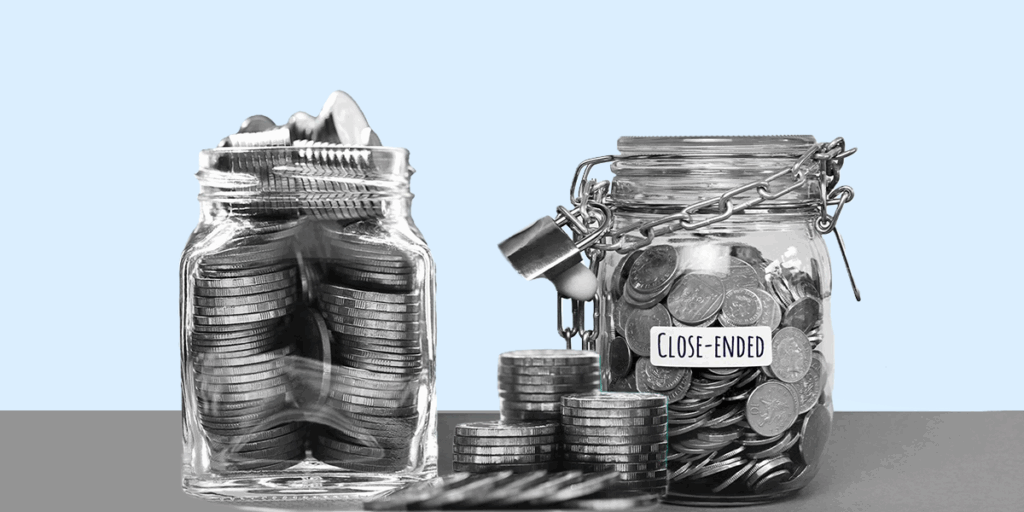

When you invest in a mutual fund, you aren’t just choosing where your money goes—you’re also choosing how you can access it. That’s where fund structures come in. Mutual funds in India are broadly divided into open-ended and close-ended schemes, and the difference between the two can impact everything from liquidity to investment discipline.

For investors, understanding these structures helps you decide whether you need the flexibility of entering and exiting anytime (open-ended funds) or the commitment of staying invested till maturity (close-ended funds).

In this blog we discuss the pros and cons of each to help you understand which suits your financial goals best.

Understanding Mutual Fund Structures

Mutual funds are investment instruments that gather money from many investors and allocate it across stocks, bonds, or other assets, based on the fund’s objective. This collective approach makes it easier for individuals to access a diversified investment portfolio that is managed by professionals, even with relatively small investments.

Broadly, mutual funds in India are classified into two structures:

- Open-ended funds: These allow continuous entry and exit at the prevailing Net Asset Value (NAV).

- Close-ended funds: These come with a fixed maturity and are listed on stock exchanges, where units can only be bought or sold during the tenure.

What is an Open-Ended Mutual Fund?

Open-ended mutual funds are among the most common types of mutual fund available to investors. These funds do not have a fixed maturity date and allow continuous buying and selling of units. Investors can enter or exit the trade anytime, and transactions are executed at the current Net Asset Value (NAV).

Daily SIP at just ₹11 a day makes open-ended funds an even more accessible option for beginners. By investing a small, manageable amount every day, you can gradually build your investment without the need for a large initial capital.

Features of Open-End Funds

- Units can be purchased or redeemed anytime during market hours.

- Pricing is NAV-based, ensuring transparency.

- Fund size is flexible as it expands or shrinks with inflows and redemptions.

Benefits of Open-Ended Funds

- Liquidity: Easy redemption makes them suitable for short- and medium-term goals.

- Flexibility: Investors can invest or exit as per their convenience.

- Professional management: Managed by experienced fund managers.

Limitations of Open-Ended Funds

- Market-linked risks: NAV fluctuates with market movements.

- Expense ratio: Higher costs may eat into returns compared to passive options.

What is a Close-Ended Mutual Fund?

Close-ended mutual funds have a set maturity period, typically ranging from 3 to 7 years. Investors can subscribe only during the New Fund Offer (NFO) period. After that, units are listed and traded on stock exchanges—similar to shares—at prices that may differ from the NAV.

Features of Closed-End Funds

- Units can be bought only during the NFO period.

- Traded on stock exchanges after listing.

- Fixed maturity period ensures discipline in investing.

Benefits of Closed-End Funds

- Disciplined long-term investing: Investors stay invested for the full tenure.

- Potential discounts/premiums: Units may trade above or below NAV on the exchange.

- Professional management: Fund managers have stable capital to invest over the tenure.

Limitations of Closed-End Funds

- Less liquidity: Investors cannot redeem before maturity (except through exchange trades).

- Market price fluctuations: Returns depend on both NAV and market demand-supply.

Open-Ended vs Close-Ended Funds: Key Differences

When comparing open-ended and close-ended mutual funds, investors usually focus on liquidity, redemption flexibility, pricing, and suitability for different investment horizons. Below is a side-by-side look at the main differences in open vs close-ended funds:

| Aspect | Open-Ended Fund | Close-Ended Fund |

| Liquidity & Redemption Flexibility | Investors can buy or redeem units anytime at the fund’s NAV. | Units are locked until maturity; investors can only exit by selling on stock exchanges. |

| Entry/Exit Opportunities | Open for subscription and redemption throughout the year. | Only available for purchase during the New Fund Offer (NFO). After that, units trade on exchanges. |

| Pricing | Based on the daily Net Asset Value (NAV) declared by the fund house. | Market-driven; can trade at a discount or premium to NAV depending on demand-supply. |

| Investment Horizon Suitability | Suitable for short-, medium-, and long-term investors due to flexibility. | More suited for investors with a fixed horizon and a willingness to stay invested till maturity. |

In short, the close-ended funds vs open-end funds debate comes down to flexibility vs discipline. An open-end mutual fund vs a close-ended choice depends on whether you prefer liquidity and convenience or are comfortable with a fixed lock-in period.

Which Fund Type is Better for You?

Choosing between open-ended and close-ended funds depends on your financial objectives, risk appetite, and how much flexibility you need in your investments. Both have their place in a portfolio, but they serve different types of investors.

When to Choose Open-Ended Funds

- Ideal for short- or medium-term goals where you may need liquidity.

- Suited for investors who want the flexibility to enter or exit at any time.

- Good option if you prefer NAV-based pricing and want professional management without worrying about trading at a discount or premium.

When to Choose Close-Ended Funds

- More suitable for long-term goals where discipline is important.

- Appeals to investors who are comfortable locking in their money until maturity.

- Can help avoid frequent entry/exit and focus on staying invested for the entire fund tenure.

Factors to Consider Before Deciding

- Risk Appetite: Conservative investors may prefer open-ended funds for liquidity, while aggressive investors may use close-ended funds to ride out volatility.

- Time Horizon: Open-ended funds work across all horizons; while close-ended funds are better for specific, long-term commitments.

- Investment Style: If you like flexibility, open-ended is a natural fit. If you want structured, disciplined investing, a close-ended one can be a good choice.

Conclusion

Open-ended and close-ended mutual funds serve different purposes. Open-ended funds give you liquidity and flexibility, making them ideal if you want easy entry and exit. With Appreciate, you can now do Daily SIP at just ₹11 a day. You can start investing in these funds with minimal financial commitment and build your portfolio over time.

Close-ended funds, on the other hand, need commitment until maturity but can encourage disciplined long-term investing.

There’s no one-size-fits-all answer, and what works best depends on your financial goals, risk appetite, and time horizon. Before you decide, take time to research the fund’s structure and, if needed, consult a SEBI-registered financial advisor to align your options with your long-term plans.

Did you know?

US ETFs (Exchange Traded Funds) offer a great opportunity for investors looking to diversify their portfolio with international exposure. With Appreciate, you can now access these ETFs easily, benefiting from the growth of US-based companies. Investing in US ETFs can be a strategic way to tap into global markets, adding stability and potential growth to your investment strategy.

FAQs

What is the main difference between an open-ended and a close-ended mutual fund?

The main difference between a close-ended and an open-end fund lies in liquidity. An open-ended fund allows investors to enter or exit anytime at the prevailing NAV. A close-ended mutual fund, on the other hand, has a fixed maturity period and can only be bought during the NFO (New Fund Offer). After that, units are tradable on the stock exchange.

Which is better for beginners: open-ended or close-ended funds?

For beginners, open-ended mutual funds are usually better since they provide higher liquidity, flexibility, and SIP options. In contrast, close-ended funds are less flexible and more suited to investors with a defined investment horizon.

Can I redeem close-ended mutual funds before maturity?

No, you cannot directly redeem close-ended funds before maturity. However, since they are listed on stock exchanges, you may sell them in the secondary market. The price here may differ from the NAV due to demand-supply factors.

Why do close-ended funds trade at a discount or a premium?

Close-ended funds trade at a discount or premium because their market price depends on demand and supply, not just NAV. For instance, if demand is low, the fund may trade at a discount; if demand is high, it may trade at a premium. This is one of the key differences between open-end vs close-ended funds.

Are open-ended funds safer than close-ended funds?

Safety in open and closed-end funds doesn’t depend on the structure itself but on the underlying assets. However, investors generally perceive open-ended funds as safer due to their liquidity and transparency compared to close-ended funds, which lock your money for a fixed tenure.

Disclaimer

The information provided in this article is for educational and informational purposes only. It should not be considered as financial or investment advice. Investing in stocks involves risk, and it is important to conduct your research and consult with a qualified financial advisor before making any investment decisions. The author and publisher are not responsible for any financial losses or gains that may result from the use of this information.