Quick Summary

The Buffett Indicator (Market Cap-to-GDP) is the total value of all stocks in a stock market compared against a country’s economic output, which is a form of determining over or undervaluation. Popularized by Warren Buffett, it suggests caution when it is over the historic long-term average, such as the United States at 160% and India at 133%. This is a useful long-term indicator of potential bubbles, though it does not capture global revenues or even interest rate impact. Best used with other metrics for a diversified investment strategy.

Read along to know more!

What is the Buffett Indicator?

The Buffett Indicator, or the Market cap-to-GDP ratio, is a metric used to assess whether the stock market is overvalued or undervalued. It measures the total market capitalization of publicly traded companies against a country’s gross domestic product (GDP), reflecting the relationship between the stock market and the overall economy.

How Is It Calculated?

The formula for the Buffett Indicator is:

Market Cap / GDP × 100

Here,

- Market Cap: The total value of all publicly listed companies. In the U.S., this is often sourced from the Wilshire 5000 Index.

- GDP: The total economic output of a country, typically obtained from official agencies like the Bureau of Economic Analysis (BEA) in the U.S.

For example, if the total market cap is $30 trillion and the GDP is $20 trillion, the Buffett Indicator would be:

30 / 20 × 100 = 150%, indicating potential overvaluation.

Warren Buffett’s Endorsement

Warren Buffett, a renowned investor, has referred to this metric as “probably the best single measure of where valuations stand at any given moment.” However, he has also acknowledged its limitations in a globalized economy where multinational companies generate substantial revenues outside their home countries.

Historical Context and Significance

The Buffett Indicator has been a staple in market analysis for decades. It offers a straightforward method for evaluating whether markets are overvalued or undervalued. Comparing the market cap (total value of publicly traded companies) to a country’s GDP (economic output) provides insights into long-term trends and economic alignment.

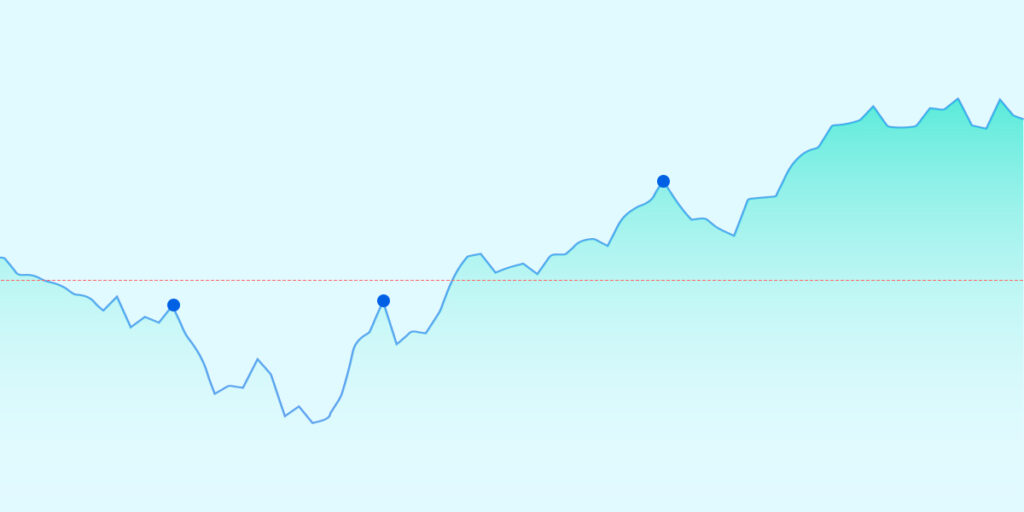

Historical Trends and Deviations

Historically, the market cap-to-GDP ratio in the U.S. has averaged around 80% to 100%. Significant deviations from this range often correspond with periods of market instability.

- Dot-com Bubble (2000): The ratio surged to over 140%, indicating extreme overvaluation, followed by a market crash.

- 2008 Financial Crisis: The ratio peaked before the downturn, highlighting a disconnection between market valuations and economic output.

Major Market Events and Insights

The Buffett Indicator has proven valuable during pivotal market events:

- Dot-com Bubble: Showcased the risks of overvaluation as tech stocks inflated market caps beyond sustainable levels.

- 2008 Crash: Warned of excesses in the housing and financial sectors as the ratio climbed before the economic downturn.

- Post-Pandemic Rally: In recent years, global markets, including the U.S. and India, have seen elevated ratios, reflecting market optimism and raising concerns about potential bubbles.

Predicting Market Valuations

The indicator remains relevant for identifying overvalued or undervalued markets:

- Ratios exceeding historical norms suggest overvaluation, indicating caution for investors.

- Lower-than-average ratios often signal undervalued opportunities, especially during market recoveries.

Why the Buffett Indicator Matters

The Buffett Indicator is a crucial tool in assessing stock market valuation by linking the total market cap (value of all publicly traded companies) with a country’s GDP (total economic output). Here’s why this is important:

Theoretical Foundation

- Market Cap and GDP Link: A higher market cap relative to GDP suggests that the stock market is growing faster than the economy, which may indicate overvaluation.

- Historical Averages: Ratios exceeding historical norms often signal that markets may enter a speculative phase.

- For instance, the Buffett Indicator frequently monitors the US stock market valuation, as its ratio consistently hovers around or exceeds 150%.

Identifying Market Bubbles

When the market valuation rises well above sustainable economic levels, it may indicate a bubble. The Buffett Indicator provides an early warning system for investors to evaluate whether the market is overheated.

For example, the U.S. ratio spiked before the 2008 financial crisis, highlighting excessive valuations.

Assessing Investment Risks

By comparing the Buffett Indicator across regions and historical trends, you can identify potential investment risks and opportunities:

- In an overheated market, consider diversifying into undervalued regions or sectors.

- Use the indicator with other metrics like P/E ratios for a more comprehensive risk analysis.

For both the US stock market valuation and emerging economies, the Buffett Indicator remains reliable in gauging whether markets are in sync with economic realities, helping investors make informed decisions.

Limitations of the Buffett Indicator

While the Buffett Indicator is a widely recognized tool for assessing stock market valuation, it has several limitations that investors should consider:

Interest Rate Effects

Low or high interest rates can distort the market cap-to-GDP ratio. For example, low rates often inflate market valuations as borrowing becomes cheaper, while high rates may depress valuations regardless of economic growth.

Impact of Globalisation

Global companies often generate significant revenues from international markets, which are not reflected in domestic GDP figures. This mismatch can make the Buffett Indicator less effective for markets with many multinational corporations, such as the Indian stock market valuation.

Sector-Specific Growth

The market capitalization to GDP ratio may not account for sector-specific dynamics. For instance, rapid growth in technology or emerging industries can lead to higher valuations than slower-growing sectors like manufacturing, skewing the indicator’s interpretation.

Comparison with Other Metrics

The Buffett Indicator works best alongside other valuation metrics, such as the price-to-earnings (P/E) ratio, dividend yields, or book value. However, overreliance on the indicator might oversimplify complex market dynamics.

Global Perspective: Buffett Indicator for Other Markets

The Buffett Indicator offers valuable insights into global stock market valuation, but its interpretation varies across regions due to differences in market structures and economic development.

India: Market Cap to GDP Ratio Trends

India’s market cap to GDP ratio currently stands at 1.33x, signaling an overvalued market. This indicates that the stock market has outpaced economic growth, potentially creating risks for investors if the economy cannot sustain such inflated values.

- The ratio was 76% in 2019, but it had risen to 125% as of September 2024, reflecting rapid market growth despite economic challenges.

- India’s growth of 1.65x over the last five years surpasses that of major economies like China (1.1x), South Korea (1.23x), and Japan (1.29x).

Challenges in Developing vs. Developed Economies

In developing markets like India, the Buffett Indicator may show higher values due to structural factors:

- Rapidly expanding industries, especially technology and services.

- A smaller GDP base compared to developed economies.

In contrast, developed markets like the U.S. often maintain high ratios (e.g., 160%) because of their economic strength and global influence.

Comparative Trends in Major Economies

- U.S. Market: Approximately 160%, reflecting strong corporate earnings and global demand.

- China: Around 60%, indicating undervaluation and opportunities for value investing.

- India: High growth but potentially overheated at 125%.

- Indonesia South Korea: Moderate growth with ratios of 1.28x and 1.23x, respectively.

Using the Buffett Indicator for Investment Decisions

The Buffett Indicator offers practical insights into stock market valuation, making it a useful tool for investors to understand long-term market trends. Here’s how you can apply it effectively:

Assessing Long-Term Market Trends

The Buffett Indicator helps you gauge whether the market is overvalued (undervalued) by comparing the market capitalisation to GDP. A high ratio suggests caution, while a low ratio may signal potential opportunities for long-term investment.

Comparing Different Markets for Global Investors

For global investors, the Buffett Indicator can compare valuations across countries. For instance, you can identify regions with better growth potential by analysing the Warren Buffett stock market metric in developed economies versus emerging markets.

Combining with Other Valuation Tools

Relying solely on the Buffett Indicator might not capture the complete picture. To develop a more balanced investment strategy, pair it with other metrics, such as the price-to-earnings (P/E) ratio, interest rate trends, and market sentiment indicators.

The Bottom Line

The Buffett Indicator is a valuable tool for assessing stock market valuation by comparing the market cap to GDP. Its simplicity and historical reliability make it an essential metric for identifying potential overvaluation or undervaluation trends. However, it has limitations, such as ignoring global revenues, sector-specific dynamics, and interest rate impacts, making it less reliable as a standalone predictor.

So, for a well-rounded investment strategy, use the Buffett Indicator alongside other market sentiment indicators and valuation metrics. Also, with Appreciate, you gain access to expert insights into market trends, including tools like the Buffett Indicator tailored to your goals.

Frequently Asked Questions (FAQs)

What is the Buffett Indicator?

The Buffett Indicator, known as the market cap-to-GDP ratio, compares a country’s total stock market valuation to its GDP. It helps assess whether the market is overvalued or undervalued.

How does the Buffett Indicator work?

The indicator divides the total market cap of a stock market by the GDP. A ratio above 100% suggests overvaluation, while below 100% indicates undervaluation.

What does a high Buffett Indicator value mean?

A high Buffett Indicator value signals market overvaluation, meaning stock prices are significantly higher than the economy’s productive output.

Is the Buffett Indicator reliable for global markets?

While useful, it has limitations. The Buffett Indicator works best in countries with stable economies. For global markets, varying GDP structures and exchange rates can distort results.

How does the Buffett Indicator apply to India?

The Buffett Indicator India compares the total market cap of the Indian stock market to the country’s GDP. A rising market cap-to-GDP ratio reflects growing investor optimism about the Indian stock market’s valuation.

What are the limitations of the Buffett Indicator?

It does not account for the global revenue of multinational companies, changes in interest rates, or sector-specific dynamics, which can skew its relevance.

Can the Buffett Indicator predict stock market crashes?

The indicator highlights overvaluation risks but cannot predict exact market crashes. It is a broad market valuation tool, not a timing mechanism.

What are alternative valuation metrics?

Other metrics include the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield, which provide additional perspectives on stock market valuation.

Why is the Buffett Indicator high in 2025?

In 2025, factors like increased market cap to GDP due to a tech boom, robust FDI inflows, and strong corporate profits will drive a higher Warren Buffett Indicator in India and globally. However, this also raises concerns about potential overvaluation.

Disclaimer: Securities market investments are subject to market risks. Read all related documents carefully before investing. The securities quoted are exemplary and not recommendatory.