Understanding the stock market can feel like trying to solve a puzzle with many pieces. One important piece of this puzzle is the Current Market Price (CMP) of a stock. The CMP is the price at which a stock is currently being bought and sold. It’s a key number that tells investors how much the market values a company at any given moment.

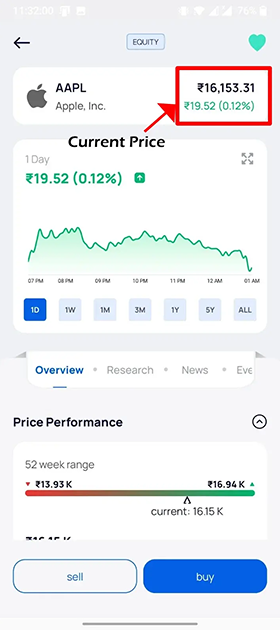

For example, if you visit our Apple share price page, the number you’ll see at the top is the current market price of 1 share of Apple.

Knowing the CMP is crucial because it helps investors decide whether to buy, sell, or hold a stock. It reflects the latest information and sentiment about a company’s worth, influenced by factors like company performance, economic conditions, and market trends. Knowing and understanding the CMP will also help you diversify your portfolio and optimise your returns.

For example, when doing your analysis, you might find that many Indian companies overvalue the current market price. On the contrary, many US stocks are available at much better valuations. So, instead of investing in Indian stocks, consider investing in US stocks. In case you’re wondering, Indians can invest in US stocks).

CMP is an essential metric in the stock market for several reasons.

- Real-Time Valuation: CMP shows a stock’s exact price at the moment. It helps investors and traders decide the best time to buy or sell.

- Market Sentiment: CMP reflects how people currently feel about a stock. If the price is high, it means many people have been buying it recently. Hence, the sentiment has been bullish. If the price is low, it indicates selling pressure and a bearish sentiment. It can help predict future price movements.

- Trends and Patterns: Traders look at the CMP to find trends and patterns. For example, when the price rises steadily, it might keep increasing. When it’s been falling, it might keep going down. Thus, they can help make trading decisions.

- Financial Health: CMP helps ascertain how a company’s financial performance affects its stock price. For instance, if a company reports good profits, its CMP might go up. If it reports losses, the CMP might go down.

- Trading Strategies: Just about every trading strategy you use will rely on the current market price (at least if you know what you’re doing). Any type of order you place will also depend on the current market price. For example, to manage your risk, you will use a stop-loss order, which will trigger the square off of your position if the current market price crosses the price set as the stop loss. You will place limit orders so that the current market price when you buy or sell makes the deal better. Market orders buy or sell immediately at the current CMP.

Evolution of CMP in Stock Markets

Back when people used to trade manually on the actual trading floors of stock exchanges, CMP was based on the last recorded sale price. However, that system had its problems, such as the risk of fake or lost share certificates, so there was a need for a better system.

As technology advanced, electronic trading platforms and computerised systems were introduced. They made it possible to update CMP continuously, showing real-time stock prices. This quick pricing information helps investors and traders make smarter decisions.

Over the years, with increased participation in the stock market, many markets have become much more volatile than they were when electronic access was not available. In this chaos, knowing the current price of a stock is important for several reasons today:

- It helps investors make sense of the price movements of various stocks.

- It enables the investors to gauge whether a stock might be overvalued or undervalued through financial ratios like price-earnings and price-book value.

- CMP helps track market trends effectively. Looking at the current price of a stock in relation to important price levels (for example, moving averages and other technical indicators) helps understand which way the stock price is trending.

Current Market Price vs LTP (Last Traded Price)

These terms are often used interchangeably by traders. However, they aren’t the same. CMP is the real-time price at which a stock is currently being traded. It changes constantly as new buy and sell orders come in. On the other hand, LTP is the price at which the last trade was made. It doesn’t change until another trade happens. You must know and understand both terms and learn the differences between them.

| Feature | Current Market Price (CMP) | Last Traded Price (LTP) |

| Definition | The current price at which a stock is being traded | The price at which the last trade was executed |

| Real-Time Indicator | Yes, updates continuously with market changes | No, updates when a new trade occurs |

| Purpose | Provides a snapshot of the stock’s current market value | Shows the price of the most recent transaction |

| Update Frequency | Continuously during market hours | Only with each new trade |

| Use in Trading | Helps make immediate trading decisions based on real-time data | Offers historical reference for past transactions |

| Significance | Reflects current market conditions and sentiment | Provides context on the latest executed price |

How do you check the Current Market Price of any stock?

You can use various resources to find the Current Market Price.

Stock Market Apps

Mobile apps like Appreciate give real-time stock prices, let you track CMP conveniently on your phone and keep you updated wherever you are.

Stock Market Websites

Check out sites like Yahoo Finance, Google Finance, Bloomberg, CNBC, or Investing.com. They give you real-time stock prices and let you search for specific stocks to see their current market price.

Check Financial News Channels

Channels like CNBC, Bloomberg TV, and ET Now report live stock prices and market updates, helping you stay informed about CMP.

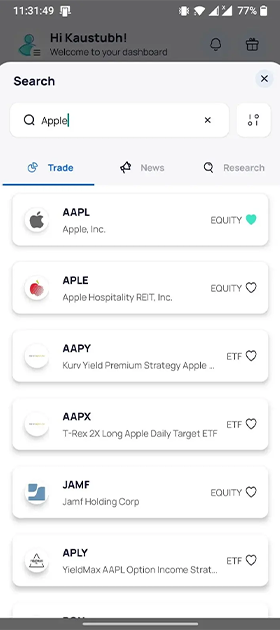

How to Monitor CMP Using Appreciate App

Here’s a simple guide on how to track the Current Market Price (CMP) of stocks using Appreciate app:

- Download the App: Get the Appreciate app from the Google Play Store.

- Sign Up: Create an account and finish the verification process.

- Find Your Stock: Look for the stock you want to track by typing its name or ticker symbol.

- Check the CMP: Once you find the stock, the app will show you its CMP. You’ll also see other important details like the stock’s description, price, and any price changes.

Knowing the current market price of the instrument you wish to invest in is vital regardless of which market you trade or invest in.

You can download the app here.

FAQs About CMP in the Stock Market

What does CMP mean in trading?

CMP stands for Current Market Price. It’s the price at which a stock is currently trading in the market.

Why is CMP important for investors?

CMP allows investors to know the current value of a stock. This helps them decide if it’s a good time to buy or sell and keep track of how well their investments are performing.

How does CMP affect investment decisions?

CMP impacts investment decisions in many ways. It guides investors in deciding when to buy or sell stocks, plan long-term strategies, and understand market sentiment.

How to use CMP in trading?

CMP is used in trading in three simple ways:

Market orders: Buying or selling at the current market price.

Stop loss orders: Selling to limit losses if the price falls below a certain level.

Limit orders: Buying below or selling above the CMP at a specified price

What is the difference between CMP and traded price?

The CMP is the price you see right now for buying or selling a stock, while the traded price is the price at which the last trade occurred.

What is the difference between CMP and LTP?

CMP is the current price of a stock for trading, while LTP is the last traded price. While CMP changes with market demand and supply, LTP only changes with trade. CMP and LTP may match in fast-moving markets, but they can differ in volatile or illiquid markets.

Conclusion

CMP plays a crucial role in the stock market. It helps you make smart investment choices and manage risk. If you’re into the Indian and US stock markets, check out the Appreciate App.

It gives you real-time CMP data, helps you track your investments, and makes smart decisions. With zero subscription fees, special forex rates, and free withdrawals, the app simplifies your investing experience.

So, what are you waiting for? Download the Appreciate App today and start investing now.