Quick Summary:

- BTST (Buy Today, Sell Tomorrow) trading refers to the process of buying a share one day and then selling it the next day, in order to make a profit on the stock’s variation during that 24-hour period, although BTST trades have overnight risk.

- The T+1 settlement cycle in India permits BTST traders to sell the share before they actually own it in their demat account, instead, realizing on a net basis to settle the trades.

- Some major ways to trade using BTST is to buy the day before any major event happens, focusing on stocks with high liquidity, setting stop-loss and target prices – as well as applying technical analysis (like candlestick patterns).

- BTST investments can show profit very quickly with potential upside, but has a downside with risk as there are major market, margin and time liabilities involved with overnight risk to capitalize.

- To be successful with BTST requires good market knowledge, conducting the research, properly setting entry and exit points, ensuring the liquidity of your potential stock buy, and maintaining discipline, while remembering to constantly monitor the market conditions

Also Read: What is trading in the stock market?

However, as with any trading strategy, BTST also has its set of risks and drawbacks, so it is important that you understand the mechanics and best practices before diving in. This article should help you learn all you need to know.

1. What is BTST trading?

BTST is a trading approach that involves buying some shares of a company on a particular day (say, today) and selling them the next trading day (i.e. tomorrow).

Imagine you’re a seasoned trader who is well-versed in analysing and spotting market trends, and you have an eye for detail. You spot a stock that’s momentarily undervalued due to temporary market jitters—perhaps driven by an overreaction to recent news. You firmly believe that by tomorrow, once the market digests the information, the stock is likely to rebound. With BTST trading, you can capitalise on this brief window of opportunity by buying the stock today and selling it the next day for a potential profit.

The crucial thing to note about BTST trading is that the shares you buy are sold before they are ever credited to your demat account. Instead of taking delivery of the shares you buy, the buy and sell trades are settled on a ‘net basis’, and the resulting profit or loss is reflected in your trading account.

Let’s get a better understanding of how BTST trading works.

2. How does BTST trading work?

In early 2023, the Securities and Exchange Board of India (SEBI) began implementing a T+1 settlement cycle in the country for share delivery, replacing the T+2 settlement cycle that was previously followed. This means that trades are now settled within 24 hours. For instance, if you buy shares of company A on Monday at 2:00 pm, they will be credited to your demat account by 2:00 pm on Tuesday.

Now, if you’re following a BTST approach to trading, then this means that you will sell the shares you bought before the buy transaction is reflected in your account. Let’s understand this with the help of an example.

In this trade, you never took delivery of the shares. Instead, the profit you made due to the price fluctuation, which works out to be ₹1,000, is credited to your trading account.

Why is this beneficial? Well, if the stock’s price rises overnight, you can lock in your gains the next day, without having to wait for the shares to officially settle. It’s a way to capitalise on short-term price movements without getting bogged down by the usual settlement delays. But remember, this strategy also means you’re exposed to overnight risks. Prices can drop just as quickly as they rise, so timing and market insight are crucial.

Let’s now look at the essential BTST trading strategies you need to know so that you can improve your chances of making a profit.

Best BTST trading strategies

Invest before major events

The stock market is volatile partly because share prices are impacted by a range of economic, political, and social events. You can benefit from this volatility by ensuring that you track such events and invest in specific companies before major events that are likely to have an effect on their share prices.

Picture this: a company is about to release its quarterly earnings report, and you’ve done your homework. You know that the market often overreacts to short-term news, creating opportunities for savvy traders like you. By buying shares before the announcement, you position yourself to benefit from any positive market reaction the next day. However, timing is everything. If you’re too early or too late, you could miss out on the opportunity or, worse, get caught on the wrong side of the trade.

Pick liquid stocks

Liquidity is the lifeblood of BTST trading. Liquidity will allow you to exit your position the next day without the risk of order slippage or a high impact cost (i.e. an unfavourable price for large orders). Without liquidity, you might find yourself stuck with a position you can’t exit because of a lack of interest, which can be disastrous in a fast-moving market.

You want to stick with stocks that have high trading volumes, high market capitalisation, and a tight bid-ask spread. These are the stocks that you can easily buy and sell without significantly affecting their price. Almost all large-cap stocks generally fall into this category, so if you are new to BTST, we’d highly recommend sticking to that category only.

Place a stop-loss and target price

Every good strategy includes a plan for when things don’t go as expected. It’s part of mitigating risk in the stock market. When conducting BTST trades, it’s helpful to place a stop-loss and target price in order to limit potential losses and manage risk. A stop-loss is a predetermined price at which you will automatically exit the trade in case the price moves against your expectations and your strategy fails.

Conversely, a target price is a predetermined price level at which you will automatically exit a trade and secure profits. Hence setting a target price allows you to book profits instead of potentially losing out on them in case of a price reversal.

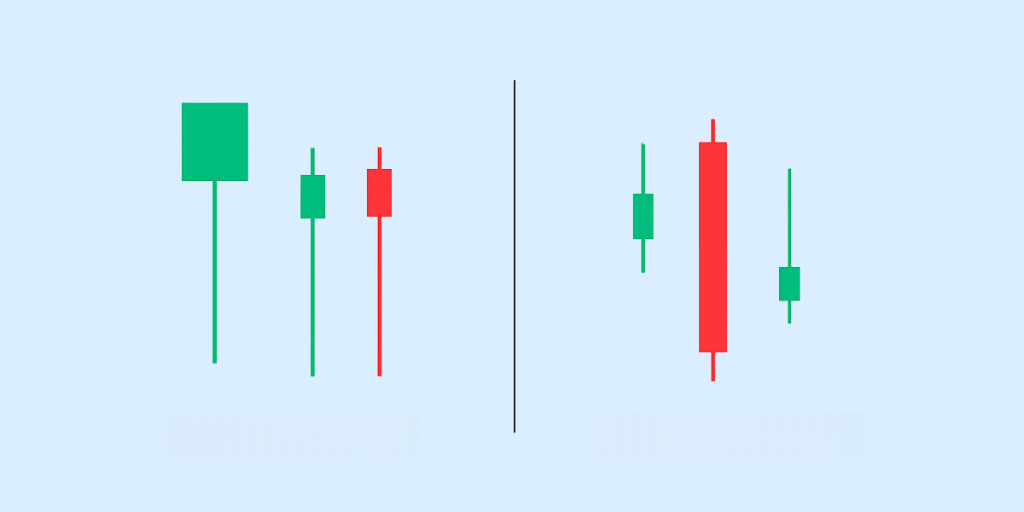

Analyse candlestick patterns

Technical analysis is a valuable tool in BTST trading, and candlestick patterns are one of the most telling indicators you can use. Since timing the market is crucial for this strategy to work, analysing candlestick charts is a good idea. These patterns provide a visual representation of market sentiment, showing you whether buyers or sellers are in control.

By using candlestick chart analysis in combination with market news, you can identify potential buying opportunities and come up with your BTST strategy.

Such an analysis will let you identify trends in the price movement, as well as potential price reversals or continuations.

Flexibility in Trading

The market is unpredictable, and one of the most important traits for a BTST trader is flexibility. You need to be ready to adjust your strategy on the go as new information comes in. This could mean having to sell earlier than you had initially planned, or even holding out for a longer period because the stock did not behave as you wanted it to behave.

Staying informed and being adaptable can make all the difference when you’re working within such short timeframes. Flexibility ensures that you’re not just reacting to the market but also anticipating its moves. Also, to be able to have this flexibility, it is crucial that you only trade with money that you do not need immediately, so that you can wait out these periods of adverse movements.

What are the benefits of BTST trading?

There are several benefits of BTST trading for short-term traders. These include:

Potential for quick profits

One of the biggest draws of BTST trading is the potential to realise quick profits. If you’ve timed your trades well, you can capitalise on overnight price movements and lock in gains the next day. Compared with longer-term strategies, where you might have to wait weeks or months to see returns, BTST offers the possibility of turning a profit within just 24 hours.

But to be able to make the most of this strategy, you need to be quick and decisive in taking action when the opportunity presents itself.

Benefitting from overnight news

Stock prices fluctuate in response to significant news, economic events, corporate announcements, and more. If some major piece of news is expected to come out overnight, you can use BTST trading to try to capitalise on it by buying the relevant stock in advance and selling it once the news is out. Examples of major news could include surprises in earnings reports, regulatory changes that could significantly benefit companies in a specific industry, or global events that impact major economies.

Flexibility in trading

BTST in trading offers flexibility to traders through increased trading frequency and allows you to make better use of your capital. It allows you to adopt a more active approach, and you can recycle your capital more frequently since you do not have to wait to take delivery of the shares. This way, you can use roughly the same amount of capital for multiple trades over several days, thus potentially earning more profits for a given capital amount.

Now that you know all the benefits BTST trading has to offer, you also need to be aware of the risks of this strategy. Understanding these risks can help you make more informed decisions and protect your investments.

Risks Associated with BTST Trading

While BTST trading offers the allure of quick profits, it’s important to be aware of the risks that come with it.

Significant Market Risk

BTST trading involves holding stocks overnight, which exposes you to the risk of unexpected market movements. The market can be volatile, and prices can swing significantly based on news that breaks after the market closes. For example, if a company announces poor earnings after you’ve bought its stock, the price could drop sharply when the market opens the next day. This overnight risk is one of the main challenges of BTST trading, and it’s something you need to be prepared for.

Margin and Liquidity Risks

Since you cannot use margin on BTST trades, you need to put up a significant amount of capital to make returns that are worthwhile. This is very different from the margin trading that intraday traders often do with a view to amplifying their potential gains.

Liquidity is also crucial in BTST trading (as already mentioned above). If a stock isn’t liquid enough, you might struggle to sell it at your desired price, leading to potential losses or missed opportunities.

Timing and Precision Risks

Timing is everything in BTST trading, and the success of your trade often hinges on making the right moves at the right time. A delay of even a few minutes in placing an order, or any mistake made when placing the order – which happens more often than you would think, because you need to enter the order quickly – can mean the difference between a profit and a loss. This risk is compounded by the unpredictability of the market—unexpected news, economic reports, or even rumours can cause prices to move in ways you didn’t anticipate. To manage timing risks, it’s important to stay informed and act quickly when opportunities arise.

Limited Time for Diligent Analysis

Since BTST trades are often driven by short-term market movements, you may not have the luxury of thoroughly analysing a stock or waiting for additional information before making a trade. This can increase the risk of making decisions based on incomplete data or gut instinct rather than solid analysis. To mitigate this risk, it’s crucial to have a clearly defined strategy and to rely only on sources of information that you trust.

Tips for successful BTST trading

Since BTST trading involves a relatively higher level of risk due to overnight exposure and a short holding period, it’s essential to minimise risk and have a clear BTST trading strategy in place. Here are some tips that can help:

Research and analysis

Before you use the BTST approach to trade a certain company’s stock, it’s important to thoroughly research the company and the industry it functions in to understand what events are liable to impact its stock price. By keeping track of industry trends, earnings reports, and changes in regulatory frameworks, you will improve your odds of executing BTST trades successfully.

Set entry and exit points

For trading strategies like BTST, it’s crucial to set entry and exit points, and to be clear about the price levels at which you want to execute your trades. As discussed above, setting stop-losses and target prices help reduce your risk.

Liquidity considerations

Make sure to choose liquid stocks with high trading volumes for BTST trades. Liquid stocks make it easier to enter and exit positions without the risk of significant price slippage. Smooth execution of trades is essential in BTST trading, given the brief holding period.

Use technical analysis

Identifying potential entry and exit points and understanding price trends is crucial in BTST trading. Hence, make use of technical analysis tools like candlestick charts to make informed decisions.

Stay disciplined

When undertaking BTST trading, it’s important to stick to the trading plan that you have come up with using technical analysis. Avoid changing your strategy based on market noise, and desist from making impulsive decisions based on emotions.

Constant monitoring

BTST trading requires you to constantly monitor the market so that you can promptly respond to short-term trends. This is also why it’s essential to monitor overnight news, since such news might determine whether or not you sell a certain stock the next day.

BTST vs Intraday Trading

Understanding how BTST trading stacks up against intraday trading can help you decide which strategy aligns best with your trading style and goals. While both strategies focus on short-term gains, they have distinct differences in execution, risk, and profit potential.

Holding Period

The most obvious difference between BTST and intraday trading is the holding period. In intraday trading, you buy and sell shares within the same trading day, closing all positions before the market closes. This means you’re not exposed to overnight risks, but it also limits the potential for gains that might occur after hours.

On the other hand, BTST trading involves holding stocks overnight, giving you the chance to benefit from price movements that occur between the market’s close and the next day’s opening. Of course, it also exposes you to overnight risks (see next point).

Risks Involved

Both BTST and intraday trading carry their own sets of risks. With intraday trading, you’re primarily dealing with intra-day volatility—prices can swing wildly within the day, driven by market news or trader sentiment. However, since you don’t hold positions overnight, you avoid the risks associated with after-hours market movements.

In contrast, BTST trading exposes you to overnight risks, such as unexpected news or global events that could significantly impact stock prices when the market reopens.

Profit Potential

The profit potential in both BTST and intraday trading depends heavily on market conditions and timing. Intraday trading allows you to capitalise on short-term price movements throughout the day, making it possible to execute multiple trades and accumulate gains. However, the quick in-and-out nature of intraday trading can also mean smaller individual profits. BTST trading, while less frequent, allows you to potentially capture larger price movements that occur overnight. If you correctly predict a positive overnight swing, BTST can offer substantial profits from a single trade.

Focus and Strategy

BTST and intraday trading require different approaches and mindsets. Intraday trading demands a high level of focus and quick decision-making, as you need to respond rapidly to market changes within the day. It’s a strategy suited for traders who thrive on fast-paced action and are comfortable with making multiple trades in a short period. BTST trading, while still requiring attentiveness, allows for slightly more breathing room. It’s ideal for traders who prefer to analyse market trends, news, and other factors over a slightly longer horizon, albeit still within a very short timeframe.

What types of traders use the BTST trading strategy?

The BTST trading strategy is typically used by traders who want to capitalise on short-term stock market fluctuations. Such traders not only tend to have a certain level of stock market expertise and experience, but also a higher risk appetite. This is because BTST trading carries a higher level of risk, given the short holding period.

Usually, traders who use BTST trading strategies also have a strong understanding of risk management and closely track the market. Hence, it’s typically experienced intraday traders and momentum traders who use BTST trading.

This strategy is not used by investors who have a long-term investment horizon and are looking for long-term wealth building. Such investors typically follow the buy-and-hold strategy to benefit from capital appreciation over extended periods.

Whether you want to undertake short-term trading and use strategies like BTST trading or build an investment portfolio to meet long-term financial goals, Appreciate is the investment platform for you. With AI-based recommendations, seamless access to the US stock market, and features like fractional investing, Appreciate helps maximise returns and minimise risks. Download the app today!

Conclusion

BTST trading offers a unique opportunity for traders who are looking to capitalize on short-term market movements. By buying today and selling tomorrow, you can take advantage of overnight price changes without committing to a long-term position. However, as with any trading strategy, BTST comes with its own set of challenges and risks. Success in BTST trading requires careful planning, thorough research, and disciplined execution. It’s essential to understand the risks involved, particularly the exposure to overnight market volatility, and to use strategies like technical analysis and liquidity management to mitigate these risks.

Frequently asked questions

Is BTST trading safe?

Compared to traditional long-term investing, BTST trading carries a higher risk. This is because of its short holding period, exposure to overnight risk, and the need to have a deep understanding of the market. Hence, only experienced traders who can constantly monitor the market and make use of technical analysis should consider BTST trading.

Can I sell BTST shares?

Yes, you can sell BTST shares. In BTST trading, you buy shares on a specific trading day (say, today) and sell them on the next trading day (i.e. tomorrow).

Is BTST in trading profitable?

Yes, BTST in trading can be profitable for traders who can capitalise on short-term market movements and manage risk well. However, like with all other trading and investing strategies, profits are not guaranteed in BTST trading, and it does come with a higher level of risk.

Which stock is best for BTST?

Liquid stocks that have high trading volumes and stocks with frequent price movements are often preferred by traders for BTST. That’s because liquid stocks allow for the smooth and timely execution of orders, and stocks with higher price volatility offer the potential to earn quick profits.

What are the BTST fees?

BTST fees typically include brokerage charges, transaction charges, and other standard charges applicable for trades. The exact amount of the BTST fees will depend on the brokerage or investment platform you use.

Is BTST eligible for dividends?

No, BTST trades are not eligible for dividends. Since you sell the shares the very next day in BTST trading, your holding period will not allow you to qualify for receiving dividends.

What is the formula for BTST in trading?

There is no specific formula for BTST trading. The only thing you need to do is sell the shares during market hours on the next trading day before they get credited to your demat account.

Related Articles

What is CMP in the Stock Market?