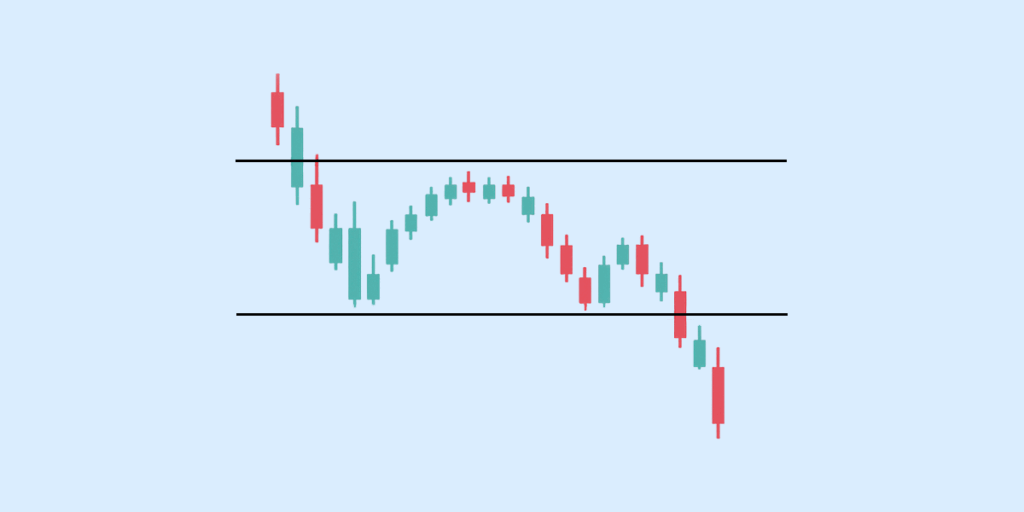

When markets shift from optimism to hesitation, certain patterns begin to reflect that change—one of the most telling among them is the inverted cup and handle pattern. It doesn’t just signal a price drop; it reveals a breakdown in market confidence.

The pattern shows up after a steady uptrend, but instead of continuing higher, the price curves downward, hesitates, and then sharply drops—often catching unaware traders on the wrong side. Continue reading to know more.

Understanding the Inverted Cup Pattern

The inverted cup pattern is a key component of the inverted cup and handle pattern, signalling a potential shift from bullish to bearish momentum. Here’s how it forms and what each phase reveals:

Inverted Cup Pattern Formation and Psychology

The inverted cup pattern forms after an uptrend. Price gradually curves downward, creating an upside-down “U” shape. This reflects a slow loss of bullish strength and growing seller control. The rounded top suggests that buyers are no longer confident, and selling pressure is increasing, often driven by profit booking or weakening fundamentals.

Volume Analysis During the Pattern

Volume typically starts high during the uptrend, then gradually declines as the curve forms. This drop in volume shows a lack of buyer conviction. Toward the end of the inverted cup, volume may stay low or spike briefly as sellers begin to dominate. A volume surge on the breakdown confirms that bearish sentiment is taking over.

How Does Price Behave During Each Phase

- Early phase: Price rises, but gains slow down.

- Mid-phase: Price starts turning downward in a rounded fashion.

- Late phase: Price stabilises at a horizontal support level, setting the stage for a small handle or minor retracement.

- Breakdown: Once support breaks, price typically falls sharply, especially if accompanied by high volume.

Inverted Cup and Handle vs Inverse Cup and Handle

The inverted cup and handle and inverse cup and handle refer to the same bearish chart pattern. There is no difference in meaning—both terms describe a reversal formation where a rounded top is followed by a small upward retracement (the handle), leading to a breakdown.

The distinction is purely semantic:

- “Inverted cup and handle pattern” is more widely used in educational material and charting software.

- “Inverse cup and handle” is also common, especially in trading communities and forums.

Both terms are accepted and understood among traders, so that you can use them interchangeably without confusion.

How to Trade the Inverted Cup and Handle Pattern

To trade the inverted cup and handle pattern, wait for the price to break below the support line (the bottom of the handle). This breakdown confirms bearish momentum. Your entry point should be just below the support level, after a retest or a strong bearish candle close.

For exits, consider two approaches:

- Partial exit at a key support or moving average level

- Full exit when the price hits the projected target (explained below)

Avoid entering during the handle formation—wait for clear confirmation of breakdown.

Setting stop-loss and target levels

- Stop-loss: Set your stop-loss slightly above the handle’s high. This protects you in case of a failed breakdown and bullish reversal.

- Target price: Measure the height of the inverted cup (from top to support), and subtract that distance from the breakdown point. This gives you a projected price target. For example, if the inverted cup is ₹50 high and the support is ₹200, your target would be ₹200 – ₹50 = ₹150.

Tools and Indicators That Support Pattern Confirmation

Use the following tools and indicators to validate the inverted cup and handle pattern:

- Volume analysis: Declining volume during the handle and spike during the breakdown adds conviction.

- Moving averages: Price staying below key moving averages (like the 50-day or 200-day) supports bearish momentum.

- Relative Strength Index (RSI): RSI moving below 50 or entering oversold territory can confirm a bearish bias.

- MACD: A bearish crossover (MACD line below signal line) around the breakdown strengthens the case.

Common Mistakes and False Signals

One common mistake is confusing the inverted cup and handle pattern with other rounded top formations or double tops. Without a clear handle and breakdown below support, it may not be a true inverse cup and handle. Always check that the pattern includes:

- A distinct, rounded top (inverted cup)

- A small upward retracement (handle)

- Horizontal or slightly upward sloping support

Failing to Wait for Confirmation

Traders often enter too early, before the breakdown below the handle support. This leads to false entries and avoidable losses. The inverted cup with handle pattern only confirms when price closes below support, ideally on strong volume. Jumping in early can expose you to sudden bullish reversals.

Importance of Volume and Trend Context

Volume plays a key role in confirming the inverse cup and handle. You should see:

- Falling volume during the handle

- Rising volume on the breakdown

Also, the pattern works best in the context of a prior uptrend, signalling a bearish reversal. If the market is already in a strong downtrend, the setup might not carry the same significance.

Conclusion

The inverted cup and handle pattern is a powerful bearish setup that signals a shift from strength to weakness in the market. You’ve seen how the pattern forms, the psychology behind it, and why waiting for confirmation, especially through a breakdown below support and volume spike, is critical before acting.

For traders, this pattern offers strong risk-reward setups — but only when combined with disciplined execution and context awareness. Don’t treat the inverse cup and handle as a shortcut to profits. Instead, use it as one part of your broader trading strategy, backed by analysis and risk control.

FAQs

What does the inverted cup and handle pattern indicate?

The inverted cup and handle pattern indicates a potential bearish reversal in a stock or asset’s price. It typically forms after an uptrend, suggesting that the upward momentum is weakening and a downward trend may follow. Traders interpret this pattern as a sign to look for short-selling opportunities or to exit long positions.

How can traders identify the inverse cup and handle pattern?

Traders can identify the inverse cup and handle pattern by looking for a rounded top resembling an upside-down “U” (the inverted cup), followed by a short-lived upward retracement or consolidation phase (the handle). Volume often decreases during the handle and may increase again during the breakdown below the support level. This pattern usually confirms once the price breaks down below the support after forming the handle.

Is the inverted cup and handle a bearish reversal pattern?

Yes, the inverted cup and handle is a bearish reversal pattern. It signals a shift from a previous uptrend to a downtrend, often indicating that sellers are gaining control. The confirmation comes when the price breaks below the handle’s support, ideally with increasing volume.

Can this pattern be applied to crypto markets?

Yes, the inverted cup and handle pattern can be applied to crypto markets. Like in traditional markets, this pattern in cryptocurrencies also suggests bearish momentum and is used by technical traders to anticipate price declines, especially in highly liquid coins. However, crypto volatility may lead to more false signals, so confirmation through volume and support breakdown is crucial.

What is the difference between a cup and handle and an inverted one?

The difference between a cup and handle and an inverted one lies in their shape and market signal. A cup and handle is a bullish continuation pattern, forming a “U” shape followed by a dip (the handle), indicating a potential upward breakout. The inverted cup and handle is its opposite—a bearish reversal pattern with an upside-down “U” and a short upward handle, signalling a potential price drop after a prior uptrend.

Disclaimer

The information provided in this article is for educational and informational purposes only. It should not be considered as financial or investment advice. Investing in stocks involves risk, and it is important to conduct your own research and consult with a qualified financial advisor before making any investment decisions. The author and publisher are not responsible for any financial losses or gains that may result from the use of this information.