Quick Summary:

Social trading is when investors (especially beginners) copy the strategies of seasoned traders. Some platforms provide tools that let investors observe and replicate expert market moves in real-time. There are different types of social trading, like Copy Trading, Mirror Trading, and Signals and Tips. It is important to understand inherent risks, thoroughly research the traders you might follow, and diversify your investments. To get started, you’d typically choose a platform, set up and fund an account, explore available traders, and then begin copying their trades.

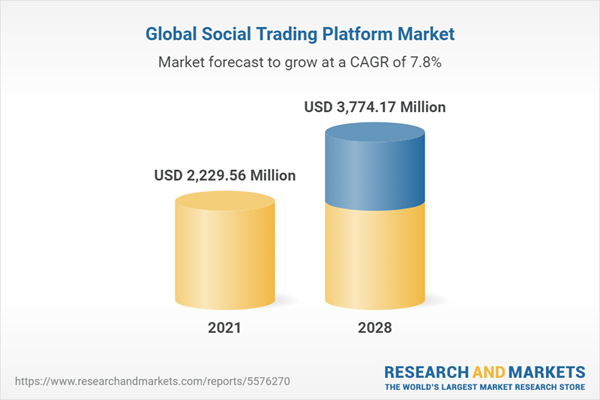

The social trading market, expected to reach $3.7 billion by 2028, is rapidly growing as more people use platforms to follow expert traders. New investors need to understand this expanding field to fully benefit from it.

What is Social Trading?

Social trading lets investors mimic the strategies of experienced traders through platforms that offer tools to observe and replicate their market moves and analyses.

When selecting a brokerage, it’s wise to examine their commission rates and fee structure closely.

Rates can differ, typically falling anywhere between 0% to 50% of the transaction amount. Most brokerages utilise an incremental system, where rates increase by chunks of 5% across pricing tiers.

How does Social Trading Work?

Social trading works by connecting inexperienced investors with seasoned traders through a platform. These platforms allow users to view the trading activities of experts in real-time. The idea is simple: by watching and copying what successful traders do, new investors can learn the ropes of trading while minimizing the risks associated with going it alone.

When you sign up on a social trading platform, you gain access to a dashboard where you can explore the profiles of different traders. Each trader’s profile typically displays their trading history, success rate, risk level, and other vital statistics. This information helps you decide which trader’s strategy you want to replicate.

Once you choose a trader to follow, the platform will automatically copy their trades into your account. This process can be fully automated or you can manually choose which trades to copy. The beauty of social trading is that it combines learning with potential earnings, making it a popular choice for beginners.

Types of Social Trading

Copy Trading

Copy Trading is a strategy where traders in the crypto market replicate the trades of successful crypto investors, hoping to mirror their success. A survey shows that 93% of futures and spot crypto traders have seen profits with this approach.

Mirror Trading

Mirror Trading is similar in that it involves copying another investor’s strategy. However, it doesn’t always guarantee success; in fact, many participants often rely on luck, as evidenced by a high failure rate.

Signals and Tips

Signals and Tips involve following alerts from experienced investors on the trading platform. Before adopting a tip, it’s vital to review the tipster’s performance statistics, specifically their success rate in reaching profit targets and the average gains at each target.

Copy Trading and Mirror Trading are more passive, whereas Signals and Tips require active decision-making based on provided information.

What You Should Know Before You Start Social Trading?

Before you dive into social trading, it’s essential to be aware of certain key factors. First, understand that while social trading can be a great way to learn, it also involves risks. Not all trades are successful, even those made by experienced traders. Therefore, it’s important to set realistic expectations and be prepared for possible losses.

Next, make sure to thoroughly research the traders you plan to follow. Look at their long-term success rates, trading style, and risk level. Just like diversifying your investments helps you mitigate your risk, it’s also a good idea to diversify by following multiple traders rather than putting all your funds into one person’s strategy.

Finally, keep in mind that while social trading can provide guidance, it shouldn’t replace your own learning and understanding of the market. Use it as a tool to supplement your knowledge and gradually develop your own trading skills. At the end of the day, there is just no substitute for the knowledge gap you will need to bridge as a beginner to reach the success level of the expert traders. So the sooner you start, the better.

How to Start Social Trading?

Social trading gives you the unique advantage of being part of a broader community of traders, where you can get new ideas from other traders, follow more experienced traders, and gain insights into market movements from members of the community.

Here’s how you can start social trading:

- Choose a Social Trading Platform: Research different platforms and choose one that fits your needs. Look for features like ease of use, available markets, and the quality of traders on the platform.

- Create an Account: Sign up and complete the registration process. You may need to verify your identity, as most platforms are regulated.

- Explore Traders: Once your account is set up, browse through the profiles of traders you can follow. Pay attention to their performance history, risk level, and trading style.

- Fund Your Account: Deposit funds into your account. The amount you start with depends on your budget and the platform’s requirements.

- Start Copying Trades: Select a trader or traders to follow. You can either set your account to automatically copy their trades or choose trades manually.

- Monitor and Adjust: Regularly check your account to monitor performance. Be prepared to make adjustments, such as stopping the copying of a trader if their performance declines.

Points to Remember While Social Trading

The idea of social trading might have you thinking that the element of risk is largely eliminated because you are following expert traders. But that is simply not the case. Experts make mistakes as well, and there is no guarantee of success for you even if you follow them.

So here are some things to always be mindful of when doing social trading:

Always Do Your Own Research

This might seem counterintuitive. After all, you came to a social trading platform probably because you didn’t want to do your own analysis and research.

While social trading can reduce the amount of personal research you need to conduct, that is no reason to become reckless and blindly follow others. Relying too heavily on social trading signals only can lead to dangerous overconfidence, especially if the trader you’re copying hasn’t done thorough research themselves. However, by combining these signals with your own analysis, you retain control over your trades and can tailor strategies to fit your specific goals and risk tolerance.

Use Technical Analysis and Market Sentiment Indicators

This is good practice for trading in general, not just social trading.

Firstly, you must at least understand the basics of candlestick patterns. These can help guide your overall view. For example, if your candlestick analysis suggests that the trend of a stock is bearish, you should avoid going long on that stock, even if the trader you follow is doing it. You might miss out on a short counter trend move, perhaps due to short covering in that stock, but far more often that not, you’ll end up saving yourself a good amount of money that you might have otherwise lost had you gone in blindly.

Next, you should learn to read the current market sentiment. Market sentiment indicators reflect the collective mood of market participants, giving you an idea of whether traders are generally optimistic (bullish) or pessimistic (bearish) about certain markets. Several tools can help you measure this sentiment. For example, there is a report called Commitment of Traders (or COT), which is released every Friday by the Commodity Futures Trading Commission (CFTC). This report gives you an idea of trader positions. Also, indicators like the volatility index (VIX) can reveal the level of fear or stability in the market, which can inform your trading decisions. You could even look at the high/low sentiment ratio to gauge whether the overall market sentiment is bullish or bearish. For example, if more stocks are hitting their 52-week high compared to the 52-week low, then it indicates that the sentiment is bullish. This will inform your view, and accordingly, you could choose to follow traders who are bullish, and avoid traders who are going bearish.

Strategy For Social Trading

A strategic approach to social trading can significantly enhance your trading outcomes. Here’s a comparison of different strategies:

| Strategy | Description | Success Rate (%) | Risk Level |

| Copy Trading | Replicate the trades of successful traders | High | Medium |

| Social Following | Follow top traders and their insights on the market | Moderate | Low-Medium |

| Crowd Trading | Base trades on overall market sentiment among a group of traders | Varies | High |

| Portfolio Mirroring | Mirror the portfolio of a successful trader completely | Moderate | Medium |

| Hybrid Approach | Combine various social trading strategies for a diversified trading approach | Custom | Custom |

Each of these strategies has its unique features and risks. As a social trader, it’s important to assess these aspects of your investment goals and risk tolerance.

Benefits of Social Trading

- Accessibility & Inclusion: Starting is as simple as creating an account on a trading platform and funding it. Instantly, traders from any corner of the world with internet access can begin searching for professionals whose strategies they wish to copy.

- Greater Information & Transparency: These platforms offer tools to monitor transactions and review all trading activities—open, closed, and pending. This real-time analysis boosts investor confidence.

- Word-of-mouth Credibility: Trust plays a pivotal role in social trading. Beyond just following popular traders, it’s important to scrutinise their trading history and reviews.

Final Thoughts

Remember, “In the world of investing, knowledge is a currency, and social trading is the exchange where it’s traded.”

Embrace this innovative approach, but tread wisely, ensuring that your investment journey is not just about following others, but also about understanding and growing your financial acumen.

Appreciate allows you to leverage the power of AI to build a portfolio that is aligned with your risk tolerance and financial goals in a way that maximises returns and minimises risks. Get personalised recommendations, guidance on your goals, and much more with Appreciate’s AI tools. Download the app today!

FAQs

How do I start social trading?

To start social trading, sign up on a social trading platform, choose a trader or strategy to follow, and begin replicating their trades using social trader tools.

Is social trading worth it?

Yes, social trading can be worth it, especially for beginners, as it allows learning from experienced traders and potentially earning while you learn.

How does trading affect a society?

Trading impacts society by influencing economic conditions, creating jobs, and sometimes affecting the prices of goods and services.

What is copy trading?

Copy trading is a strategy where you automatically replicate the trades of another investor, ideally a more experienced one, to mirror their success.

What is social trading vs. copy trading?

While both involve learning from others, social trading is broader, encompassing community learning and strategy sharing, whereas copy trading focuses on directly mirroring another trader’s moves.

What is a social trading broker?

A social trading broker is a financial intermediary that offers platforms and tools for traders to engage in social and copy trading.

Do social trading platforms allow copy trading?

Yes, most social trading platforms provide features for copy trading, enabling users to automatically replicate the trades of selected traders.

How can I be successful with copy trading?

Success in copy trading comes from carefully selecting experienced traders to copy, diversifying whom you copy, and regularly reviewing and adjusting your strategy.

What’s the risk of social trading?

Social trading involves risks, especially when dealing with CFDs (Contracts for Difference), which are complex and carry a high risk of rapid money loss due to leverage. Between 74% and 89% of retail investors lose money in these trades.

More Articles for Beginners

What is CMP in the Stock Market?