Key benefits

Mutual funds aim to replicate the performance of a specific market index. Spreading your investments across sectors & asset classes reduces risk, keeping your financial goals on track in any market.

Mutual funds have historically given higher returns to investors compared to traditional investments like fixed deposits, recurring deposits, and provident funds.

Mutual funds are easy to buy and sell. They often have lower minimum investment requirements than individual stocks or bonds. This makes them accessible to a wide range of investors.

Mutual funds are managed by professionals who research and select the best securities for investment. This often leads to better decisions than an individual investor might make.

Understanding mutual funds

Mutual funds pool money from many investors to buy a diversified portfolio of stocks, bonds, or other securities.

Each investor owns shares (units) representing their portion of the mutual fund's holdings. Professional fund managers aim to meet the fund's investment objectives.

Get the gold standard of investing

Access popular and diverse range of funds, offering ample investment choices for your financial goals

Monitor portfolio performance, view statements and insights on the go

Invest with zero commissions and zero account opening fees, ensuring more of your money works for you

*Applicable only for direct mutual funds

Advanced AI algorithms suggests best mutual funds suited for you

Market winners

| Mutual Funds | AUM | Expense Ratio | 3Y Return | ||

|

|

HDFC Balanced Advantaged Fund | ₹86,471 Cr | 0.73% | 24.58% | |

|

|

Tata Small Cap Fund | ₹7,083 Cr | 0.34% | 29.97% | |

|

|

Parag Parikh Flexi Cap Fund | ₹66,384 Cr | 0.62% | 21.95% | |

|

|

ICICI Prudential Balanced Advantaged Fund | ₹56,750 Cr | 0.86% | 13.93% | |

|

|

Mirae Asset Large Cap Fund | ₹37,631 Cr | 0.55% | 14.92% | |

|

|

Axis ELSS Tax saver | ₹34,896 Cr | 0.80% | 11.96% | |

|

|

Aditya Birla Sunlife Frontline Equity Fund | ₹27,275 Cr | 0.99% | - | |

|

|

UTI Liquid Fund | ₹23,972 Cr | 0.88% | 10.07% | |

|

|

DSP Mid Cap Fund | ₹17,668 Cr | 0.77% | 19.35% | |

|

|

Motilal Oswal Midcap Fund | ₹10,378 Crs | 0.65% | 39.83% |

Calculator

The Mutual Fund Calculator estimates the returns on your SIP and lump sum investments.

Invest your way

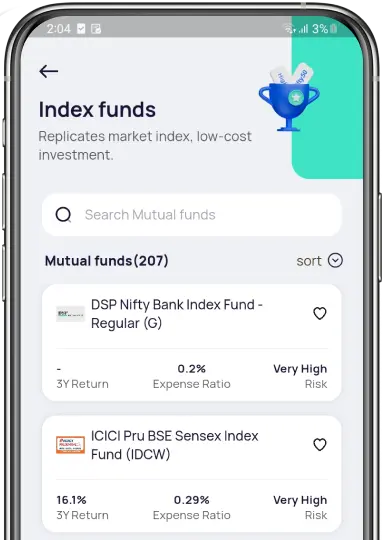

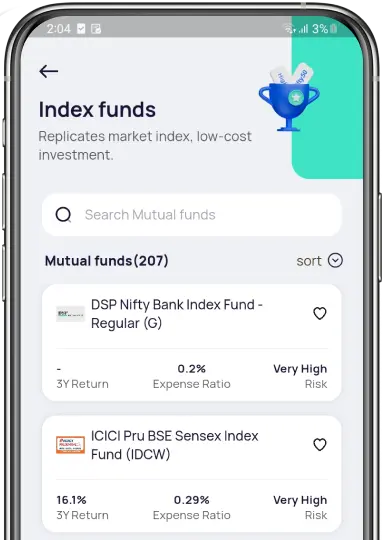

Index mutual funds aim to replicate the performance of a specific market index. They are passively managed and typically have lower fees compared to actively managed funds. They are ideal for investors looking for a low-cost, long-term investment strategy.

Index mutual funds aim to replicate the performance of a specific market index. They are passively managed and typically have lower fees compared to actively managed funds. They are ideal for investors looking for a low-cost, long-term investment strategy.

How it works

Learn as you earn

Don’t take our word for it

Mutual funds are investment funds managed by professional fund managers who pool money from individual investors to invest in various financial instruments such as stocks, bonds, and other assets. The fund managers make investment decisions based on factors like investors' risk tolerance and investment duration.

Investing in mutual funds is simple:

During the onboarding process, once you complete your personal details, you’ll be asked to choose your investment preference. You can simply select “Indian Mutual Funds” and proceed .

We need to verify your details ( CKYC) before you can start investing in mutual funds. If you’re already a Mutual Fund investor, we’ll check your CKYC automatically. If it’s your first time, you'll need to submit your signature and verify your Aadhaar using DigiLocker.The KYC Registration Agency (KRA) usually verifies your CKYC status within 24 to 48 hours.

Due to regulatory compliance, we must verify your data again to make you eligible for mutual funds. This verification involves submitting a selfie, signature, and verifying Aadhar via Digilocker. The KRA will share the final status within 24-48 hours.

If your Video KYC (vKYC) with YES Bank doesn’t go through, you can still invest in Mutual Funds. All you need to do is add a bank account of your choice and complete the Mutual Fund onboarding process.

A Systematic Investment Plan (SIP) allows you to invest a fixed amount at regular intervals, usually monthly, into a mutual fund. Based on the fund’s Net Asset Value (NAV) at the time of investment, you are allocated units accordingly.

Benefits of SIP:

To automate your SIPs, you can set up a bank mandate (such as e-NACH), ensuring timely and hassle-free payments.

There’s no one-size-fits-all answer. The right choice depends on your financial goals, risk appetite, and investment style.

|

Feature |

Lump Sum |

SIP |

|

Market Exposure |

Full exposure at once |

Gradual and consistent |

|

Potential Gains |

High gains if timed well |

Steady, long term growth |

|

Market Timing Dependency |

High - requires good timing |

Low - averages out over time |

|

Rupee Cost Averaging |

Not applicable |

Benefits from averaging |

|

Risk in Volatile Markets |

Higher risk due to lump sum |

Lower risk due to staggered investment |

|

Investment Build-up |

Immediate capital deployment |

Gradual portfolio accumulation |

Tip: Choose based on your risk appetite and investing style.

Note: Ensure e-NACH mandate is set up before starting your SIP.

We apologize for the inconvenience. Please retry with the following checks:

If the issue continues, try again later or raise a support ticket, and we'll help resolve it.

We understand it can be overwhelming. Use our "My Investment Calculator" to simplify the process. Please note that this is not a buy or sell recommendation.

e-NACH (Electronic National Automated Clearing House) is an electronic approval that lets mutual fund companies auto-debit money from your bank account for SIPs. It’s paperless, fast, and safe.

e-NACH typically activates instantly and your SIP is set up.

The SIP transaction will fail if there aren't enough funds in your account on the scheduled date. Your bank may also charge a penalty for the failed auto-debit. It's advisable to keep sufficient balance at least a day in advance.

Exit load is a fee charged by the AMC for exiting a scheme early. Exit loads applicable on different fund categories are:

NAV (Net Asset Value) cutoff time The time by which you need to make your investment or redemption to get the same day’s NAV. Requests submitted after the cutoff time will be processed at the next business day's NAV. The cutoff times can vary:

STCG (Short-Term Capital Gains) and LTCG (Long-Term Capital Gains) refer to the profits earned from the sale of investments.

Adding a bank account for mutual funds is optional but recommended. You can easily link up to 4 bank accounts.

Adding a bank account for mutual funds is simple:

Option 1: Go to Profile section → Bank accounts → Mutual funds → Add bank → Enter bank details, and we’ll verify within seconds.

Option 2: While placing an investment order, you can add a new bank account, complete the verification, and use it for the investment.

Note: Ensure correct bank details for verification, sufficient funds to avoid cancellation, and remember you can add up to 4 bank accounts.

Just contact our customer support team at helpdesk@ppreciate.com, and we’ll help you update your bank account for withdrawals.

Some funds have a lock-in period, meaning your funds will be locked for a specific duration (e.g., 1 year). In the case of ELSS, there is a mandatory 3-year lock-in period.

For a one-time mutual fund investment, you'll use a UPI lump sum order:

You can track your investment and returns in the portfolio section on the Mutual Fund home screen. Click on it to view detailed information about your transactions, one-time payments, and active SIPs.

Withdrawals usually take 2–3 working days. Once processed, the money typically reaches your bank within a few hours.

When you need money or have reached your investment target, here are the steps to withdraw your funds:

You should receive the funds back to the primary bank account that you selected for your first Mutual Funds investment order. The money should be received within 4-5 working days.

When you need money or have reached your investment target, here are the steps to withdraw your funds:

Note: "Working days" means weekdays, excluding weekends and public holidays.

If your withdrawal order has failed, there could be multiple reasons for the failure:

Raise a support ticket at helpdesk@ppreciate.com if the issue persists.

By joining our referral program, you agree to our Terms of Use

Powered by Viral Loops.