Quick Summary

- Three White Soldiers is a bullish reversal pattern made of three consecutive bullish candles.

- It forms after a downtrend, signaling a shift from bearish to bullish sentiment.

- Each candle opens within the previous one’s body and closes higher, indicating sustained buying pressure.

- Best used with confirmation from indicators like RSI, MACD, and volume for reliable signals.

- While effective, it requires caution near resistance or when the market is overbought.

The three white soldiers candlestick pattern is one of the clearest signs that buyers are regaining control after a period of selling. It doesn’t just show a price rise, but also conviction. Three strong bullish candles form back-to-back, each closing higher than the last, signaling a steady and confident market reversal.

In this blog, we’ll look at how the pattern forms, what it reveals about market psychology, how to trade it effectively, and how it compares with other bullish reversal patterns.

Understanding the Three White Soldiers Candle

The three white soldiers pattern is a bullish reversal signal in technical analysis. It shows up after a downtrend or a consolidation phase and indicates that buying momentum is returning to the market. This pattern is made up of three consecutive bullish candles—each opening within the previous candle’s body and closing higher than the last.

Key Characteristics of the Three White Soldiers Pattern

Here’s how you can identify a three white soldiers candle on the chart:

- Three strong bullish candles: Each candle opens within the previous one’s real body and closes near its high.

- Small or no shadows: Shadows (or wicks) are short, showing that buyers controlled most of the session with little pushback from sellers.

- Formed after a downtrend or sideways phase: This pattern is most meaningful when it appears after a decline or a period of consolidation — it signals that the market might be preparing for an upward move.

- Consistent buying pressure: The steady climb across three sessions reflects sustained interest from buyers, not just a temporary bounce.

How the Three White Soldiers Candlestick Pattern Works

The three white soldiers candlestick pattern shows a clear shift in market sentiment—from bearish to bullish. It forms when buyers steadily gain control over three consecutive sessions, pushing prices higher each time.

Here’s how it plays out:

- First candle: Marks the beginning of renewed buying interest. It closes higher than the previous session, hinting that sellers are losing strength.

- Second candle: Confirms growing momentum. It opens within the first candle’s body and closes above its high, showing that buyers are firmly in charge.

- Third candle: Extends the move. By this point, the pattern signals strong conviction; the trend is likely reversing, and traders start positioning for further gains.

Three White Soldiers Pattern Examples

The three white soldiers candlestick patterns can appear across different markets—equities, forex, or crypto. The logic stays the same: three strong bullish candles following a downtrend or period of indecision.

Let’s take a real-world three white soldiers pattern example using GBP/USD:

- Day 1: GBP/USD opens at 1.2372, dips to 1.2365, but closes strong at 1.2421.

- Day 2: The pair opens near 1.2419 and closes higher at 1.2487, showing steady momentum.

- Day 3: Bulls continue to push the price up, and the pair closes at 1.2538.

Each candle opens within the previous one’s body and closes progressively higher—a textbook setup of the three soldiers pattern.

How to Trade Using the Three White Soldiers Pattern

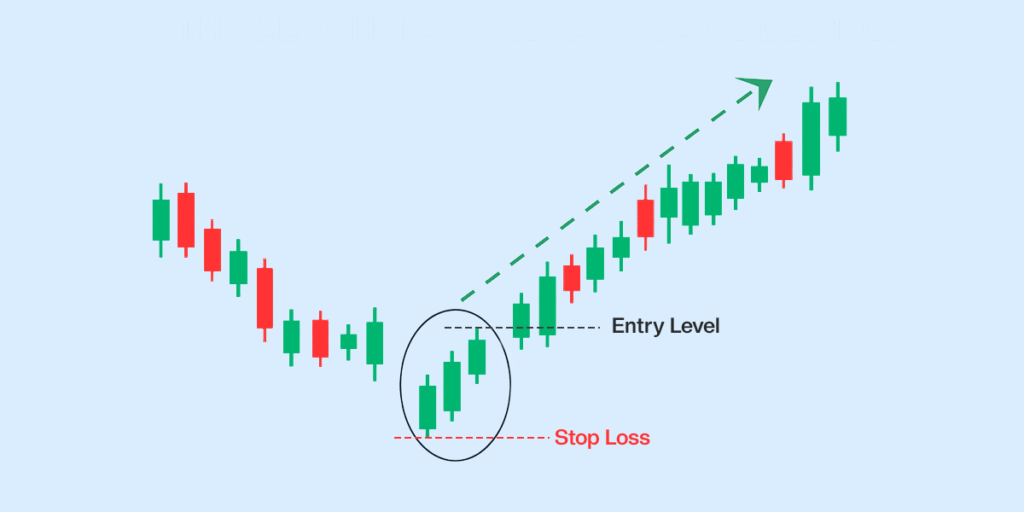

The three white soldiers pattern is a strong signal of a possible bullish reversal — but trading it effectively requires discipline and confirmation. Here’s a step-by-step approach to use it in your strategy.

1. Identify and Confirm the Pattern

Look for three consecutive bullish candles forming after a downtrend or sideways phase. Each candle should open within the previous candle’s body and close near its high.

2. Entry Points After Confirmation

After confirmation, traders usually consider entering at the open or a slight pullback of the next candle. For example, if the third candle closes at ₹1,450, a safe entry could be near ₹1,440–₹1,445 if the next candle opens strongly or dips slightly before rising again.

3. Setting Stop-Loss Levels

To manage risk, set your stop-loss just below the low of the first candle in the pattern. This is the point where the bullish setup would fail—meaning sellers have regained control. For example, if the first candle’s low is ₹1,380, your stop-loss could be ₹1,375–₹1,378.

4. Using Indicators for Confirmation

Combine the pattern with these tools to filter out weak signals and avoid premature entries:

| Indicator | What to Check | Why It Helps |

| RSI (Relative Strength Index) | Should be moving upward, but below 70 | Confirms momentum without being overbought |

| MACD | Bullish crossover or widening histogram | Supports the trend reversal signal |

| Moving Averages | Short-term MA crossing above long-term MA | Adds trend direction confirmation |

| Volume | Rising volume during pattern formation | Confirms genuine buying strength |

Limitations of the Three White Soldiers Pattern

While the three white soldiers pattern is a reliable reversal signal, it has some limitations, including:

- Risk of False Signals: The pattern can sometimes form when prices are already stretched. Jumping in without checking RSI or resistance levels can lead to reversals or consolidation.

- Requires Confirmation: Volume and indicators are essential to verify that the buying is sustainable. Without them, the pattern may reflect a short-covering rally rather than true buying strength.

- Works Best on Higher Timeframes: Daily or weekly charts provide more reliable signals than intraday charts, which can be noisy and prone to false setups.

Three White Soldiers vs Other Candlestick Patterns

The three white soldiers pattern is one of the most reliable bullish reversal signals, but it’s often compared with other Candlestick patterns like the Morning Star and Bullish Engulfing. Here’s how they compare to each other:

| Feature | Three White Soldiers | Morning Star | Bullish Engulfing |

| Number of Candles | 3 bullish candles | 3 candles (bearish → indecision → bullish) | 2 candles (bearish → bullish) |

| Formation Context | Appears after a downtrend or consolidation | Appears after a downtrend | Appears after a downtrend |

| Market Psychology | Steady buying pressure over multiple sessions | Buyers regain control after hesitation | Sudden rejection of selling pressure |

| Candle Characteristics | Long bodies, small or no wicks | The small middle candle shows indecision | The second candle fully engulfs the first |

| Volume Behaviour | Rising volume over all three sessions | Volume rises on the third candle | Volume spikes on the bullish candle |

| Reliability | High — shows sustained shift | Moderate — depends on the strength of the 3rd candle | Moderate — needs confirmation |

FAQs

What does the three white soldiers’ candles mean?

The three white soldiers’ candle signals a strong bullish reversal. It forms after a downtrend when buyers take control for three straight sessions, pushing prices higher each day. This steady rise suggests that market sentiment is turning from negative to positive — and the trend may be shifting upward.

What is the 3 candle rule in trading?

The 3 candle rule refers to a pattern formed by three consecutive candlesticks that confirm a market move. In the case of the three white soldiers, it means three bullish candles closing higher each time, confirming sustained buying pressure. Traders often use this rule to validate that a reversal is genuine and not just a one-day reaction.

Which candlestick pattern is considered most powerful?

No single pattern guarantees accuracy in every situation, but the three white soldiers, morning star, and bullish engulfing patterns are among the most reliable reversal signals. The three white soldiers stand out because they show consistent strength across multiple sessions, not just a single-day bounce.

What is the success rate of the three white soldiers pattern?

The success rate varies significantly by market, timeframe, and overall market conditions. While there is no fixed success rate, it is generally considered one of the more reliable bullish reversal patterns, especially when confirmed with rising volume and other technical indicators

Is the three white soldiers candlestick always bullish?

Yes, by definition, the three white soldiers’ candlestick pattern is bullish. However, it should not be traded in isolation. If it forms near resistance or when RSI is already overbought, the move could weaken or reverse.

Disclaimer

The information provided in this article is for educational and informational purposes only. It should not be considered as financial or investment advice. Investing in stocks involves risk, and it is important to conduct your research and consult with a qualified financial advisor before making any investment decisions. The author and publisher are not responsible for any financial losses or gains that may result from the use of this information.